Question: Effective Interest Amortization On December 3 1 , Caper, Inc., issued ( $ 7 5 0 , 0 0 0 ) of

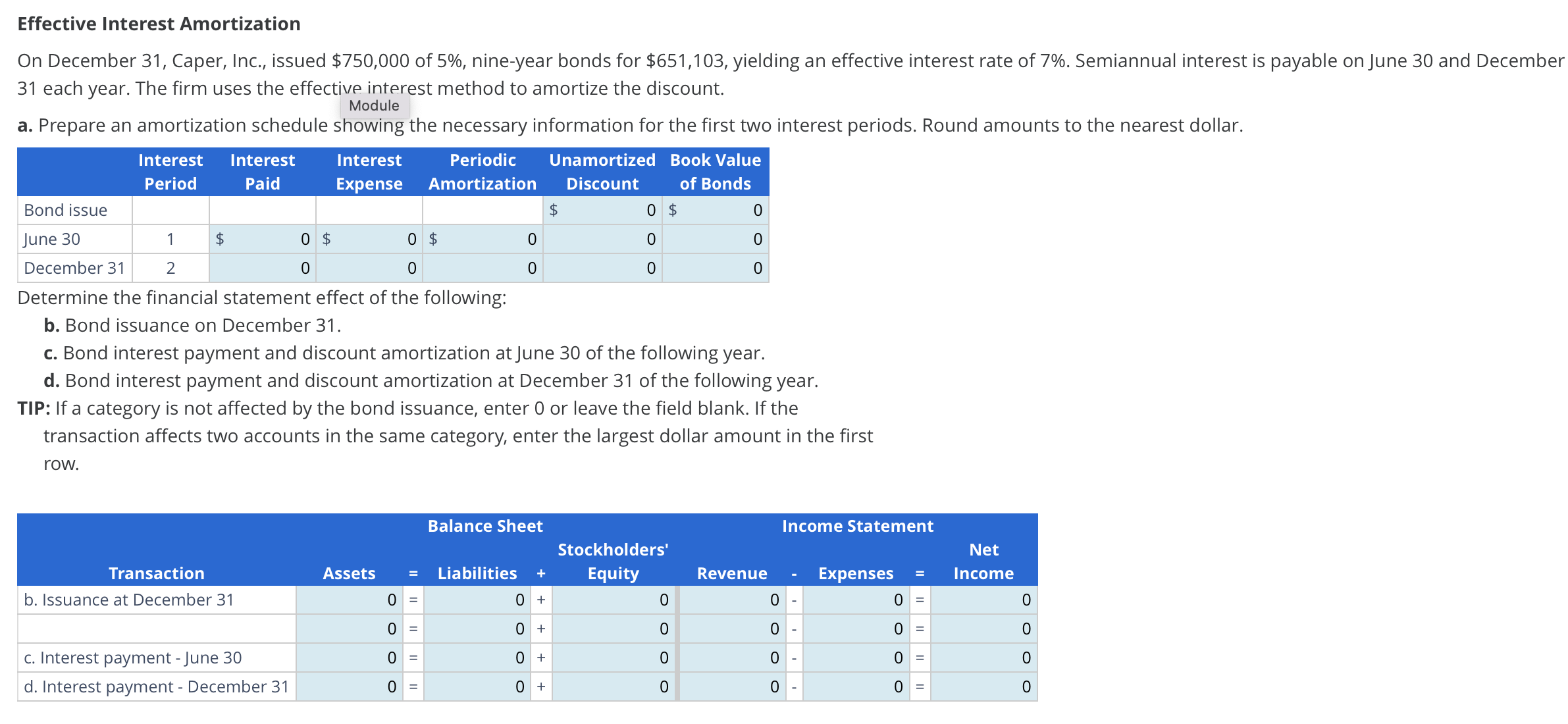

Effective Interest Amortization On December Caper, Inc., issued $ of nineyear bonds for $ yielding an effective interest rate of Semiannual interest is payable on June and December each year. The firm uses the effective interest method to amortize the discount. Module a Prepare an amortization schedule showing the necessary information for the first two interest periods. Round amounts to the nearest dollar. Determine the financial statement effect of the following: b Bond issuance on December c Bond interest payment and discount amortization at June of the following year. d Bond interest payment and discount amortization at December of the following year. TIP: If a category is not affected by the bond issuance, enter or leave the field blank. If the transaction affects two accounts in the same category, enter the largest dollar amount in the first row.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock