Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Effects of leverage to return on ordinary equity. You are in the process of organizing a new company to produce and sell a lady

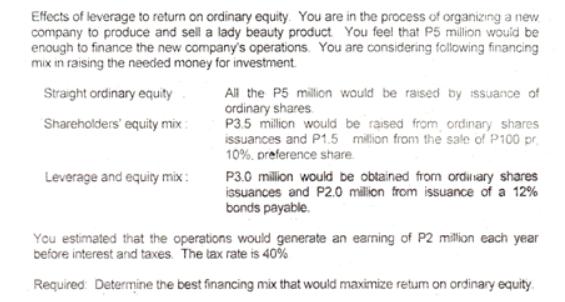

Effects of leverage to return on ordinary equity. You are in the process of organizing a new company to produce and sell a lady beauty product You feel that P5 million would be enough to finance the new company's operations. You are considering following financing mix in raising the needed money for investment Straight ordinary equity Shareholders' equity mix: Leverage and equity mix: All the P5 million would be raised by issuance of ordinary shares P3.5 million would be raised from ordinary shares issuances and P1.5 million from the sale of P100 pr 10% preference share P3.0 million would be obtained from ordinary shares issuances and P2.0 million from issuance of a 12% bonds payable. You estimated that the operations would generate an earning of P2 million each year before interest and taxes. The tax rate is 40% Required: Determine the best financing mix that would maximize return on ordinary equity.

Step by Step Solution

★★★★★

3.26 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer I Retain Earnings Share Capital means both Equity and Preference too Hence Bonds Payable will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started