Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Efficient Market Hypothesis (EMH) classifies three levels of Market Efficiency: Weak form efficiency, Semi-strong form efficiency and Strong form efficiency. (i) Search on internet,

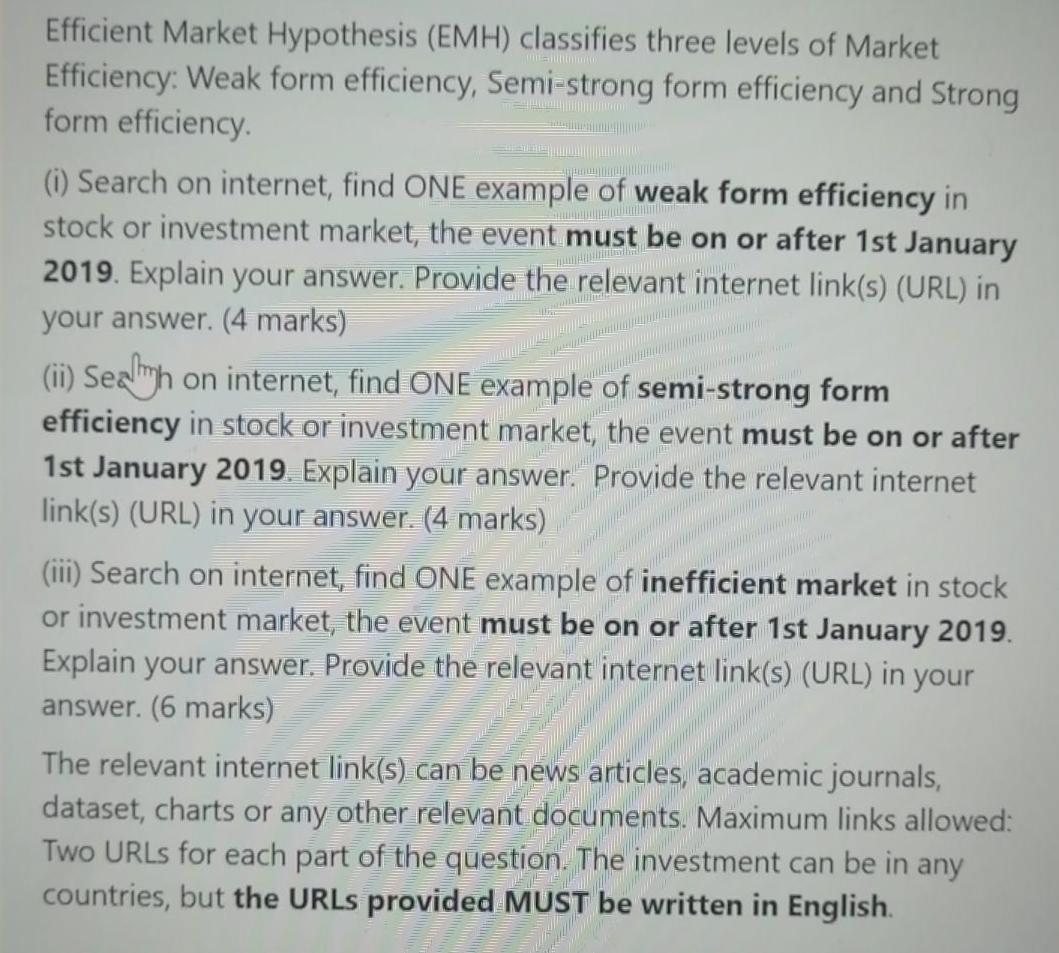

Efficient Market Hypothesis (EMH) classifies three levels of Market Efficiency: Weak form efficiency, Semi-strong form efficiency and Strong form efficiency. (i) Search on internet, find ONE example of weak form efficiency in stock or investment market, the event must be on or after 1st January 2019. Explain your answer. Provide the relevant internet link(s) (URL) in your answer. (4 marks) (ii) Seah on internet, find ONE example of semi-strong form efficiency in stock or investment market, the event must be on or after 1st January 2019. Explain your answer. Provide the relevant internet link(s) (URL) in your answer. (4 marks) (iii) Search on internet, find ONE example of inefficient market in stock or investment market, the event must be on or after 1st January 2019. Explain your answer. Provide the relevant internet link(s) (URL) in your answer. (6 marks) The relevant internet link(s) can be news articles, academic journals, dataset, charts or any other relevant documents. Maximum links allowed: Two URLs for each part of the question. The investment can be in any countries, but the URLs provided MUST be written in English.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

i weak form efficiency example I Suppose David a swing trader sees Alphabet Inc GOOGL continuously decline on Mondays and increase in value on Fridays He may assume he can profit if he buys the stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started