Answered step by step

Verified Expert Solution

Question

1 Approved Answer

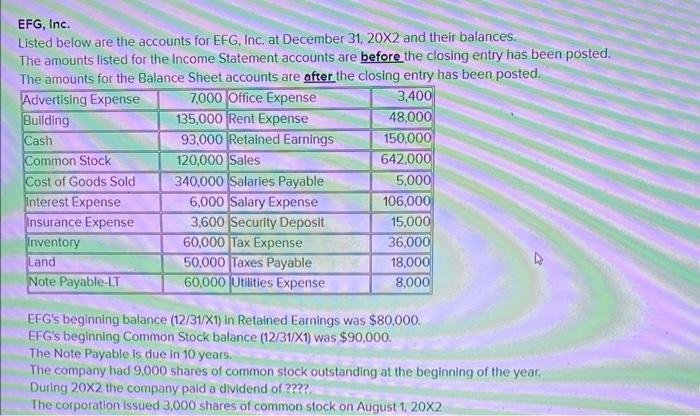

EFG, Inc. Listed below are the accounts for EFG, Inc. at December 31, 20X2 and their balances. The amounts listed for the Income Statement

EFG, Inc. Listed below are the accounts for EFG, Inc. at December 31, 20X2 and their balances. The amounts listed for the Income Statement accounts are before the closing entry has been posted. The amounts for the Balance Sheet accounts are after the closing entry has been posted. Advertising Expense 7,000 Office Expense 3,400 Building 135,000 Rent Expense 48,000 Cash 93,000 Retained Earnings 150,000 Common Stock 120,000 Sales 642,000 Cost of Goods Sold 340,000 Salaries Payable 6,000 Salary Expense Interest Expense Insurance Expense 3,600 Security Deposit Inventory 60,000 Tax Expense 50,000 Taxes Payable 60,000 Utilities Expense Land Note Payable-LT 5,000 106,000 15,000 36,000 18,000 8,000 EFG's beginning balance (12/31/X1) in Retained Earnings was $80,000. EFG's beginning Common Stock balance (12/31/X1) was $90,000. The Note Payable is due in 10 years. The company had 9,000 shares of common stock outstanding at the beginning of the year. During 20X2 the company paid a dividend of ????. The corporation Issued 3,000 shares of common stock on August 1, 20X2

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To determine the dividend paid by EFG Inc during 20X2 we need addit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started