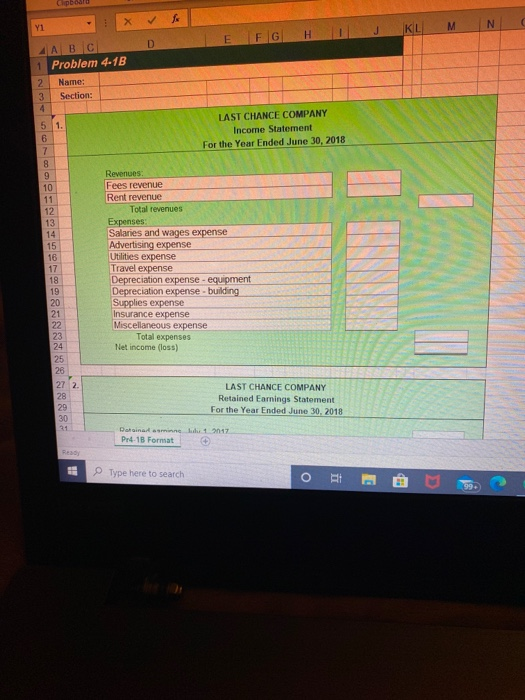

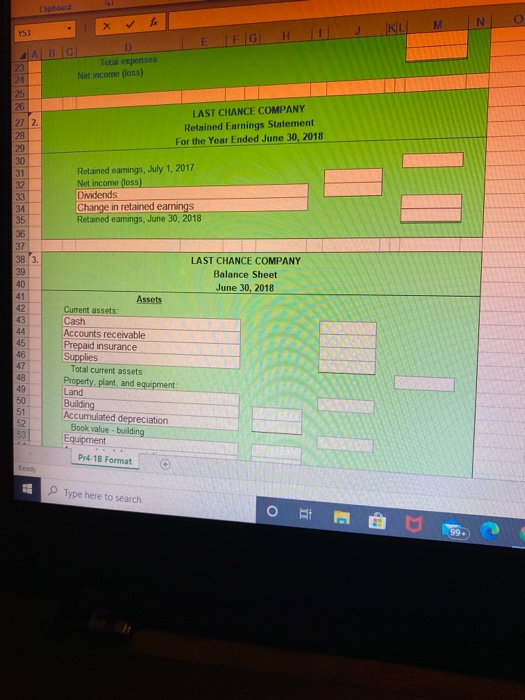

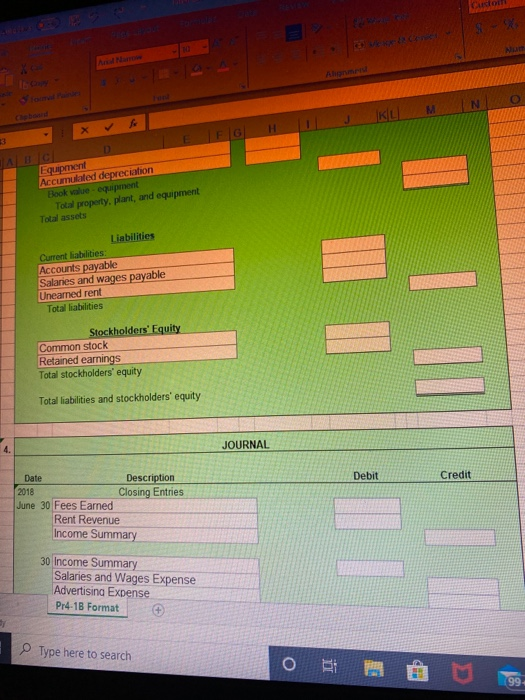

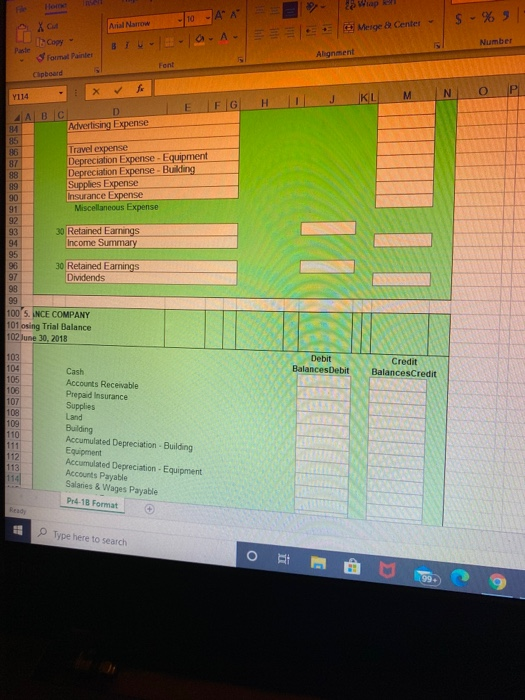

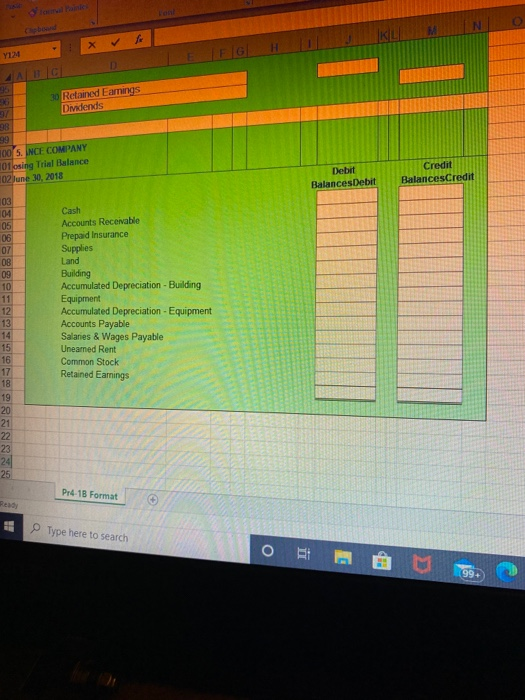

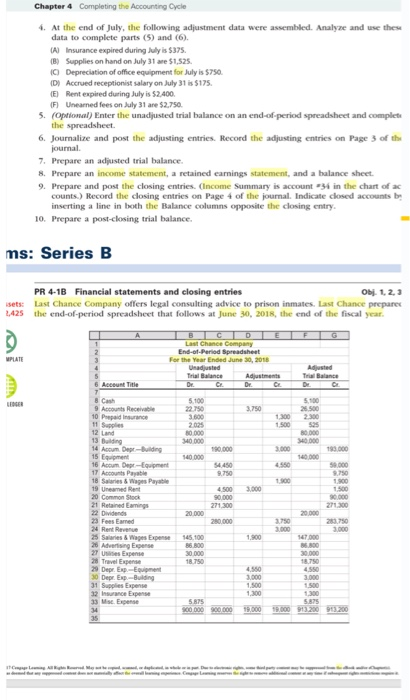

EFGH I J K ABC Total expenses Net income foss) LAST CHANCE COMPANY Retained Earnings Statement For the Year Ended June 30, 2018 Retained earnings, July 1, 2017 Net income (loss) Dividends Change in retained earnings Retained earnings, June 30, 2018 LAST CHANCE COMPANY Balance Sheet June 30, 2018 Assets Current assets: Cash Accounts receivable Prepaid insurance Supplies Total current assets Land Building Accumulated depreciation Book value-building Equipment Pr4-18 Format Type here to search Carton Equipment Accumulated depreciation Book value equipment Total property, plant, and equipment Total assets Liabilities Current abilities: Accounts payable Salaries and wages payable Uneamed rent Total liabilities Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity JOURNAL Debit Credit Date Description 2018 Closing Entries June 30 Fees Earned Rent Revenue Income Summary 30 Income Summary Salaries and Wages Expense Advertising Expense Pr4.1B Format Type here to search Arial Narrow S - % 3 -10 O - A A -A- Meige a Center - off Number o xa Paste Format Painter Clipboard BLU- Alignment Font Y114 DEFGHIJKL M N O P A B C D Advertising Expense Travel expense Depreciation Expense - Equipment Depreciation Expense - Buikling Supplies Expense Insurance Expense Miscellaneous Expense 30 Retained Earnings Income Summary 30 Retained Earnings Dividends 100 SINCE COMPANY 101 osing Trial Balance 102 June 30, 2018 103 Debit BalancesDebit Credit BalancesCredit 107 Cash Accounts Receivable Prepaid Insurance Supplies Land Building Accumulated Depreciation - Building Equipment Accumulated Depreciation - Equipment Accounts Payable Salaries & Wages Payable P4-1B Format 111 Type here to search 3. Retained Earnings Dividends 5. NCE COMPANY si Trial Balance 2 June 30, 2018 Credit BalancesCredit BalancesDebit Cash Accounts Receivable Prepaid Insurance Supplies Land Building Accumulated Depreciation - Building Equipment Accumulated Depreciation - Equipment Accounts Payable Salanes & Wages Payable Unearned Rent Common Stock Retained Earnings Pr 18 Format Type here to search Chapter 4 Completing the Accounting Cycle 4. At the end of July, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6) (A) Insurance expired during my is $375 (B) Supplies on hand on July 31 are $1.525 10 Depreciation of office equipment for July is $750. (D) Accrued receptionist salary on July 31 is $175. E) Rent expired during July is $2.400 (F) Unearned fees on July 31 are $2.750. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a retained earnings statement, and a balance sheet. 9. Prepare and post the closing entries, (income Summary is account in the chart of a counts. Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry 10. Prepare a post-closing trial balance. ms: Series B sets: 2,425 PR 4-1B Financial statements and closing entries Ob 1,2,3 Last Chance Company offers legal consulting advice to prison inmates. Last Chance prepares the end-of-period spreadsheet that follows at June 30, 2018, the end of the fiscal year. Last Chance Company End-of-Period Spreadsheet 9 Accounts Receivable 14 Acum Dept-Bulding 540000 16 cm Dept-cument 17 Accounts Payable 18 Sales & Waes Payable 9.750 Cock 20.000 22 Dividends 23 Fees Eamed 24 Rent Revenue 25 Salaries & Wapes Expense 26 Adverteng Expense 27 Expense 28 Travel Expense 145.100 86.800 30.000 # BREDA 10 Depr Busing 31 Supplies Expense 32 Insurance Expense is. En EFGH I J K ABC Total expenses Net income foss) LAST CHANCE COMPANY Retained Earnings Statement For the Year Ended June 30, 2018 Retained earnings, July 1, 2017 Net income (loss) Dividends Change in retained earnings Retained earnings, June 30, 2018 LAST CHANCE COMPANY Balance Sheet June 30, 2018 Assets Current assets: Cash Accounts receivable Prepaid insurance Supplies Total current assets Land Building Accumulated depreciation Book value-building Equipment Pr4-18 Format Type here to search Carton Equipment Accumulated depreciation Book value equipment Total property, plant, and equipment Total assets Liabilities Current abilities: Accounts payable Salaries and wages payable Uneamed rent Total liabilities Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity JOURNAL Debit Credit Date Description 2018 Closing Entries June 30 Fees Earned Rent Revenue Income Summary 30 Income Summary Salaries and Wages Expense Advertising Expense Pr4.1B Format Type here to search Arial Narrow S - % 3 -10 O - A A -A- Meige a Center - off Number o xa Paste Format Painter Clipboard BLU- Alignment Font Y114 DEFGHIJKL M N O P A B C D Advertising Expense Travel expense Depreciation Expense - Equipment Depreciation Expense - Buikling Supplies Expense Insurance Expense Miscellaneous Expense 30 Retained Earnings Income Summary 30 Retained Earnings Dividends 100 SINCE COMPANY 101 osing Trial Balance 102 June 30, 2018 103 Debit BalancesDebit Credit BalancesCredit 107 Cash Accounts Receivable Prepaid Insurance Supplies Land Building Accumulated Depreciation - Building Equipment Accumulated Depreciation - Equipment Accounts Payable Salaries & Wages Payable P4-1B Format 111 Type here to search 3. Retained Earnings Dividends 5. NCE COMPANY si Trial Balance 2 June 30, 2018 Credit BalancesCredit BalancesDebit Cash Accounts Receivable Prepaid Insurance Supplies Land Building Accumulated Depreciation - Building Equipment Accumulated Depreciation - Equipment Accounts Payable Salanes & Wages Payable Unearned Rent Common Stock Retained Earnings Pr 18 Format Type here to search Chapter 4 Completing the Accounting Cycle 4. At the end of July, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6) (A) Insurance expired during my is $375 (B) Supplies on hand on July 31 are $1.525 10 Depreciation of office equipment for July is $750. (D) Accrued receptionist salary on July 31 is $175. E) Rent expired during July is $2.400 (F) Unearned fees on July 31 are $2.750. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 3 of the journal 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a retained earnings statement, and a balance sheet. 9. Prepare and post the closing entries, (income Summary is account in the chart of a counts. Record the closing entries on Page 4 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry 10. Prepare a post-closing trial balance. ms: Series B sets: 2,425 PR 4-1B Financial statements and closing entries Ob 1,2,3 Last Chance Company offers legal consulting advice to prison inmates. Last Chance prepares the end-of-period spreadsheet that follows at June 30, 2018, the end of the fiscal year. Last Chance Company End-of-Period Spreadsheet 9 Accounts Receivable 14 Acum Dept-Bulding 540000 16 cm Dept-cument 17 Accounts Payable 18 Sales & Waes Payable 9.750 Cock 20.000 22 Dividends 23 Fees Eamed 24 Rent Revenue 25 Salaries & Wapes Expense 26 Adverteng Expense 27 Expense 28 Travel Expense 145.100 86.800 30.000 # BREDA 10 Depr Busing 31 Supplies Expense 32 Insurance Expense is. En