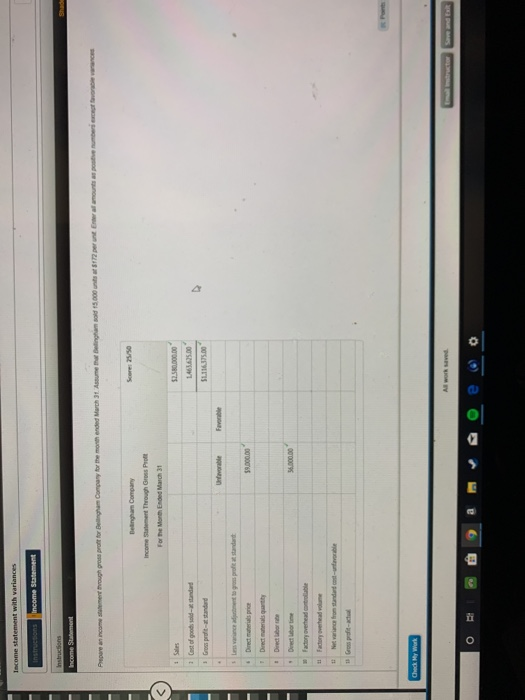

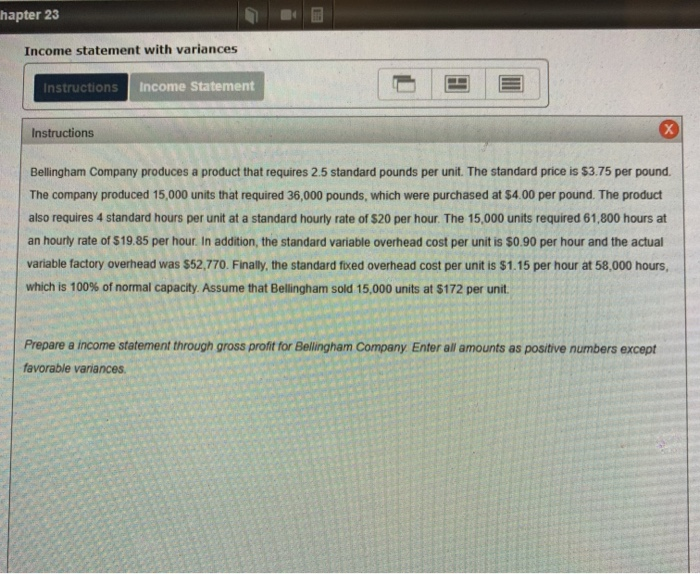

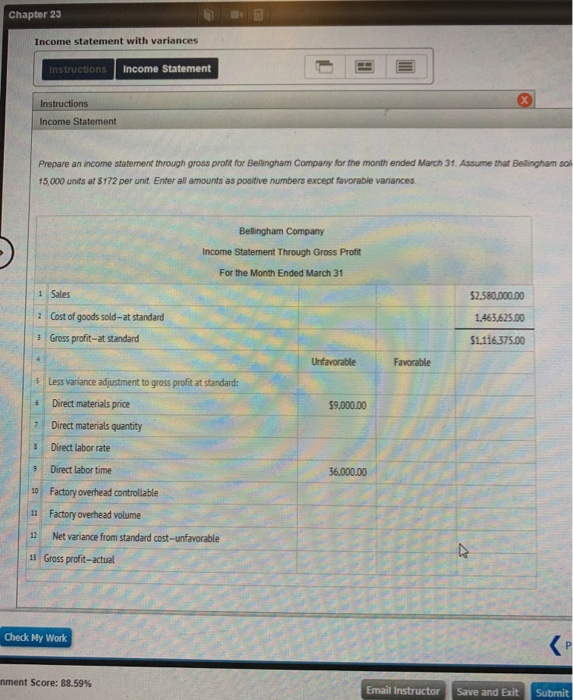

eflook Show Me How Caator Income statement with variences Instructions income Statement Instructions Beinghan Company produces a product that requres 25 standard pounds per unt The standard pricen 5375 per pound The company produced 15,000 unts that requred 3000 pound wich were purchaned at 5400 per pound The product rees 4 standard hous per unt at a standard houty ate of 520 per hour The 15.000 unts requred 6100 hours at an hourty rate of $19 85 per hour in addion the standard vareovehead cost per unt standard ed verhead cest per untis S1.15 per hour at S.000 hour, which is 100% of nomal capacty Asume hat Dengso 15 000 unts atS172 per unt the achual varae tary ovehead w 2770 Finaty the Prepare a income atatement through gros proft for Belingham Compeny Enter al amounts as postive numbers except fevorable varnce Income statement with variances Instructions Income Statement Instructions Income Statement apeus o qunu angod ae unou e nad AS n 00I P dupg auny v papue uo a uedueg w ag oud od uno cour ue aed Delingham Company OS/SE Income Statement Through Gross Proft For the Month Ended March 31 $2580000.00 saes pepur-ps spood o y 00SEVW Gros profit-at standard 00SEVIS Untvorable Favonble Les variance adjntent to gros profit at standandt Direct materials price 0000s Direct mterials quantity Divect lubor time 00000 Factory overhead controllable Factory overhead volume Net variance from standard cost-ufavorable pr-pd man Ponts Check y Work Email Intructor hapter 23 Income statement with variances Income Statement Instructions Instructions Bellingham Company produces a product that requires 2.5 standard pounds per unit. The standard price is $3.75 per pound. The company produced 15,000 units that required 36,000 pounds, which were purchased at $4.00 per pound. The product also requires 4 standard hours per unit at a standard hourly rate of $20 per hour. The 15,000 units required 61,800 hours at an hourly rate of $19.85 per hour. In addition, the standard variable overhead cost per unit is $0.90 per hour and the actual variable factory overhead was $52,770. Finally, the standard fixed overhead cost per unit is $1.15 per hour at 58,000 hours, which is 100% of normal capacity. Assume that Bellingham sold 15,000 units at $172 per unit. Prepare a income statement through gross profit for Bellingham Company. Enter all amounts as positive numbers except favorable variances. Chapter 23 Income statement with variances Income Statement Instructions Instructions Income Statement Prepare an income statement through gross profit for Bellingham Company for the month ended March 31. Assume that Belingham sol 15,000 units at $172 per unit. Enter all amounts as positive numbers except favorable variances. Bellingham Con Income Statement Through Gross Profit For the Month Ended March 31 1 Sales $2.580.000.00 2 Cost of goods sold-at standard 1.463,625.00 3 Gross profit-at standard $1.116.375.00 Unfavorable Favorable 5 Less variance adjustment to gross profit at standard: Direct materials price $9,000.00 Direct materials quantity Direct labor rate Direct labor time 36.000.00 Factory overhead controllable 10 Factory overhead volume 11 12 Net variance from standard cost-unfavorable 13 Gross profit-actual Check My Work P. unment Score: 88.59% Email Instructor Save and Exit Submit