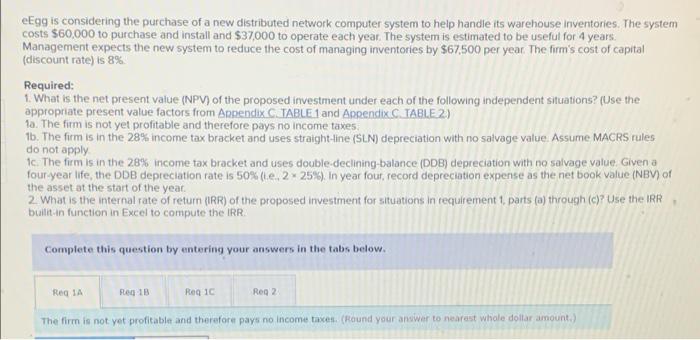

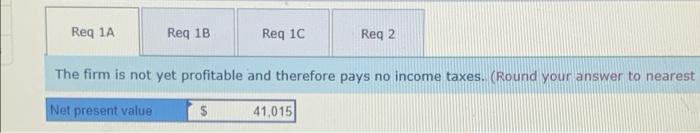

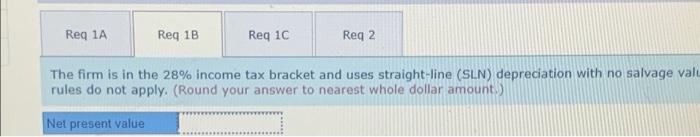

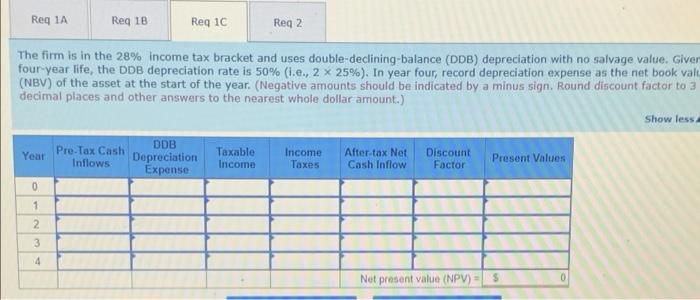

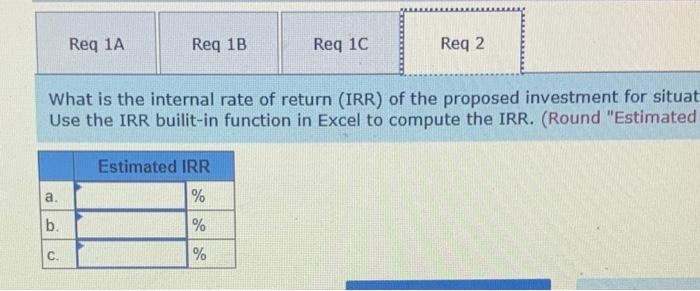

Egg is considering the purchase of a new distributed network computer system to help handle its warehouse Inventories. The system costs $60,000 to purchase and install and $37000 to operate each year. The system is estimated to be useful for 4 years. Management expects the new system to reduce the cost of managing inventories by $67,500 per year. The firm's cost of capital (discount rate) is 8% Required: 1. What is the net present value (NPV) of the proposed investment under each of the following independent situations? (Use the appropriate present value factors from Appendix C TABLE 1 and Appendix. TABLE 2) 10. The firm is not yet profitable and therefore pays no income taxes 16. The firm is in the 28% income tax bracket and uses straight-line (SLN) depreciation with no salvage value Assume MACRS rules do not apply 1c. The firm is in the 28% income tax bracket and uses double declining-balance (DDB) depreciation with no salvage value. Given a four-year life, the DDB depreciation rate is 50%(e. 225). In year fout, record depreciation expense as the net book value (NBV) of the asset at the start of the year. 2 What is the internal rate of return (IRR) of the proposed investment for situations in requirement 1 parts (a) through (c)? Use the IRR built in function in Excel to compute the IRR. Complete this question by entering your answers in the tabs below. Reg 1A Reg 13 Reg 10 Reg 2 The firm is not yet profitable and therefore pays no income taxes (Round your answer to nearest whole dollar amount.) Req 1A Reg 1B Req 1C Reg 2 The firm is not yet profitable and therefore pays no income taxes. (Round your answer to nearest Net present value $ 41,015 Req 1A Req 1B Regic Reg 2 The firm is in the 28% income tax bracket and uses straight-line (SLN) depreciation with no salvage valu rules do not apply. (Round your answer to nearest whole dollar amount) Nel present value Req 1A Reg 1B Reg 10 Req 2 The firm is in the 28% income tax bracket and uses double-declining-balance (DDB) depreciation with no salvage value. Giver four year life, the DDB depreciation rate is 50% (1.e., 2 25%). In year four, record depreciation expense as the net book valu (NBV) of the asset at the start of the year. (Negative amounts should be indicated by a minus sign. Round discount factor to 3 decimal places and other answers to the nearest whole dollar amount.) Show less Year Pre-Tax Cash Inflows DDB Depreciation Expense Taxable Income Income Taxes After-tax Net Cash Inflow Discount Factor Present Values 0 1 2 3 4 Net present value (NPV) = $ 0 Req 1A Req 1B Req 10 Req 2 What is the internal rate of return (IRR) of the proposed investment for situat Use the IRR built-in function in Excel to compute the IRR. (Round "Estimated Estimated IRR a. % b. % C %