Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eggs Ample Corporation Or Eggs Ample Partnership The goal of this final is to show the difference, if any, in the tax due if the

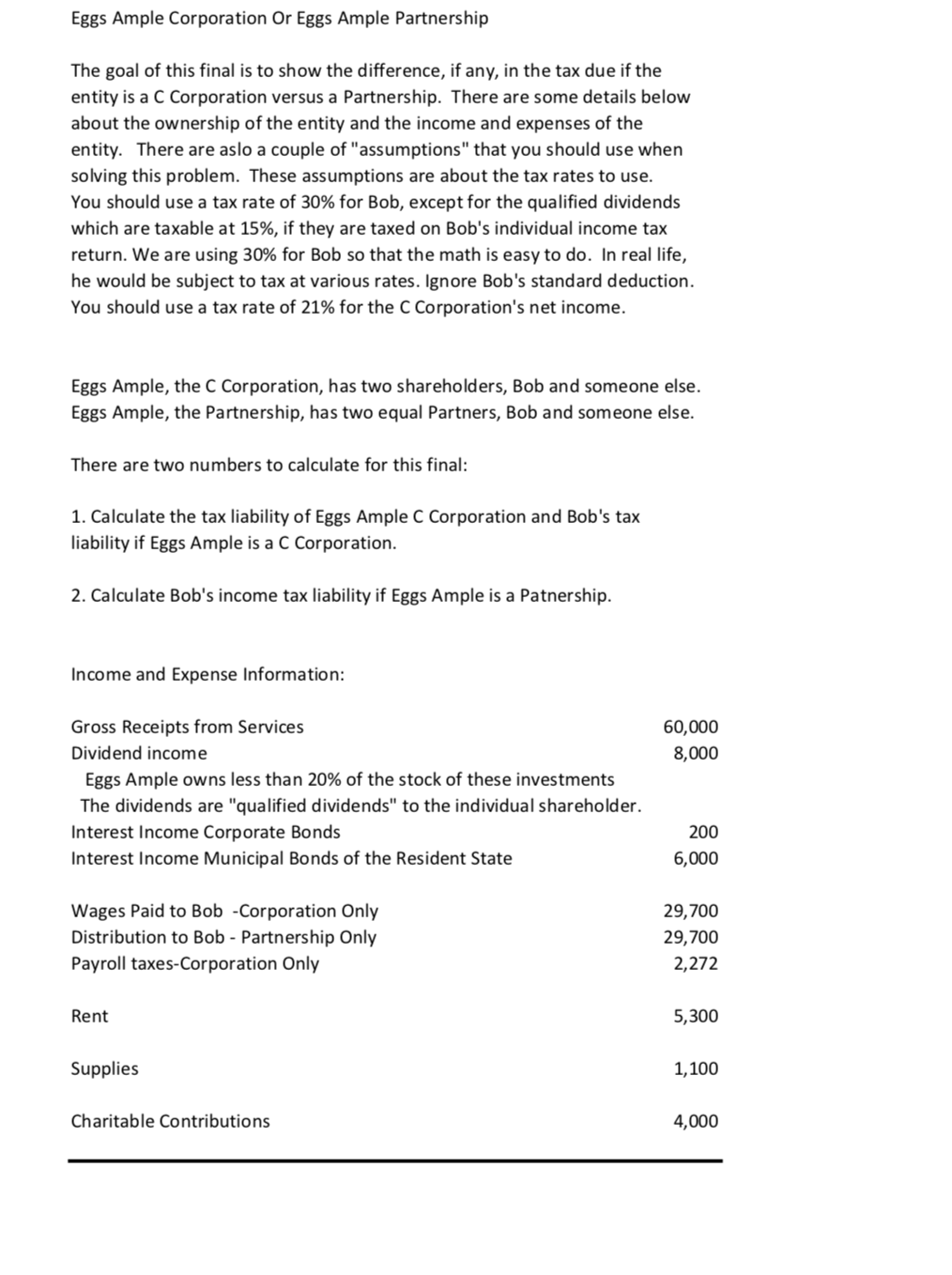

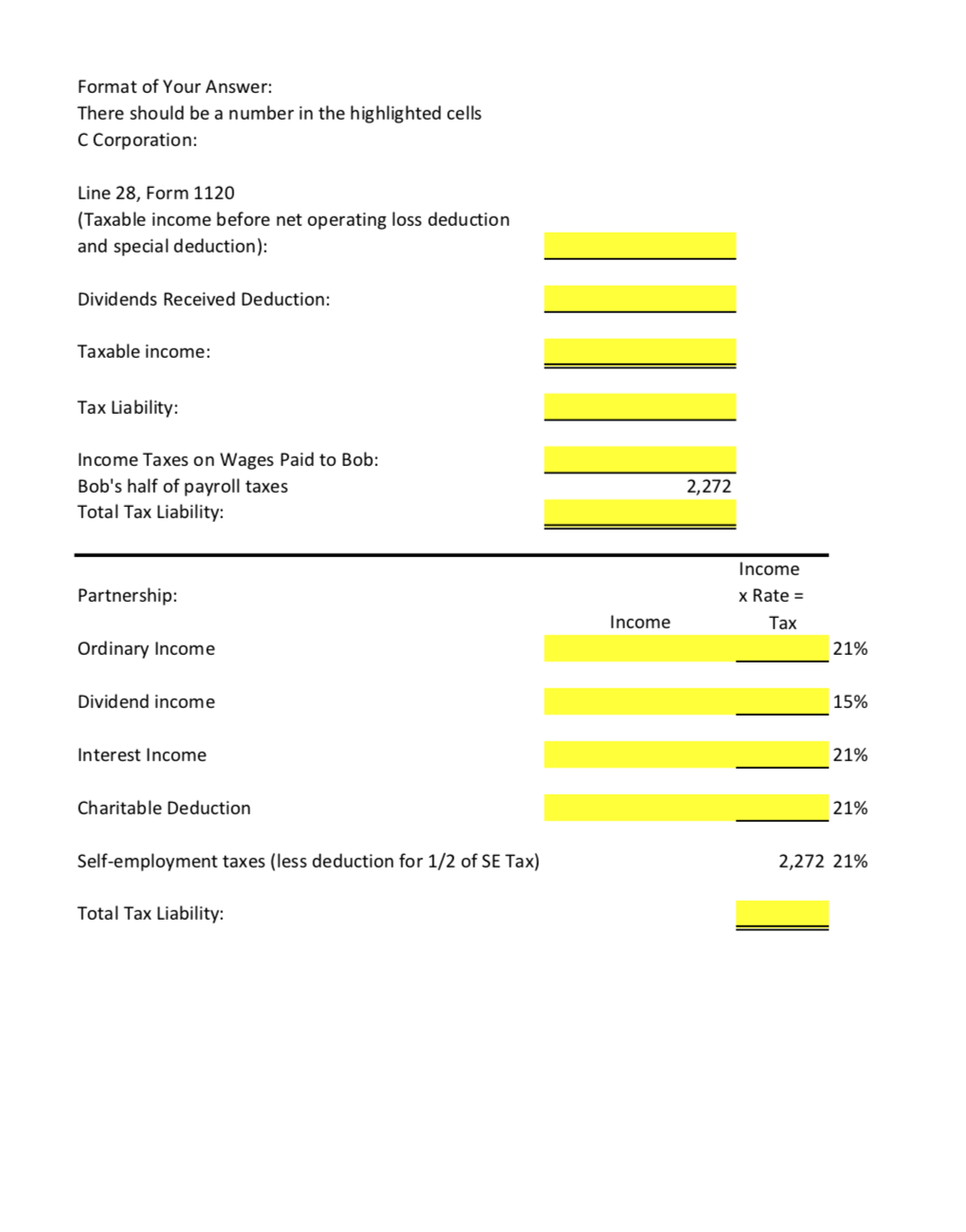

Eggs Ample Corporation Or Eggs Ample Partnership The goal of this final is to show the difference, if any, in the tax due if the entity is a C Corporation versus a Partnership. There are some details below about the ownership of the entity and the income and expenses of the entity. There are aslo a couple of "assumptions" that you should use when solving this problem. These assumptions are about the tax rates to use. You should use a tax rate of 30% for Bob, except for the qualified dividends which are taxable at 15%, if they are taxed on Bob's individual income tax return. We are using 30% for Bob so that the math is easy to do. In real life, he would be subject to tax at various rates. Ignore Bob's standard deduction. You should use a tax rate of 21% for the C Corporation's net income. Format of Your Answer: There should be a number in the highlighted cells C Corporation

Eggs Ample Corporation Or Eggs Ample Partnership The goal of this final is to show the difference, if any, in the tax due if the entity is a C Corporation versus a Partnership. There are some details below about the ownership of the entity and the income and expenses of the entity. There are aslo a couple of "assumptions" that you should use when solving this problem. These assumptions are about the tax rates to use. You should use a tax rate of 30% for Bob, except for the qualified dividends which are taxable at 15%, if they are taxed on Bob's individual income tax return. We are using 30% for Bob so that the math is easy to do. In real life, he would be subject to tax at various rates. Ignore Bob's standard deduction. You should use a tax rate of 21% for the C Corporation's net income. Format of Your Answer: There should be a number in the highlighted cells C Corporation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started