Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ego Ltd is a rapidly expanding company whose only source of debt before 1 October 2017 was 5m 8% debentures whose loan agreement required

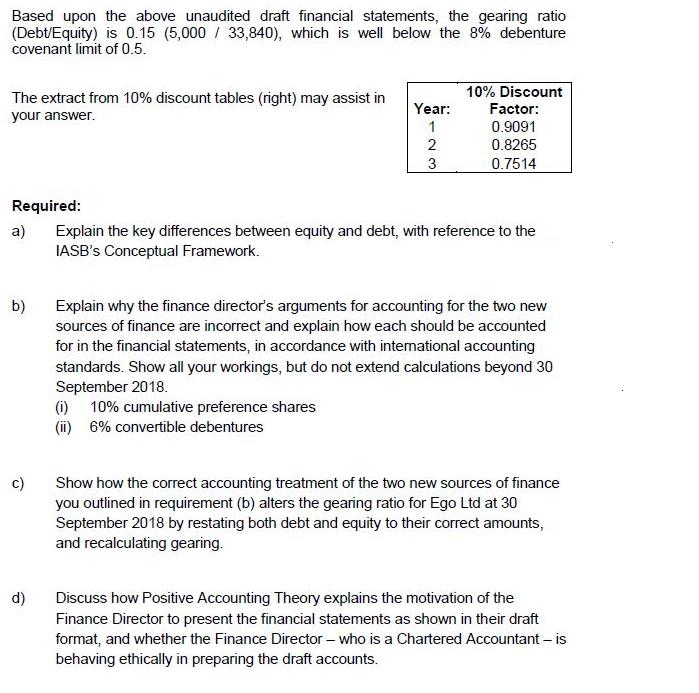

Ego Ltd is a rapidly expanding company whose only source of debt before 1 October 2017 was 5m 8% debentures whose loan agreement required immediate repayment if the company's gearing ratio (debt/equity) exceeded 0.5. On 1 October 2017, the first day of their current reporting year ended 30 September 2018, the company issued the following forms of finance: 12m worth of Cumulative Preference shares, issued at par, guaranteeing a constant return of 10% each year regardless of the profit made in the year, and redeemable in six years' time at par. 6% Convertible debentures with a nominal value of 6m, paying interest of in arrears annually (on 30 September), and providing the holders with the choice to convert into ordinary shares, or receive back the nominal value on 30th September 2020. The interest payable on debentures similar in terms of risk but without conversion option is 10%. The finance director regards both the above sources of finance as equity, suggesting that "preference shares are equity since they are called shares" and "we are confident that the convertible debentures will be converted into equity at the end of the term". As a result of accounting for both items under equity, the payments made to the holders of both were recorded in the Statement of Changes in Equity as a distribution of profit, rather than an interest expense in the income statement. Extracts from the unaudited financial statements are provided below: Extract from Draft (unaudited) Income statement for the year ended 30 September 2018 Operating profit before interest and tax Interest payable on 8% debentures Tax Profit retained in the year Equity Ordinary Share capital 10% Preference Share capital (issued 1 October 2017) Share premium 6% debentures (issued 1 October 2017) Extract from Draft (unaudited) Statement of Financial Position as at 30 September 2018 Retained Earnings Total Equity Non-Current Liabilities '000 8% Debentures Total Debt Total Equity and Debt 3,800 (400) (650) 2,750 '000 12,250 12,000 550 6,000 3,040 33,840 5,000 5,000 38,840 Based upon the above unaudited draft financial statements, the gearing ratio (Debt/Equity) is 0.15 (5,000/ 33,840), which is well below the 8% debenture covenant limit of 0.5. The extract from 10% discount tables (right) may assist in your answer. Required: a) b) c) d) Year: 1 2 3 10% Discount Factor: 0.9091 0.8265 0.7514 Explain the key differences between equity and debt, with reference to the IASB's Conceptual Framework. (1) 10% cumulative preference shares (ii) 6% convertible debentures Explain why the finance director's arguments for accounting for the two new sources of finance are incorrect and explain how each should be accounted for in the financial statements, in accordance with international accounting standards. Show all your workings, but do not extend calculations beyond 30 September 2018. Show how the correct accounting treatment of the two new sources of finance you outlined in requirement (b) alters the gearing ratio for Ego Ltd at 30 September 2018 by restating both debt and equity to their correct amounts, and recalculating gearing. Discuss how Positive Accounting Theory explains the motivation of the Finance Director to present the financial statements as shown in their draft format, and whether the Finance Director - who is a Chartered Accountant - is behaving ethically in preparing the draft accounts.

Step by Step Solution

★★★★★

3.49 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

a The key differences between equity and debt can be summarized as follows Equity represents the residual interest in the assets of an entity after deducting all of its liabilities In other words equi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started