Answered step by step

Verified Expert Solution

Question

1 Approved Answer

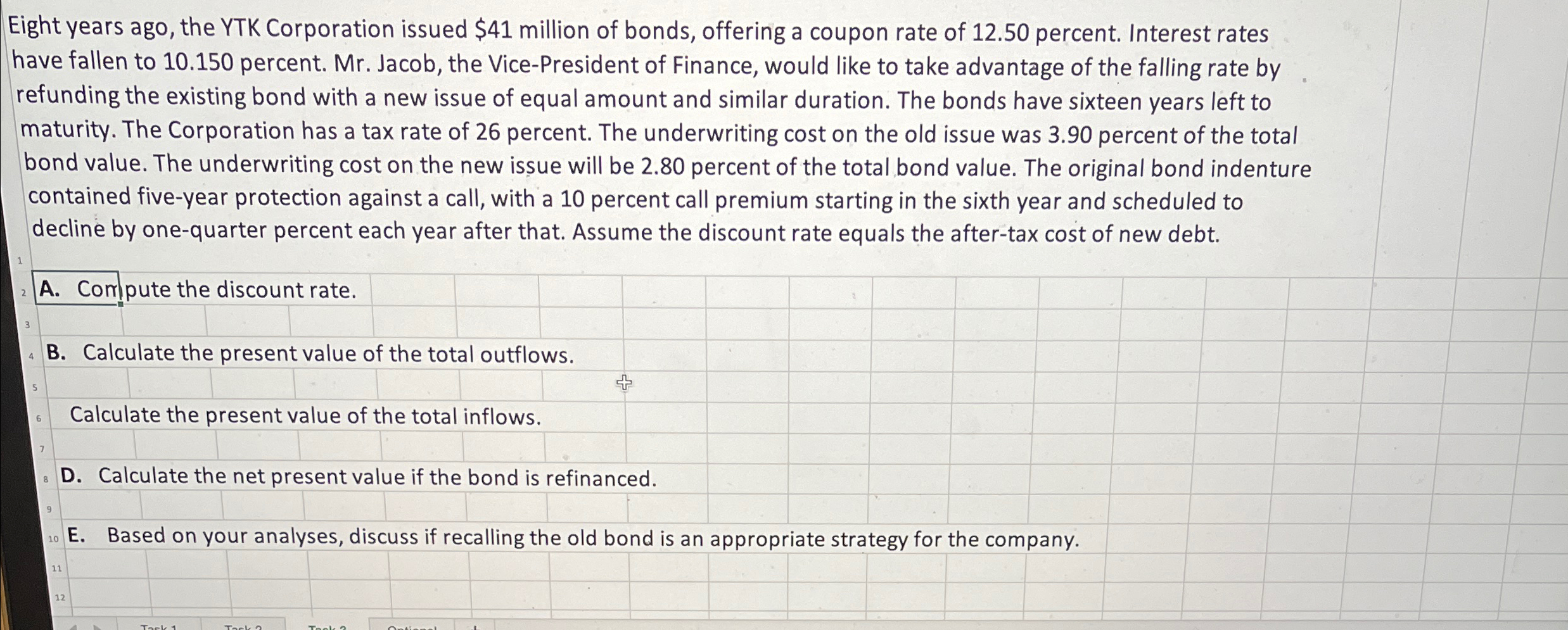

Eight years ago, the YTK Corporation issued $ 4 1 million of bonds, offering a coupon rate of 1 2 . 5 0 percent. Interest

Eight years ago, the YTK Corporation issued $ million of bonds, offering a coupon rate of percent. Interest rates have fallen to percent. Mr Jacob, the VicePresident of Finance, would like to take advantage of the falling rate by refunding the existing bond with a new issue of equal amount and similar duration. The bonds have sixteen years left to maturity. The Corporation has a tax rate of percent. The underwriting cost on the old issue was percent of the total bond value. The underwriting cost on the new issue will be percent of the total bond value. The original bond indenture contained fiveyear protection against a call, with a percent call premium starting in the sixth year and scheduled to decline by onequarter percent each year after that. Assume the discount rate equals the aftertax cost of new debt.

A Compute the discount rate.

B Calculate the present value of the total outflows.

Calculate the present value of the total inflows.

D Calculate the net present value if the bond is refinanced.

E Based on your analyses, discuss if recalling the old bond is an appropriate strategy for the company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started