Answered step by step

Verified Expert Solution

Question

1 Approved Answer

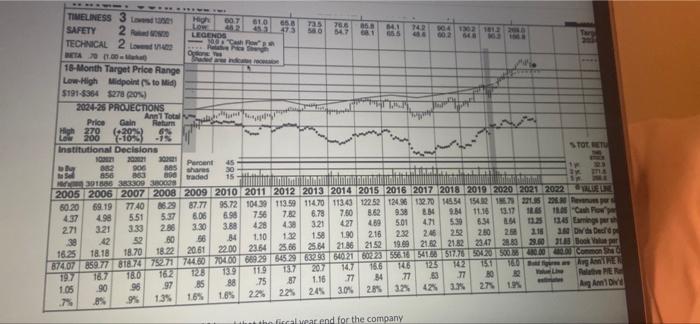

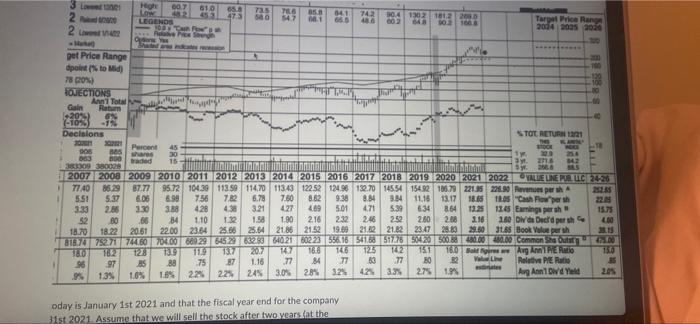

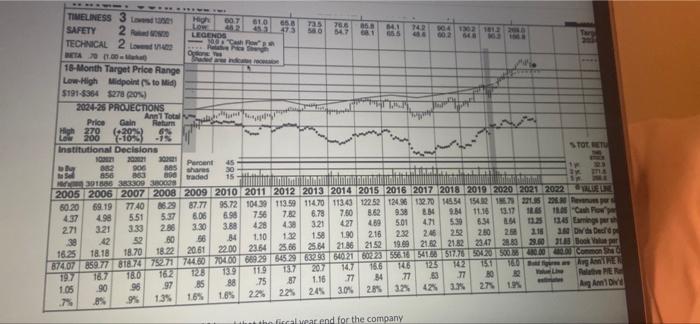

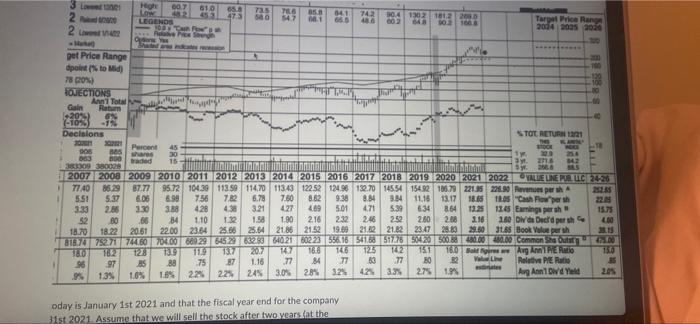

El 27042013 TIMELINESS 3 00.7 010 658 SAFETY Ta LOW 2 70.6 25 580 14,1 LEGENDS 54.7 04132 161 TECHNICAL 2 002 w ETA 18-Month

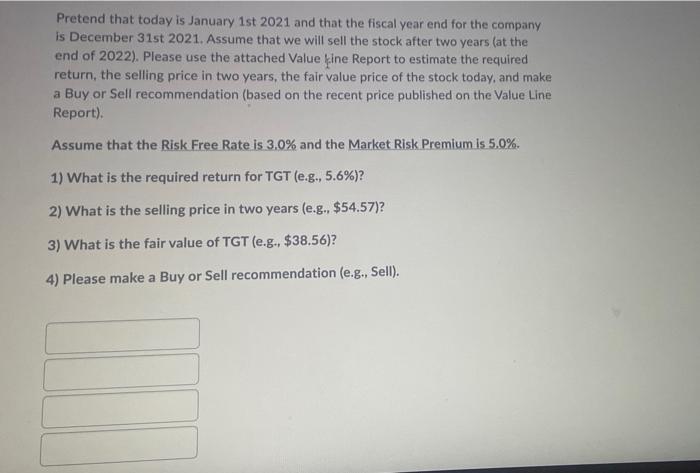

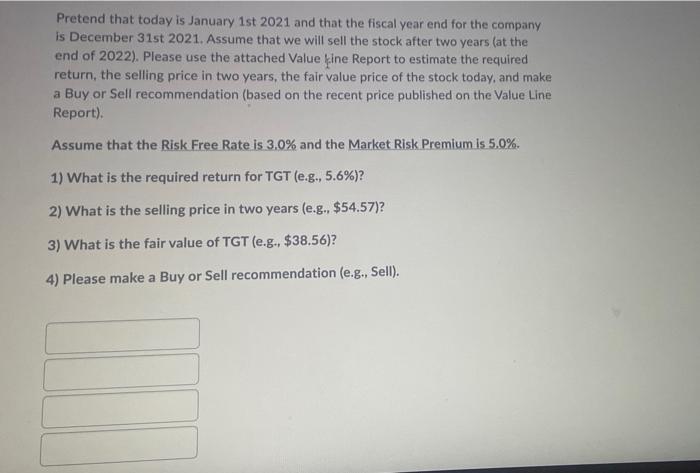

El 27042013 TIMELINESS 3 00.7 010 658 SAFETY Ta LOW 2 70.6 25 580 14,1 LEGENDS 54.7 04132 161 TECHNICAL 2 002 w ETA 18-Month Target Price Range Low-High Midpoints to Mid $191-6364 327320N 2024-26 PROJECTIONS Ann1 Total Price Gain Return LU 8 Y-101 Institutional Decisions STOT LETU 20 882 Percent 30 850 15 330108 3800 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 50.20 69.19 77.40 26 29 87.77 95.72 104.30 113.59 114.70 113.43 122522496 132.70 14554 15421221.5 22. De 437 498 5.51 5.37 6.06 6.98 7:56 782 6.78 7.50 8.62 9.38 8.34 9.54 11.10 13.11 Cachos 271 3:21 3.33 284 330 389 428 439 3.21 4.27 489 501 47 5:30 5.54 LA 42 38 60 56 34 1.10 132 150 190 2.16 232 24 252 280 31 ON Ded 18.18 18.70 1822 20.61 22.00 21 21.86 2152 16.25 2064 25.86 28.64 19.00 21.82 23:47 239 28.00 Book Vapor 5740715977 BIL.74275271 7600460600354526323640210235671051279420500236.00 12 11 12 731 TE 123 14. 180 762 19 TO 16.7 1551 54 1.16 88 77 77 83 77 80 75 Malah PER 97 90 105 85 98 22% 273 245 1 30% 185 16% 224 2.83% 42% 1. BS 7% 94 ROS as she 300wded 160 AD 1.35 thical wear end for the company 5.888 BB Heghe 007 610 65 as Low 341 742 547 30.4 130 LEGENDS 1812200 66 002 Target Price Rang 30.2 1000 2 TO 2004 2035 2030 Q pet Price Range $ dpoled to Mid 78 COM BOJECTIONS Ann Tot Gain Ram 20%) (-10%) 3 Decisions TOT RETUR1221 30 Percent 45 30 15 383009 380029 2 142 sy 2008 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 TALLE LINER LLC 24-26 7740 85.29 87.77 95.72 104.30 113.59 114.7011343 122.52 122.96 152.70 14554 15492 106.79 2215 22.0 Revenues part 22.30 551 5.37 6.08 8.99 7.58 7.32 6.74 7.50 8.82 9.38 8.84 3.4 11.16 13.17 18.6 10 Cash 22 3.33 2.85 330 3.88 428 438 3.21 4.27 409 5.01 4.71 5.30 634 8.64 13.25 12.45 Earningspers 15.75 52 80 .86 34 110 12 1.50 1.90 216 2.32 2.46 252 2.80 200 116 1.80 DIY Deerd persh 400 18.70 18.22 20.61 22.00 23.64 25.00 25.64 2184 21.52 19.00 21.02 21.82 23:47 2389 2960 3L5 Book Worth 21 BIB/I782712820068922 645262364021626616161235542030000.00 Commentit DO 1600 162 128 110 1517 2017 147 TE 126 125 T2 151 180 Str w Ang Ann IMEO 150 36 97 85 88 75 87 1.16 .77 84 77 3 77 WN B0 32 Rolat PE Ratio 35 . 1.35 1.6% 10% 224 225 245 3.05 24 324 4253 275 1.94 Ang And Yeld 205 was wed oday is January 1st 2021 and that the fiscal year end for the company 31st 2021. Assume that we will sell the stock after two years.cat the Pretend that today is January 1st 2021 and that the fiscal year end for the company is December 31st 2021. Assume that we will sell the stock after two years (at the end of 2022). Please use the attached Value xine Report to estimate the required return, the selling price in two years, the fair value price of the stock today, and make a Buy or Sell recommendation (based on the recent price published on the Value Line Report), Assume that the Risk Free Rate is 3.0% and the Market Risk Premium is 5,0%. 1) What is the required return for TGT (e.g., 5.6%)? 2) What is the selling price in two years (e.g. $54.57)? 3) What is the fair value of TGT (e.g.. $38.56)? 4) Please make a Buy or Sell recommendation (e.g., Sell). El 27042013 TIMELINESS 3 00.7 010 658 SAFETY Ta LOW 2 70.6 25 580 14,1 LEGENDS 54.7 04132 161 TECHNICAL 2 002 w ETA 18-Month Target Price Range Low-High Midpoints to Mid $191-6364 327320N 2024-26 PROJECTIONS Ann1 Total Price Gain Return LU 8 Y-101 Institutional Decisions STOT LETU 20 882 Percent 30 850 15 330108 3800 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 50.20 69.19 77.40 26 29 87.77 95.72 104.30 113.59 114.70 113.43 122522496 132.70 14554 15421221.5 22. De 437 498 5.51 5.37 6.06 6.98 7:56 782 6.78 7.50 8.62 9.38 8.34 9.54 11.10 13.11 Cachos 271 3:21 3.33 284 330 389 428 439 3.21 4.27 489 501 47 5:30 5.54 LA 42 38 60 56 34 1.10 132 150 190 2.16 232 24 252 280 31 ON Ded 18.18 18.70 1822 20.61 22.00 21 21.86 2152 16.25 2064 25.86 28.64 19.00 21.82 23:47 239 28.00 Book Vapor 5740715977 BIL.74275271 7600460600354526323640210235671051279420500236.00 12 11 12 731 TE 123 14. 180 762 19 TO 16.7 1551 54 1.16 88 77 77 83 77 80 75 Malah PER 97 90 105 85 98 22% 273 245 1 30% 185 16% 224 2.83% 42% 1. BS 7% 94 ROS as she 300wded 160 AD 1.35 thical wear end for the company 5.888 BB Heghe 007 610 65 as Low 341 742 547 30.4 130 LEGENDS 1812200 66 002 Target Price Rang 30.2 1000 2 TO 2004 2035 2030 Q pet Price Range $ dpoled to Mid 78 COM BOJECTIONS Ann Tot Gain Ram 20%) (-10%) 3 Decisions TOT RETUR1221 30 Percent 45 30 15 383009 380029 2 142 sy 2008 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 TALLE LINER LLC 24-26 7740 85.29 87.77 95.72 104.30 113.59 114.7011343 122.52 122.96 152.70 14554 15492 106.79 2215 22.0 Revenues part 22.30 551 5.37 6.08 8.99 7.58 7.32 6.74 7.50 8.82 9.38 8.84 3.4 11.16 13.17 18.6 10 Cash 22 3.33 2.85 330 3.88 428 438 3.21 4.27 409 5.01 4.71 5.30 634 8.64 13.25 12.45 Earningspers 15.75 52 80 .86 34 110 12 1.50 1.90 216 2.32 2.46 252 2.80 200 116 1.80 DIY Deerd persh 400 18.70 18.22 20.61 22.00 23.64 25.00 25.64 2184 21.52 19.00 21.02 21.82 23:47 2389 2960 3L5 Book Worth 21 BIB/I782712820068922 645262364021626616161235542030000.00 Commentit DO 1600 162 128 110 1517 2017 147 TE 126 125 T2 151 180 Str w Ang Ann IMEO 150 36 97 85 88 75 87 1.16 .77 84 77 3 77 WN B0 32 Rolat PE Ratio 35 . 1.35 1.6% 10% 224 225 245 3.05 24 324 4253 275 1.94 Ang And Yeld 205 was wed oday is January 1st 2021 and that the fiscal year end for the company 31st 2021. Assume that we will sell the stock after two years.cat the Pretend that today is January 1st 2021 and that the fiscal year end for the company is December 31st 2021. Assume that we will sell the stock after two years (at the end of 2022). Please use the attached Value xine Report to estimate the required return, the selling price in two years, the fair value price of the stock today, and make a Buy or Sell recommendation (based on the recent price published on the Value Line Report), Assume that the Risk Free Rate is 3.0% and the Market Risk Premium is 5,0%. 1) What is the required return for TGT (e.g., 5.6%)? 2) What is the selling price in two years (e.g. $54.57)? 3) What is the fair value of TGT (e.g.. $38.56)? 4) Please make a Buy or Sell recommendation (e.g., Sell)

El 27042013 TIMELINESS 3 00.7 010 658 SAFETY Ta LOW 2 70.6 25 580 14,1 LEGENDS 54.7 04132 161 TECHNICAL 2 002 w ETA 18-Month Target Price Range Low-High Midpoints to Mid $191-6364 327320N 2024-26 PROJECTIONS Ann1 Total Price Gain Return LU 8 Y-101 Institutional Decisions STOT LETU 20 882 Percent 30 850 15 330108 3800 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 50.20 69.19 77.40 26 29 87.77 95.72 104.30 113.59 114.70 113.43 122522496 132.70 14554 15421221.5 22. De 437 498 5.51 5.37 6.06 6.98 7:56 782 6.78 7.50 8.62 9.38 8.34 9.54 11.10 13.11 Cachos 271 3:21 3.33 284 330 389 428 439 3.21 4.27 489 501 47 5:30 5.54 LA 42 38 60 56 34 1.10 132 150 190 2.16 232 24 252 280 31 ON Ded 18.18 18.70 1822 20.61 22.00 21 21.86 2152 16.25 2064 25.86 28.64 19.00 21.82 23:47 239 28.00 Book Vapor 5740715977 BIL.74275271 7600460600354526323640210235671051279420500236.00 12 11 12 731 TE 123 14. 180 762 19 TO 16.7 1551 54 1.16 88 77 77 83 77 80 75 Malah PER 97 90 105 85 98 22% 273 245 1 30% 185 16% 224 2.83% 42% 1. BS 7% 94 ROS as she 300wded 160 AD 1.35 thical wear end for the company 5.888 BB Heghe 007 610 65 as Low 341 742 547 30.4 130 LEGENDS 1812200 66 002 Target Price Rang 30.2 1000 2 TO 2004 2035 2030 Q pet Price Range $ dpoled to Mid 78 COM BOJECTIONS Ann Tot Gain Ram 20%) (-10%) 3 Decisions TOT RETUR1221 30 Percent 45 30 15 383009 380029 2 142 sy 2008 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 TALLE LINER LLC 24-26 7740 85.29 87.77 95.72 104.30 113.59 114.7011343 122.52 122.96 152.70 14554 15492 106.79 2215 22.0 Revenues part 22.30 551 5.37 6.08 8.99 7.58 7.32 6.74 7.50 8.82 9.38 8.84 3.4 11.16 13.17 18.6 10 Cash 22 3.33 2.85 330 3.88 428 438 3.21 4.27 409 5.01 4.71 5.30 634 8.64 13.25 12.45 Earningspers 15.75 52 80 .86 34 110 12 1.50 1.90 216 2.32 2.46 252 2.80 200 116 1.80 DIY Deerd persh 400 18.70 18.22 20.61 22.00 23.64 25.00 25.64 2184 21.52 19.00 21.02 21.82 23:47 2389 2960 3L5 Book Worth 21 BIB/I782712820068922 645262364021626616161235542030000.00 Commentit DO 1600 162 128 110 1517 2017 147 TE 126 125 T2 151 180 Str w Ang Ann IMEO 150 36 97 85 88 75 87 1.16 .77 84 77 3 77 WN B0 32 Rolat PE Ratio 35 . 1.35 1.6% 10% 224 225 245 3.05 24 324 4253 275 1.94 Ang And Yeld 205 was wed oday is January 1st 2021 and that the fiscal year end for the company 31st 2021. Assume that we will sell the stock after two years.cat the Pretend that today is January 1st 2021 and that the fiscal year end for the company is December 31st 2021. Assume that we will sell the stock after two years (at the end of 2022). Please use the attached Value xine Report to estimate the required return, the selling price in two years, the fair value price of the stock today, and make a Buy or Sell recommendation (based on the recent price published on the Value Line Report), Assume that the Risk Free Rate is 3.0% and the Market Risk Premium is 5,0%. 1) What is the required return for TGT (e.g., 5.6%)? 2) What is the selling price in two years (e.g. $54.57)? 3) What is the fair value of TGT (e.g.. $38.56)? 4) Please make a Buy or Sell recommendation (e.g., Sell). El 27042013 TIMELINESS 3 00.7 010 658 SAFETY Ta LOW 2 70.6 25 580 14,1 LEGENDS 54.7 04132 161 TECHNICAL 2 002 w ETA 18-Month Target Price Range Low-High Midpoints to Mid $191-6364 327320N 2024-26 PROJECTIONS Ann1 Total Price Gain Return LU 8 Y-101 Institutional Decisions STOT LETU 20 882 Percent 30 850 15 330108 3800 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 50.20 69.19 77.40 26 29 87.77 95.72 104.30 113.59 114.70 113.43 122522496 132.70 14554 15421221.5 22. De 437 498 5.51 5.37 6.06 6.98 7:56 782 6.78 7.50 8.62 9.38 8.34 9.54 11.10 13.11 Cachos 271 3:21 3.33 284 330 389 428 439 3.21 4.27 489 501 47 5:30 5.54 LA 42 38 60 56 34 1.10 132 150 190 2.16 232 24 252 280 31 ON Ded 18.18 18.70 1822 20.61 22.00 21 21.86 2152 16.25 2064 25.86 28.64 19.00 21.82 23:47 239 28.00 Book Vapor 5740715977 BIL.74275271 7600460600354526323640210235671051279420500236.00 12 11 12 731 TE 123 14. 180 762 19 TO 16.7 1551 54 1.16 88 77 77 83 77 80 75 Malah PER 97 90 105 85 98 22% 273 245 1 30% 185 16% 224 2.83% 42% 1. BS 7% 94 ROS as she 300wded 160 AD 1.35 thical wear end for the company 5.888 BB Heghe 007 610 65 as Low 341 742 547 30.4 130 LEGENDS 1812200 66 002 Target Price Rang 30.2 1000 2 TO 2004 2035 2030 Q pet Price Range $ dpoled to Mid 78 COM BOJECTIONS Ann Tot Gain Ram 20%) (-10%) 3 Decisions TOT RETUR1221 30 Percent 45 30 15 383009 380029 2 142 sy 2008 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 TALLE LINER LLC 24-26 7740 85.29 87.77 95.72 104.30 113.59 114.7011343 122.52 122.96 152.70 14554 15492 106.79 2215 22.0 Revenues part 22.30 551 5.37 6.08 8.99 7.58 7.32 6.74 7.50 8.82 9.38 8.84 3.4 11.16 13.17 18.6 10 Cash 22 3.33 2.85 330 3.88 428 438 3.21 4.27 409 5.01 4.71 5.30 634 8.64 13.25 12.45 Earningspers 15.75 52 80 .86 34 110 12 1.50 1.90 216 2.32 2.46 252 2.80 200 116 1.80 DIY Deerd persh 400 18.70 18.22 20.61 22.00 23.64 25.00 25.64 2184 21.52 19.00 21.02 21.82 23:47 2389 2960 3L5 Book Worth 21 BIB/I782712820068922 645262364021626616161235542030000.00 Commentit DO 1600 162 128 110 1517 2017 147 TE 126 125 T2 151 180 Str w Ang Ann IMEO 150 36 97 85 88 75 87 1.16 .77 84 77 3 77 WN B0 32 Rolat PE Ratio 35 . 1.35 1.6% 10% 224 225 245 3.05 24 324 4253 275 1.94 Ang And Yeld 205 was wed oday is January 1st 2021 and that the fiscal year end for the company 31st 2021. Assume that we will sell the stock after two years.cat the Pretend that today is January 1st 2021 and that the fiscal year end for the company is December 31st 2021. Assume that we will sell the stock after two years (at the end of 2022). Please use the attached Value xine Report to estimate the required return, the selling price in two years, the fair value price of the stock today, and make a Buy or Sell recommendation (based on the recent price published on the Value Line Report), Assume that the Risk Free Rate is 3.0% and the Market Risk Premium is 5,0%. 1) What is the required return for TGT (e.g., 5.6%)? 2) What is the selling price in two years (e.g. $54.57)? 3) What is the fair value of TGT (e.g.. $38.56)? 4) Please make a Buy or Sell recommendation (e.g., Sell)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started