Question

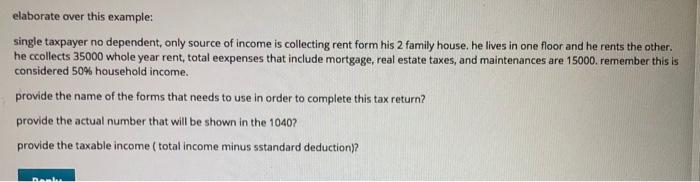

elaborate over this example: single taxpayer no dependent, only source of income is collecting rent form his 2 family house. he lives in one

elaborate over this example: single taxpayer no dependent, only source of income is collecting rent form his 2 family house. he lives in one floor and he rents the other. he ccollects 35000 whole year rent, total eexpenses that include mortgage, real estate taxes, and maintenances are 15000. remember this is considered 50% household income. provide the name of the forms that needs to use in order to complete this tax return? provide the actual number that will be shown in the 1040? provide the taxable income ( total income minus sstandard deduction)? Denku

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer A Forms 1040 and 1040ES are should have been utilized so as to complete the tax return Form 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Tax Research

Authors: Barbara H. Karlin

4th Edition

013601531X, 978-0136015314

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App