Question

Sticky Wicket (SW) manufactures cricket bats using high quality wood and skilled labour using mainly traditional manual techniques. The manufacturing department is a cost centre

Sticky Wicket (SW) manufactures cricket bats using high quality wood and skilled labour using mainly traditional manual techniques. The manufacturing department is a cost centre within the business and operates a standard costing system based on marginal costs. At the beginning of April the production director attempted to reduce the cost of the bats by sourcing wood from a new supplier and deskilIing the process a little by using lower grade staff on parts of the production process. The standards were not adjusted to reflect these changes.The variance report for April is shown below (extract):

The production director pointed out in his April board report that the new grade of labour required significant training in April and this meant that productive time was lower than usual. He accepted that the workers were a little slow at the moment but expected that an improvement would be seen in May. He also mentioned that the new wood being used was proving difficult to cut cleanly resulting in increased waste levels. Sales for April were down 10 per cent on budget and returnsof faulty bats were up 20 percent on the previous month. The sales director resigned after the board meeting stating that SW had always produced quality products but the new strategy was bound to upset customers and damage the brand of the business.

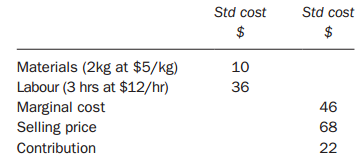

Required:(a) Assess the performance of the production director using all the information above taking into account both the decision to use a new supplier and the decision to deskill the process.In May the budgeted sales were 19 000 bats and the standard cost card is as follows:

In May the following results were achieved: 40 000 kg of wood were bought at a cost of $196 000, this produced 19 200 cricket bats. No inventory of raw materials is held. The labour was paid for 62 000 hours and the total cost was $694 000. Labour worked for 61 500 hours.

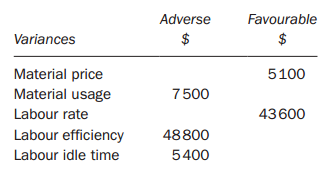

The sales price was reduced to protect the sales levels.However, only 18 000 cricket bats were sold at an average price of $65.(b) Calculate the materials, labour and sales variances for May in as much detail as the information allows.You are not required to comment on the performance of the business.

Variances Material price Material usage Labour rate Labour efficiency Labour idle time Adverse $ 7500 48800 5400 Favourable $ 5100 43600 Materials (2kg at $5/kg) Labour (3 hrs at $12/hr) Marginal cost Selling price Contribution Std cost $ 10 36 Std cost $ 46 68 22

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Part a Due to the increased variety of tournaments in terms of T20 IPL and other competitions open at regional level the market share of Bats manufacture is bigger than other industries Being in charg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started