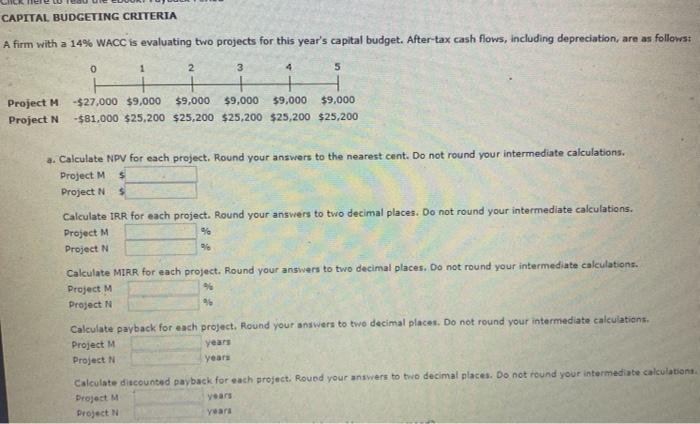

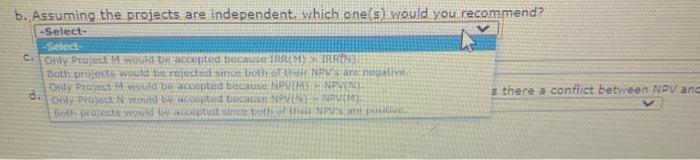

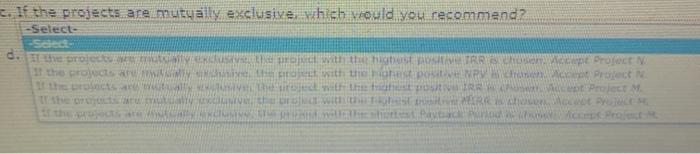

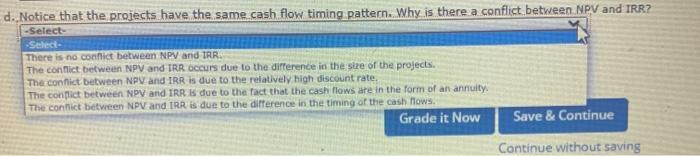

ele CAPITAL BUDGETING CRITERIA A firm with a 14% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: 0 1 2 3 4 5 Project M Project N -$27,000 $9,000 $9,000 $9,000 $9,000 $9,000 -$81,000 $25,200 $25,200 $25,200 $25,200 $25,200 2. Calculate NPV for each project. Round your answers to the nearest cent. Do not round your intermediate calculations. Project M $ Project N $ 90 Calculate IRR for each project. Round your answers to two decimal places. Do not round your intermediate calculations. Project M Project N Calculate MIRR for each project. Round your answers to two decimal places. Do not round your intermediate calculations. Project M % Project N 96 Calculate payback for each project. Round your answers to two decimal places. Do not round your intermediate calculations. Project M Project N years Calculate discounted payback for each project. Round your answers to two decimal places. Do not round your intermediate calculation Project M years Project years years b. Assuming the projects are independent which one(s) would you recommend? -Select- -Selce C. TONY Project Mecepted tiuca SO IRRIMIRRON Both pro Would be rejected in both NRV's are negative NEVER Oy Project we accepted tuca NPU 3. s there a conflict between NPV and Only Project NS pod bucal NPVN WUM bow both NEVE c. If the projects are mutually exclusive, which would you recommend? -Select- d. If the project auch with this TRR pt Project t the root het with the recipe WP Project twit nith the fra Prett M thuis d. Notice that the projects have the same cash flow timing pattern. Why is there a conflict between NPV and IRR? -Select Select- There is no conflict between NPV and IRR. The conflict between NPV and IRR occurs due to the difference in the size of the projects. The conflict between NPV and IRR is due to the relatively high discount rate, The conflict between NPV and IRR is due to the fact that the cash flows are in the form of an annuity The conflict between NPV and IRR is due to the difference in the timing of the cash flows. Grade it Now Save & Continue Continue without saving