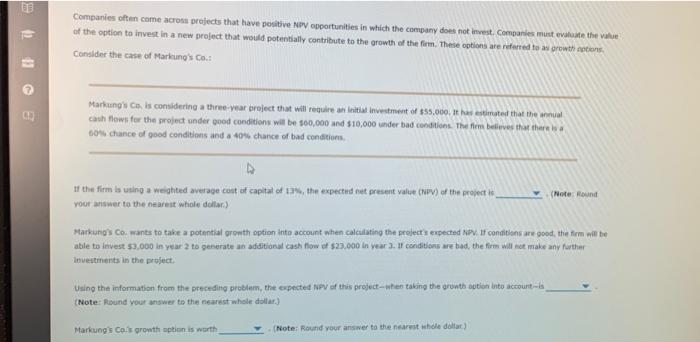

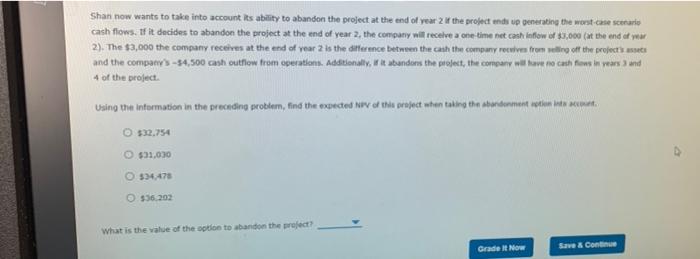

ELE Companies often come across projects that have positive NPV opportunities in which the company does not invest Companies must vaate the value of the option to invest in a new project that would potentially contribute to the growth of the form. These options are referred to as growth options Consider the case of Markeung's Co.: C Markung's C, is considering a three-year project that will require an initial investment of 455,000. It has estimated that the anal cash flows for the project under good conditions will be $60,000 and $10,000 under bad conditions. The firm believes that there is a con chance of good conditions and a 40% chance of bad conditions If the firm is using a weighted average cost of capital of 12, the expected not present Value (NPV) of the project is your answer to the nearest whole dollar) (Note: Round Markuno's Co. wants to take a potential growth option into account when calculating the project's expected Now. If conditions are good, the firm will be able to invest $3.000 in year 2 to generate an additional cash flow of $23.000 in year). It conditions are bad, the fire will dot make any further Investments in the project Using the information from the preceding problem, the expected NPV of this project--when taking the granthaction into account- (Note: Round your answer to the nearest whole dollar) Markung's Coi's growth option is worth (Note: Round your answer to the nearest whole dollar) Shan now wants to take into account its ability to abandon the project at the end of year the project ends up generating the worst case scenario cash flows. If it decides to abandon the project at the end of year 2, the company will receive a one-time net cash inflow of 3,000 (at the end of year 2). The $3,000 the company receives at the end of year 2 is the difference between the cash the company receives from all of the projects and the company's -54,500 cash outflow from operations. Additionally, it abandons the project, the company wave no cash flows in years and 4 of the project Using the intormation in the preceding problem, find the expected Nov of this project when taking the tendermentum internet $22.754 $31.030 534478 $36.203 What is the value of the option to abandon the project Grad Now Save & Con