Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eleanor Evans had a cosmetics manufacturing business in Poole, Dorset. Eleanor bought factory for 1,700,000 in February 2009 and sold it for 2,700,000 in

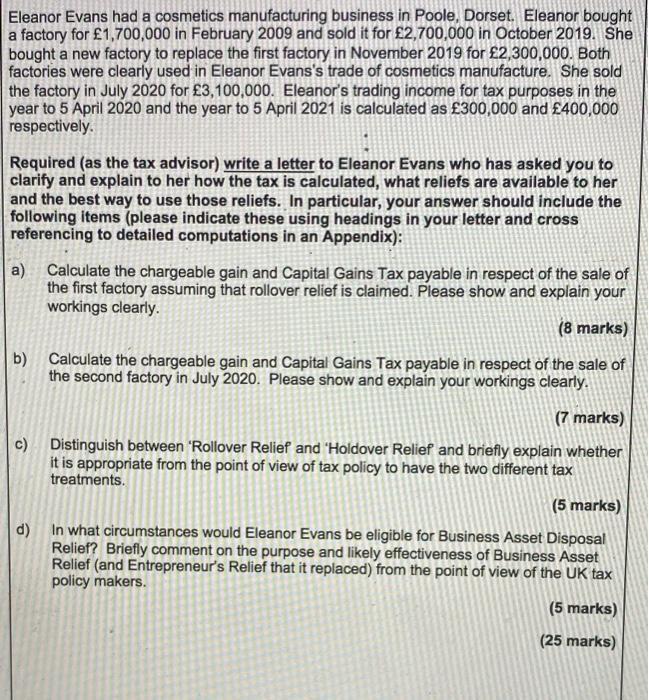

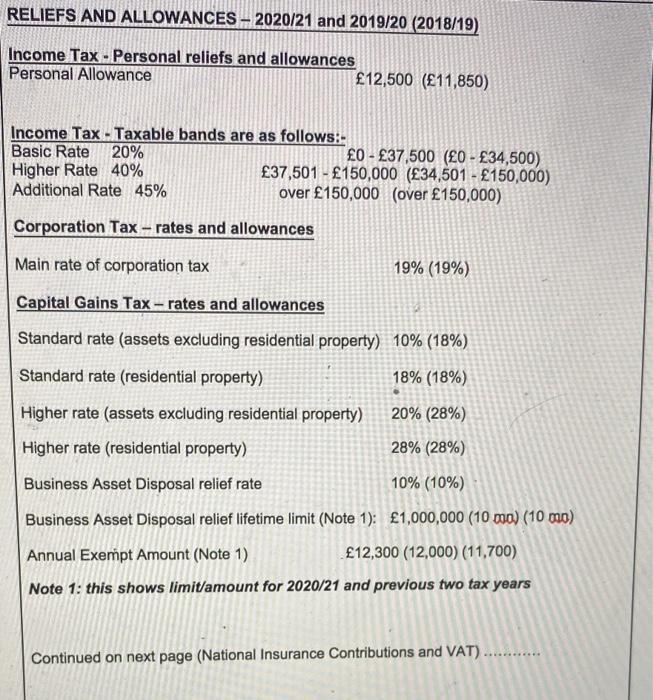

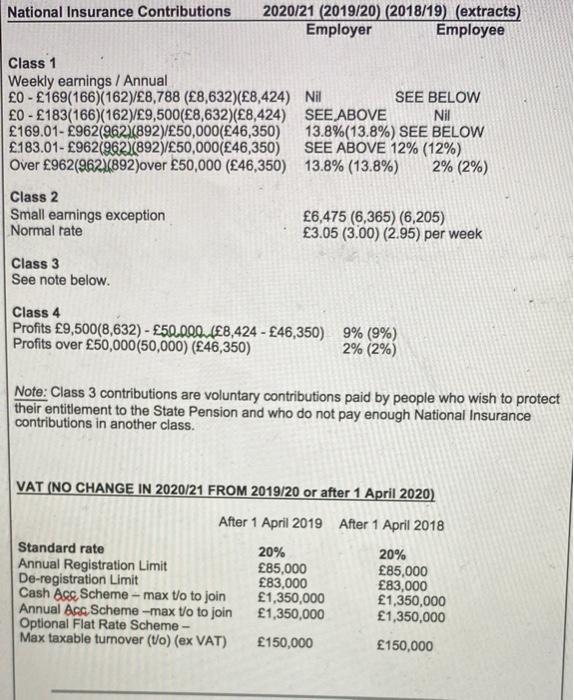

Eleanor Evans had a cosmetics manufacturing business in Poole, Dorset. Eleanor bought factory for 1,700,000 in February 2009 and sold it for 2,700,000 in October 2019. She bought a new factory to replace the first factory in November 2019 for 2,300,000. Both factories were clearly used in Eleanor Evans's trade of cosmetics manufacture. She sold the factory in July 2020 for 3,100,000. Eleanor's trading income for tax purposes in the year to 5 April 2020 and the year to 5 April 2021 is calculated as 300,000 and 400,000 respectively. Required (as the tax advisor) write a letter to Eleanor Evans who has asked you to clarify and explain to her how the tax is calculated, what reliefs are available to her and the best way to use those reliefs. In particular, your answer should include the following items (please indicate these using headings in your letter and cros referencing to detailed computations in an Appendix): a) Calculate the chargeable gain and Capital Gains Tax payable in respect of the sale of the first factory assuming that rollover relief is claimed. Please show and explain your workings clearly. (8 marks) b) Calculate the chargeable gain and Capital Gains Tax payable in respect of the sale of the second factory in July 2020. Please show and explain your workings clearly. (7 marks) c) Distinguish between 'Rollover Relief and "Holdover Relief and briefly explain whether it is appropriate from the point of view of tax policy to have the two different tax treatments. (5 marks) d) In what circumstances would Eleanor Evans be eligible for Business Asset Disposal Relief? Briefly comment on the purpose and likely effectiveness of Business Asset Relief (and Entrepreneur's Relief that it replaced) from the point of view of the UK tax policy makers. (5 marks) (25 marks) RELIEFS AND ALLOWANCES 2020/21 and 2019/20 (2018/19) Income Tax - Personal reliefs and allowances Personal Allowance 12,500 (11,850) Income Tax -Taxable bands are as follows:- Basic Rate Higher Rate 40% Additional Rate 45% 20% 0 - 37,500 (O - 34,500) 37,501 - 150,000 (34,501 - 150,000) over 150,000 (over 150,000) Corporation Tax- rates and allowances Main rate of corporation tax 19% (19%) Capital Gains Tax-rates and allowances Standard rate (assets excluding residential property) 10% (18%) Standard rate (residential property) 18% (18%) Higher rate (assets excluding residential property) 20% (28%) Higher rate (residential property) 28% (28%) Business Asset Disposal relief rate 10% (10%) Business Asset Disposal relief lifetime limit (Note 1): 1,000,000 (10 mo) (10 mo) Annual Exempt Amount (Note 1) 12,300 (12,000) (11,700) Note 1: this shows limit/amount for 2020/21 and previous two tax years Continued on next page (National Insurance Contributions and VAT) 2020/21 (2019/20) (2018/19) (extracts) Employer National Insurance Contributions Employee Class 1 Weekly earnings / Annual 0 - 169(166)(162)/8,788 (8,632)(8,424) Nil 0 - 183(166)(162)/9,500(8,632)(8,424) SEE ABOVE 169.01- 962(962)(892)/50,000(46,350) 183.01- 962(962)(892)/50,000(46,350) Over 962(962892)over 50,000 (46,350) 13.8% (13.8%) SEE BELOW Nil 13.8%(13.8%) SEE BELOW SEE ABOVE 12% (12%) 2% (2%) Class 2 Small earnings exception Normal rate 6,475 (6,365) (6,205) 3.05 (3.00) (2.95) per week Class 3 See note below. Class 4 Profits 9,500(8,632) - 50.000 (8,424 - 46,350) 9% (9%) Profits over 50,000(50,000) (46,350) 2% (2%) Note: Class 3 contributions are voluntary contributions paid by people who wish to protect their entitlement to the State Pension and who do not pay enough National Insurance contributions in another class. VAT (NO CHANGE IN 2020/21 FROM 2019/20 or after 1 April 2020) After 1 April 2019 After 1 April 2018 Standard rate Annual Registration Limit De-registration Limit Cash Acc Scheme - max t/o to join Annual Acc Scheme -max t/o to join Optional Flat Rate Scheme - Max taxable turnover (/o) (ex VAT) 20% 85,000 83,000 1,350,000 1,350,000 20% 85,000 83,000 1,350,000 1,350,000 150,000 150,000

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

aCALCULATION OF CHARGEABLE GAIN PROCEEDS ON SALE OF FIRST FACTORYA POUND 2700000 COST OF FIRST FACTO...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started