Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Electric Trans manufactures and sells electric transportation devices. One of the company's products is an electric carrier for golf clubs called a Powercaddy. A

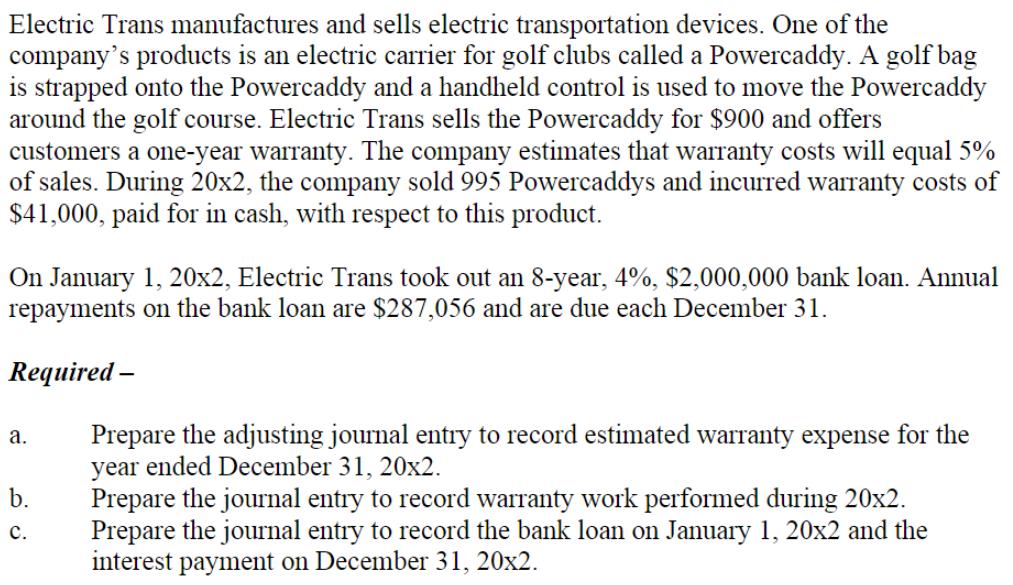

Electric Trans manufactures and sells electric transportation devices. One of the company's products is an electric carrier for golf clubs called a Powercaddy. A golf bag is strapped onto the Powercaddy and a handheld control is used to move the Powercaddy around the golf course. Electric Trans sells the Powercaddy for $900 and offers customers a one-year warranty. The company estimates that warranty costs will equal 5% of sales. During 20x2, the company sold 995 Powercaddys and incurred warranty costs of $41,000, paid for in cash, with respect to this product. On January 1, 20x2, Electric Trans took out an 8-year, 4%, $2,000,000 bank loan. Annual repayments on the bank loan are $287,056 and are due each December 31. Required Prepare the adjusting journal entry to record estimated warranty expense for the year ended December 31, 20x2. Prepare the journal entry to record warranty work performed during 20x2. Prepare the journal entry to record the bank loan on January 1, 20x2 and the interest payment on December 31, 20x2. . b. .

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Solution Account title and explanation Dec 3120x2 Warranty expenses Warranty liability SNo ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started