Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Electro plc Electro plc ('Electro') is a company based in the UK that manufactures electric bikes. Electro's directors wish to expand their business by

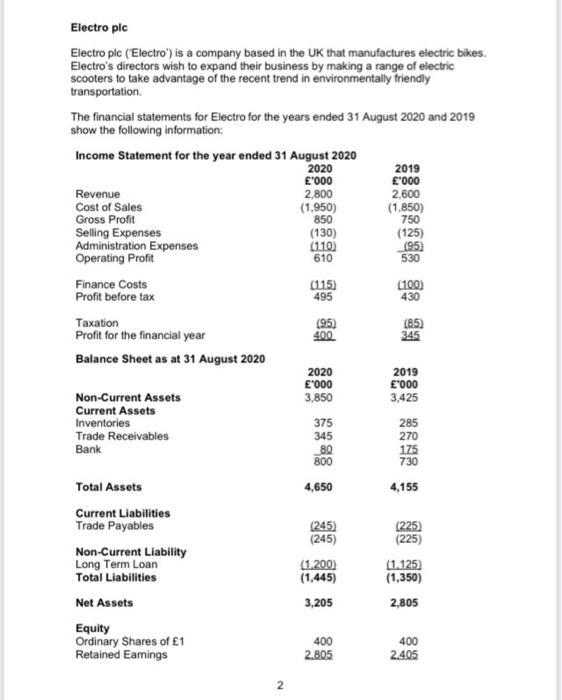

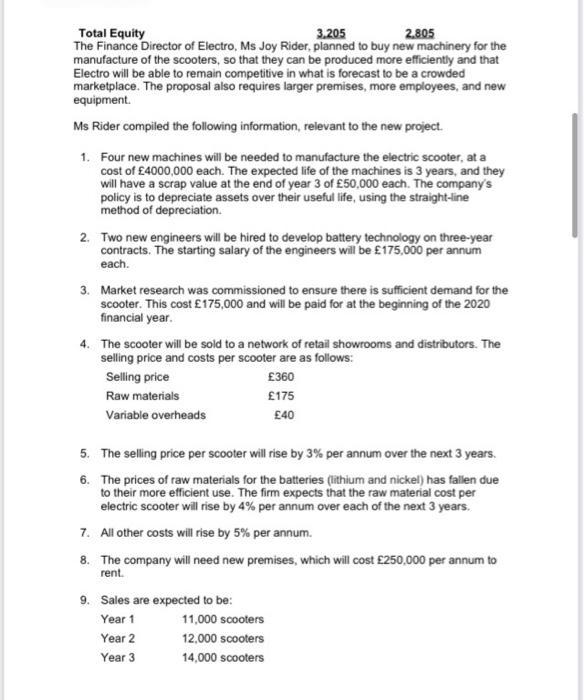

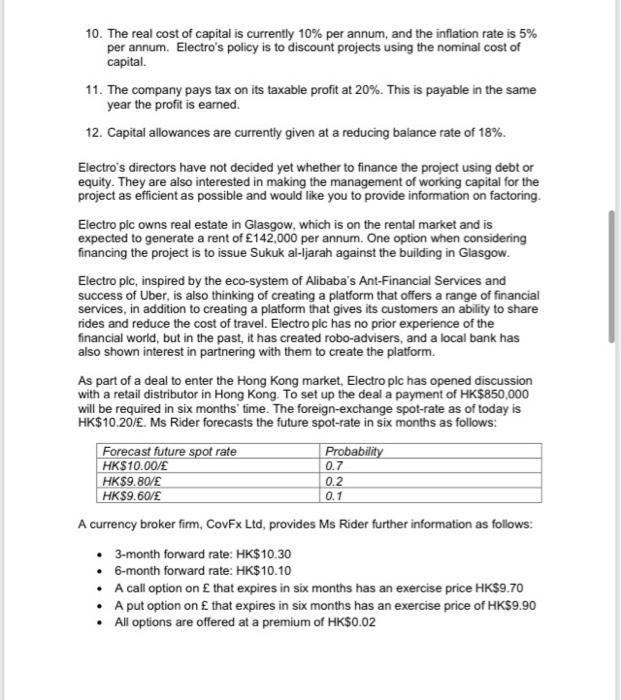

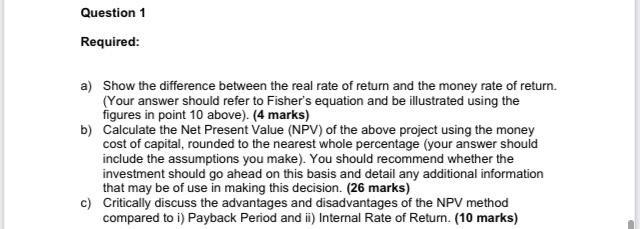

Electro plc Electro plc ('Electro') is a company based in the UK that manufactures electric bikes. Electro's directors wish to expand their business by making a range of electric scooters to take advantage of the recent trend in environmentally friendly transportation. The financial statements for Electro for the years ended 31 August 2020 and 2019 show the following information: Income Statement for the year ended 31 August 2020 2020 '000 Revenue Cost of Sales Gross Profit Selling Expenses Administration Expenses Operating Profit Finance Costs Profit before tax Taxation Profit for the financial year Balance Sheet as at 31 August 2020 Non-Current Assets Current Assets Inventories Trade Receivables Bank Total Assets Current Liabilities Trade Payables Non-Current Liability Long Term Loan Total Liabilities Net Assets Equity Ordinary Shares of 1 Retained Earnings 2 2,800 (1,950) 850 (130) (110) 610 (115) 495 (95) 400 2020 '000 3,850 375 345 80 800 4,650 (245) (245) (1.200) (1,445) 3,205 400 2.805 2019 '000 2,600 (1,850) 750 (125) (95) 530 (100) 430 (85) 345 2019 '000 3,425 285 270 175 730 4,155 (225) (225) (1.125) (1,350) 2,805 400 2.405 Total Equity 3,205 2,805 The Finance Director of Electro, Ms Joy Rider, planned to buy new machinery for the manufacture of the scooters, so that they can be produced more efficiently and that Electro will be able to remain competitive in what is forecast to be a crowded marketplace. The proposal also requires larger premises, more employees, and new equipment. Ms Rider compiled the following information, relevant to the new project. 1. Four new machines will be needed to manufacture the electric scooter, at a cost of 4000,000 each. The expected life of the machines is 3 years, and they will have a scrap value at the end of year 3 of 50,000 each. The company's policy is to depreciate assets over their useful life, using the straight-line method of depreciation. 2. Two new engineers will be hired to develop battery technology on three-year contracts. The starting salary of the engineers will be 175,000 per annum each. 3. Market research was commissioned to ensure there is sufficient demand for the scooter. This cost 175,000 and will be paid for at the beginning of the 2020 financial year. 4. The scooter will be sold to a network of retail showrooms and distributors. The selling price and costs per scooter are as follows: 360 175 40 Selling price Raw materials Variable overheads 5. The selling price per scooter will rise by 3% per annum over the next 3 years. 6. The prices of raw materials for the batteries (lithium and nickel) has fallen due to their more efficient use. The firm expects that the raw material cost per electric scooter will rise by 4% per annum over each of the next 3 years. 7. All other costs will rise by 5% per annum. 8. The company will need new premises, which will cost 250,000 per annum to rent. 9. Sales are expected to be: Year 1 Year 2 Year 3 11,000 scooters 12,000 scooters 14,000 scooters 10. The real cost of capital is currently 10% per annum, and the inflation rate is 5% per annum. Electro's policy is to discount projects using the nominal cost of capital. 11. The company pays tax on its taxable profit at 20%. This is payable in the same year the profit is earned. 12. Capital allowances are currently given at a reducing balance rate of 18%. Electro's directors have not decided yet whether to finance the project using debt or equity. They are also interested in making the management of working capital for the project as efficient as possible and would like you to provide information on factoring. Electro plc owns real estate in Glasgow, which is on the rental market and is expected to generate a rent of 142,000 per annum. One option when considering financing the project is to issue Sukuk al-Ijarah against the building in Glasgow. Electro plc, inspired by the eco-system of Alibaba's Ant-Financial Services and success of Uber, is also thinking of creating a platform that offers a range of financial services, in addition to creating a platform that gives its customers an ability to share rides and reduce the cost of travel. Electro plc has no prior experience of the financial world, but in the past, it has created robo-advisers, and a local bank has also shown interest in partnering with them to create the platform. As part of a deal to enter the Hong Kong market, Electro plc has opened discussion with a retail distributor in Hong Kong. To set up the deal a payment of HK$850,000 will be required in six months' time. The foreign-exchange spot-rate as of today is HK$10.20/E. Ms Rider forecasts the future spot-rate in six months as follows: Forecast future spot rate HK$10.00/ HK$9.80/E HK$9.60/E Probability 0.7 0.2 0.1 A currency broker firm, CovFx Ltd, provides Ms Rider further information as follows: 3-month forward rate: HK$10.30 6-month forward rate: HK$10.10 A call option on that expires in six months has an exercise price HK$9.70 A put option on that expires in six months has an exercise price of HK$9.90 All options are offered at a premium of HK$0.02 Question 1 Required: a) Show the difference between the real rate of return and the money rate of return. (Your answer should refer to Fisher's equation and be illustrated using the figures in point 10 above). (4 marks) b) Calculate the Net Present Value (NPV) of the above project using the money cost of capital, rounded to the nearest whole percentage (your answer should include the assumptions you make). You should recommend whether the investment should go ahead on this basis and detail any additional information that may be of use in making this decision. (26 marks) c) Critically discuss the advantages and disadvantages of the NPV method compared to i) Payback Period and ii) Internal Rate of Return. (10 marks)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the financial aspects of Electros new project and provide information ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started