Answered step by step

Verified Expert Solution

Question

1 Approved Answer

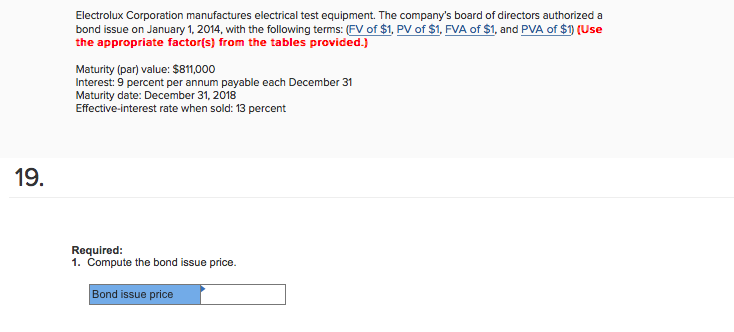

Electrolux Corporation manufactures electrical test equipment. The company's board of directors authorized a bond issue on January 1, 2014, with the following terms: (FV of

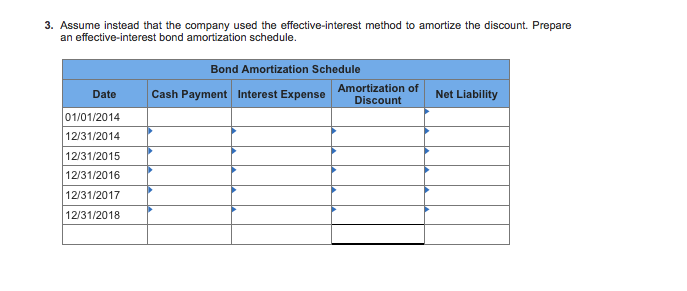

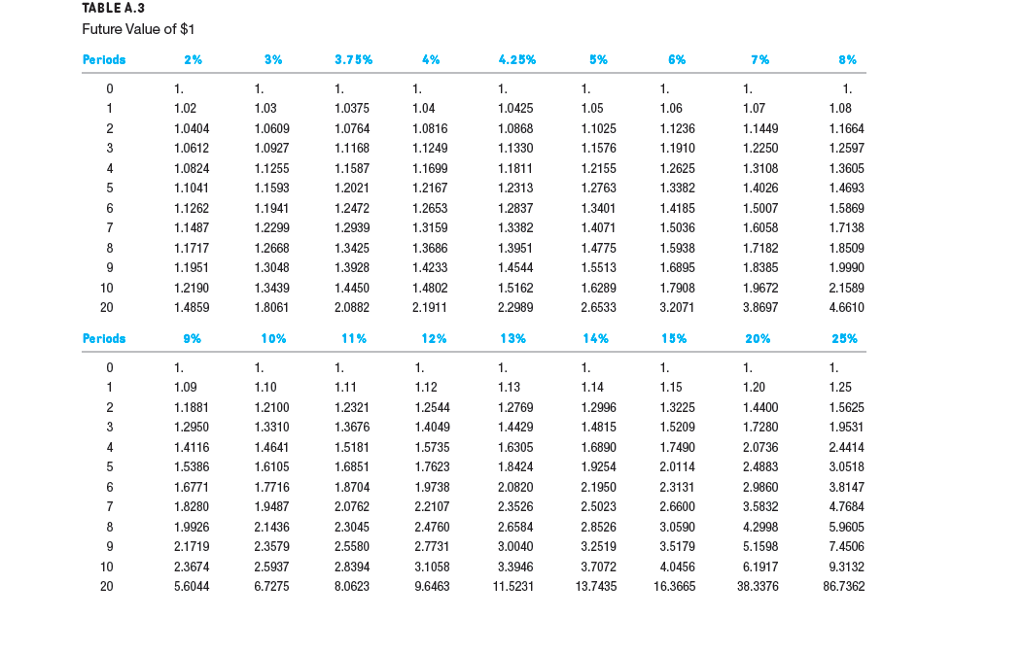

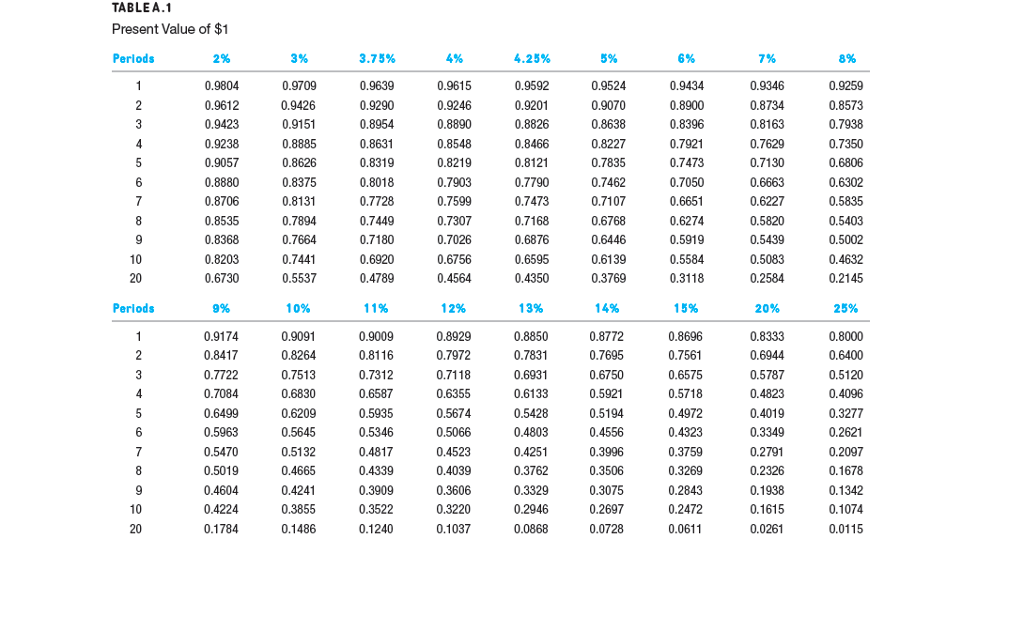

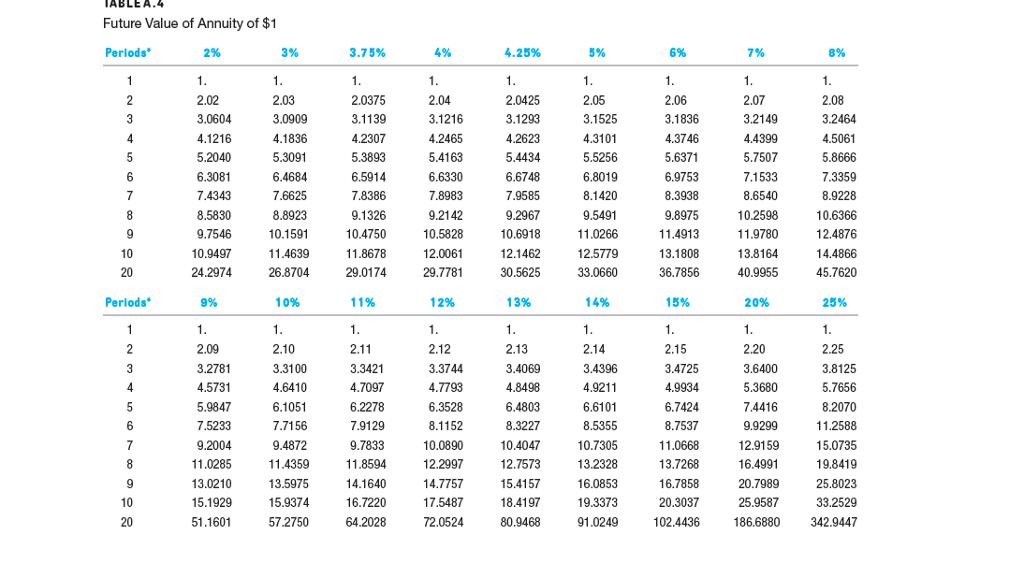

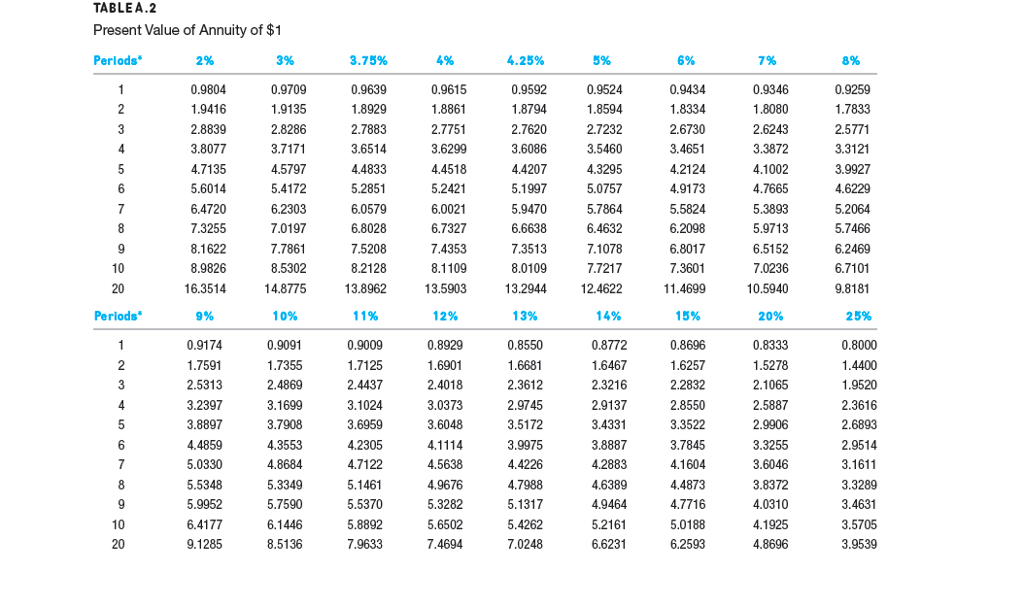

Electrolux Corporation manufactures electrical test equipment. The company's board of directors authorized a bond issue on January 1, 2014, with the following terms: (FV of $1, PV of $1, FVA of $1, and PVA of $1 (Use the appropriate factor(s) from the tables provided.) Maturity (par) value: $811,000 Interest: 9 percent per annum payable each December 31 Maturity date: December 31, 2018 Effective-interest rate when sold: 13 percent 19. Required: 1. Compute the bond issue price. Bond issue price 3. Assume instead that the company used the effective-interest method to amortize the discount. Prepare an effective-interest bond amortization schedule. Bond Amortization Schedule Amortization of Net Liability Discount Date Cash Payment Interest Expense 01/01/2014 12/31/2014 12/31/2015 12/31/2016 12/31/2017 12/31/2018 1487 114 087 1 2 3 6052568 2 5703 5 5051 01 550 8277 5 111-1122233 013721 954064 8 0 04 08 2 1 2 2 3 3 2 89 2 457924 00112233 5 16114 1 371 0011222334 785 618 3568 0156 4241 6610694 2 2 LE re o 0 012345678900 rio 012345678900 2 TFP 9 399 2 88777 40875 7 7655 1 00000000000 74 888777 92854 39607 00000000000 1-000 198 63 3 1 2 4 8 92 78 % 7 3. 0 0 0 0 0 0 0 0 0 0 0 1 00000000000 1 309 156 0 0. 0 0 0 0 0 0 0 0 0 00000000000 1 0 $2 888886 1234567890 1234567890 ABLEA.4 Future Value of Annuity of $1 Periods 4.25% 2.0375 3.1139 4.2307 5.3893 6.5914 7.8386 9.1326 10.4750 3.0604 4.1216 5.2040 6.3081 3.1216 4.2465 5.4163 3.1525 4.3101 5.5256 6.8019 3.1836 4.3746 5.6371 6.9753 8.3938 9.8975 11.4913 3.2149 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 12.4876 4.2623 5.3091 5.7507 6.6748 7.6625 8.8923 10.1591 11.4639 26.8704 7.8983 9.2142 10.5828 12.0061 29.7781 9.5491 11.0266 12.5779 33.0660 8.6540 10.2598 11.9780 8.5830 9.2967 10.6918 10 10.9497 24.2974 20 29.0174 30.5625 36.7856 40.9955 45.7620 Periods 2.25 3.8125 3.3421 3.2781 4.5731 5.9847 3.3744 4.7793 6.3528 3.4396 4.9211 6.6101 8.5355 10.7305 13.2328 16.0853 19.3373 91.0249 3.4725 4.6410 6.1051 7.7156 9.4872 11.4359 13.5975 15.9374 57.2750 4.8498 5.3680 7.4416 9.9299 12.9159 16.4991 20.7989 25.9587 6.7424 8.7537 6.2278 8.2070 11.2588 15.0735 19.8419 25.8023 33.2529 186.6880 342.9447 8.3227 10.4047 12.7573 9.2004 11.0285 13.0210 15.1929 51.1601 10.0890 12.2997 14.7757 17.5487 72.0524 13.7268 16.7858 20.3037 102.4436 18.4197 80.9468 16.7220 20 64.2028 TABLE A.2 Present Value of Annuity of $1 Perlods 0.9804 1.9416 2.8839 3.8077 4.7135 5.6014 6.4720 7.3255 0.9709 0.9592 0.9346 1.8080 2.6243 3.3872 0.9259 1.8594 2.7232 3.5460 4.3295 5.0757 5.7864 1.8861 2.7751 2.6730 3.4651 2.8286 2.7883 3.6514 4.4833 5.2851 6.0579 6.8028 7.5208 8.2128 13.8962 2.7620 3.6086 4.4207 5.1997 5.9470 6.6638 7.3513 8.0109 3.2944 12 3.3121 3.9927 4.5797 5.2421 4.9173 5.5824 6.2303 7.0197 7.7861 8.5302 14.8775 5.3893 5.9713 6.5152 5.2064 5.7466 6.2469 6.7101 9.8181 6.7327 10 20 8.9826 16.3514 7.1078 7.7217 12.4622 6.8017 7.3601 13.5903 10.5940 Periods 0.9009 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 0.8550 0.8772 1.6467 0.9174 0.9091 0.8696 2.5313 3.2397 3.8897 4.4859 5.0330 5.5348 2.2832 2.8550 3.3522 3.7845 2.4869 2.4437 3.1024 3.6959 .2305 4.7122 2.3612 2.9745 3.5172 2.3616 2.6893 2.9514 3.1611 3.3289 3.4631 3.5705 2.9137 2.5887 4.3553 4.8684 5.3349 5.7590 3.8887 4.2883 4.6389 4.9464 5.2161 6.6231 3.3255 4.4873 4.7716 5.0188 6.2593 3.8372 4.0310 5.5370 5.8892 5.1317 10 20 6.4177 9.1285 8.5136 4.8696

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started