Electro-Phi Inc. (the Company) is a utility provider that sells electricity to the public. The Company produces the electricity using various forms of power

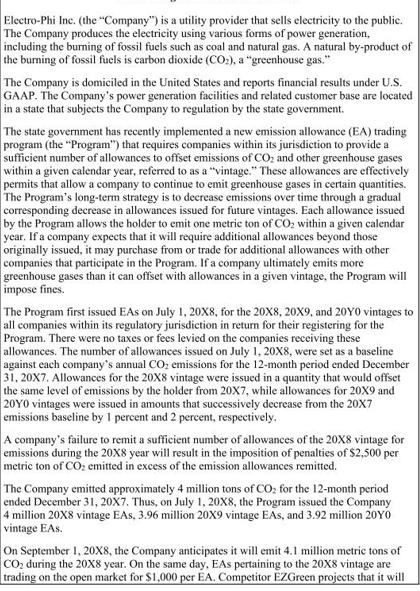

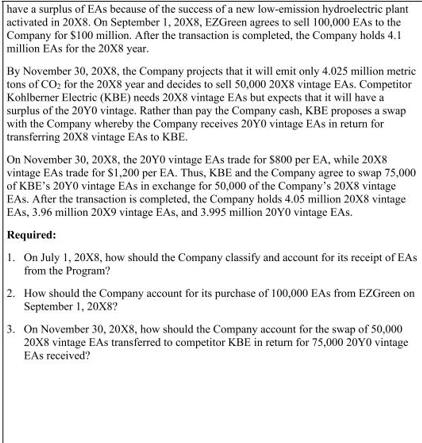

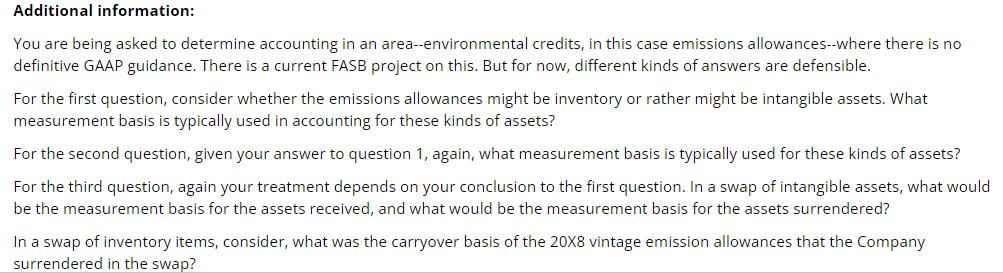

Electro-Phi Inc. (the "Company") is a utility provider that sells electricity to the public. The Company produces the electricity using various forms of power generation, including the burning of fossil fuels such as coal and natural gas. A natural by-product of the burning of fossil fuels is carbon dioxide (CO), a "greenhouse gas." The Company is domiciled in the United States and reports financial results under U.S. GAAP. The Company's power generation facilities and related customer base are located in a state that subjects the Company to regulation by the state government. The state government has recently implemented a new emission allowance (EA) trading program (the "Program") that requires companies within its jurisdiction to provide a sufficient number of allowances to offset emissions of CO and other greenhouse gases within a given calendar year, referred to as a "vintage." These allowances are effectively permits that allow a company to continue to emit greenhouse gases in certain quantities. The Program's long-term strategy is to decrease emissions over time through a gradual corresponding decrease in allowances issued for future vintages. Each allowance issued by the Program allows the holder to emit one metric ton of CO within a given calendar year. If a company expects that it will require additional allowances beyond those originally issued, it may purchase from or trade for additional allowances with other companies that participate in the Program. If a company ultimately emits more greenhouse gases than it can offset with allowances in a given vintage, the Program will impose fines. The Program first issued EAs on July 1, 20X8, for the 20X8, 20X9, and 20Y0 vintages to all companies within its regulatory jurisdiction in return for their registering for the Program. There were no taxes or fees levied on the companies receiving these allowances. The number of allowances issued on July 1, 20X8, were set as a baseline against each company's annual CO emissions for the 12-month period ended December 31, 20X7. Allowances for the 20X8 vintage were issued in a quantity that would offset the same level of emissions by the holder from 20X7, while allowances for 20X9 and 20Y0 vintages were issued in amounts that successively decrease from the 20X7 emissions baseline by 1 percent and 2 percent, respectively. A company's failure to remit a sufficient number of allowances of the 20X8 vintage for emissions during the 20X8 year will result in the imposition of penalties of $2,500 per metric ton of CO emitted in excess of the emission allowances remitted. The Company emitted approximately 4 million tons of CO for the 12-month period ended December 31, 20X7. Thus, on July 1, 20X8, the Program issued the Company 4 million 20X8 vintage EAs. 3.96 million 20X9 vintage EAs, and 3.92 million 20Y0 vintage EAs. On September 1, 20X8, the Company anticipates it will emit 4.1 million metric tons of CO during the 20X8 year. On the same day, EAs pertaining to the 20X8 vintage are trading on the open market for $1,000 per EA. Competitor EZGreen projects that it will have a surplus of EAs because of the success of a new low-emission hydroelectric plant activated in 20X8. On September 1, 20X8, EZGreen agrees to sell 100,000 EAs to the Company for $100 million. After the transaction is completed, the Company holds 4.1 million EAs for the 20X8 year. By November 30, 20X8, the Company projects that it will emit only 4.025 million metric tons of CO for the 20X8 year and decides to sell 50,000 20X8 vintage EAs. Competitor Kohlberner Electric (KBE) needs 20X8 vintage EAs but expects that it will have a surplus of the 20Y0 vintage. Rather than pay the Company cash, KBE proposes a swap with the Company whereby the Company receives 20Y0 vintage EAs in return for transferring 20X8 vintage EAs to KBE. On November 30, 20X8, the 20Y0 vintage EAs trade for $800 per EA, while 20X8 vintage EAs trade for $1,200 per EA. Thus, KBE and the Company agree to swap 75,000 of KBE's 20Y0 vintage EAs in exchange for 50,000 of the Company's 20X8 vintage EAS. After the transaction is completed, the Company holds 4.05 million 20X8 vintage EAS, 3.96 million 20X9 vintage EAS, and 3.995 million 20Y0 vintage EAs. Required: 1. On July 1, 20X8, how should the Company classify and account for its receipt of EAS from the Program? 2. How should the Company account for its purchase of 100,000 EAs from EZGreen on September 1, 20X8? 3. On November 30, 20X8, how should the Company account for the swap of 50,000 20X8 vintage EAs transferred to competitor KBE in return for 75,000 20Y0 vintage EAs received? Additional information: You are being asked to determine accounting in an area--environmental credits, in this case emissions allowances--where there is no definitive GAAP guidance. There is a current FASB project on this. But for now, different kinds of answers are defensible. For the first question, consider whether the emissions allowances might be inventory or rather might be intangible assets. What measurement basis is typically used in accounting for these kinds of assets? For the second question, given your answer to question 1, again, what measurement basis is typically used for these kinds of assets? For the third question, again your treatment depends on your conclusion to the first question. In a swap of intangible assets, what would be the measurement basis for the assets received, and what would be the measurement basis for the assets surrendered? In a swap of inventory items, consider, what was the carryover basis of the 20X8 vintage emission allowances that the Company surrendered in the swap?

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 On July 1 20X8 the Company should classify and account for its receipt of emission allowances EAs from the Program based on the nature of the allowances and the applicable accounting treatment Since ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started