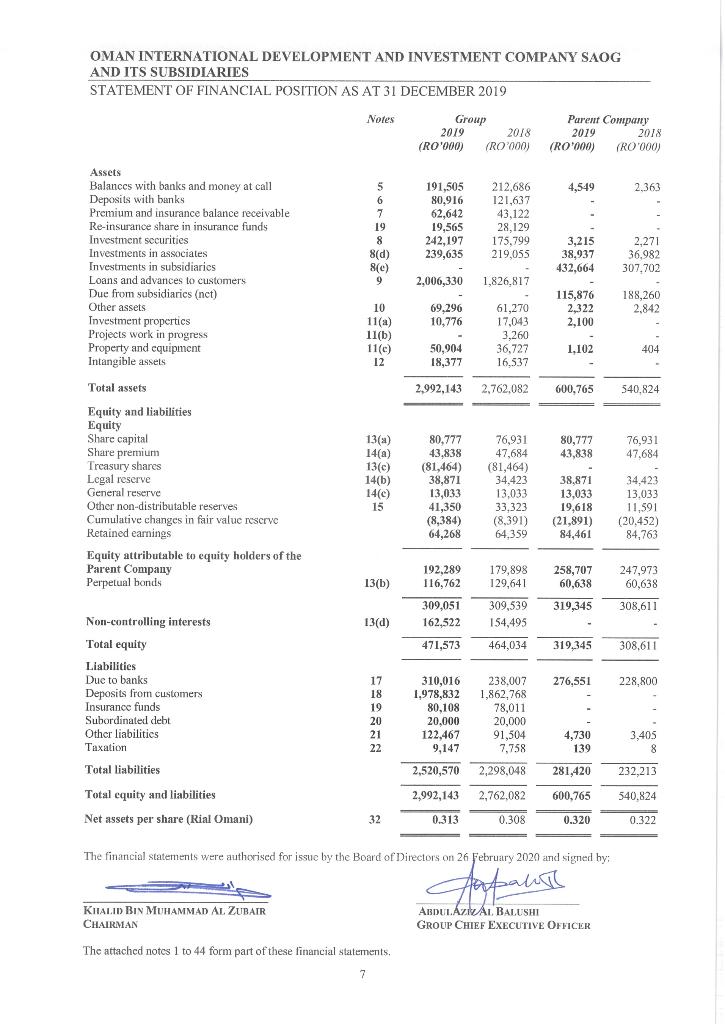

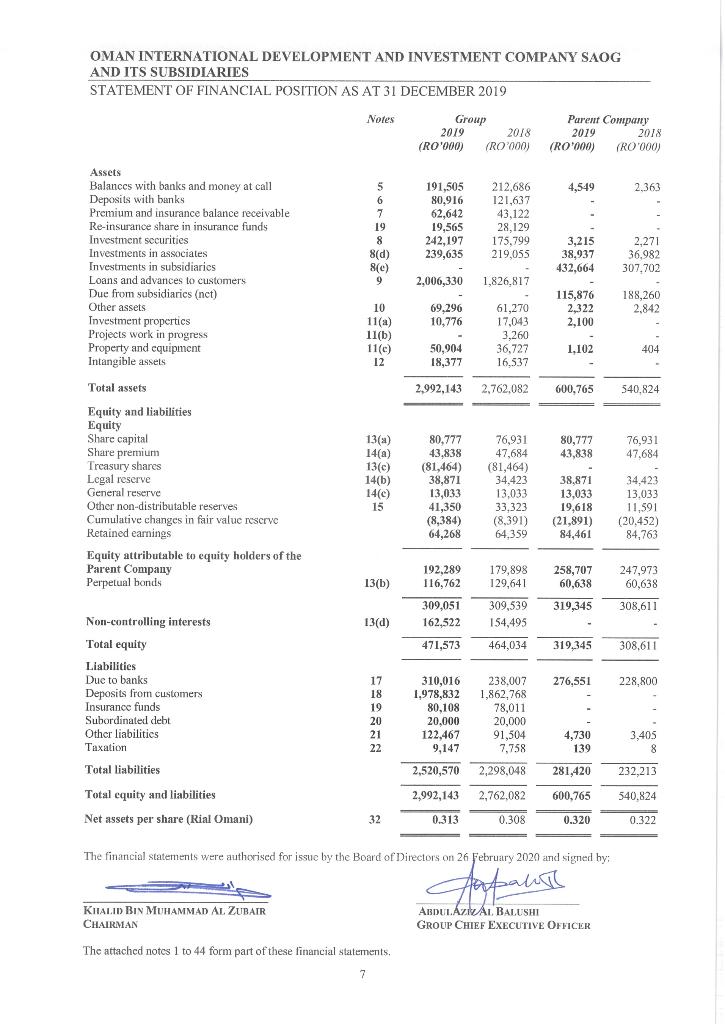

Elements to identify from the downloaded statement of financial position are ;

- Cash and cash equivalent

- Accounts receivables

- Accounts payables

- Equity

- Sales revenue and

Net profit.

OMAN INTERNATIONAL DEVELOPMENT AND INVESTMENT COMPANY SAOG AND ITS SUBSIDIARIES STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2019 Notes Group 2019 (R0'00 (0) 2018 LR030/3) Parent Company 2019 2018 (R0'000) (0'(ACC) 4,549 2,363 5 6 7 19 8 8(d) 8(e) 9 191,505 80,916 62,642 19,565 242,197 239,635 Assets Balances with banks and money at call Deposits with banks Premium and insurance balance receivable Re-insurance share in insurance funds Investment securities Investments in associates Investments in subsidiaries Loans and advances to customers Due from subsidiaries (net) Other assets Investment properties Projects work in progress Property and equipment Intangible assets 212,686 121,637 43,122 28,129 175,799 219,055 3,215 38,937 432,664 2,271 36,982 307.702 2,006,330 1,826,817 115,876 2,322 2,100 188,260 2.842 69.296 10,776 10 11(a) 11(b) 11(c) 12 61,270 17,043 3,260 36,727 16,537 50,904 18,377 1,102 404 Total assets 2,992,143 2,762,082 600,765 540,824 80,777 43,838 76,931 47,684 Equity and liabilities Equity Share capital Share premium Treasury shares Legal reserve General reserve Other non-distributable reserves Cumulative changes in fair value reserve Retained earnings Equity attributable to equity holders of the Parent Company Perpetual bonds 13(a) a 14(a) 13(c) 14(b) 14(e) 15 80,777 43,838 (81,464) 38,871 13,033 41,350 (8,384) 64,268 76,931 47,684 (81,464) 34,423 13,033 33,323 (8,391) 64,359 38,871 13,033 19,618 (21,891) 84,461 34.423 13.033 11,591 (20.452 84,763 192,289 116,762 13(b) 179,898 129,641 258,707 60,638 247,973 60,638 319,345 308,611 309,051 162,522 309,539 154,495 13(d) 471,573 464,034 319,345 308,611 276,551 228,800 Non-controlling interests Total equity Liabilities Due to banks Deposits from customers Insurance funds Subordinated debt Other liabilities Taxation Total liabilities 17 18 19 20 21 22 310,016 1,978,832 80,108 20.000 122,467 9,147 2,520,570 238.007 1,862,768 78,011 20,000 91,504 7,758 4,730 139 3,405 8 2,298,048 281,420 232,213 2,992,143 2,762,082 600,765 540,824 Total equity and liabilities Net assets per share (Rial Omani) 32 0.313 0.308 0.320 0.322 The financial statements were authorised for issue by the Board of Directors on 26 February 2020 and signed by: KHALID BIN MUHAMMAD AL ZUBAIR CHAIRMAN ABDULAZIZAL BALUSHI GROUP CHIEF EXECUTIVE OFFICER The attached notes 1 to 44 form part of these financial statements, 7 OMAN INTERNATIONAL DEVELOPMENT AND INVESTMENT COMPANY SAOG AND ITS SUBSIDIARIES STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2019 Notes Group 2019 (R0'00 (0) 2018 LR030/3) Parent Company 2019 2018 (R0'000) (0'(ACC) 4,549 2,363 5 6 7 19 8 8(d) 8(e) 9 191,505 80,916 62,642 19,565 242,197 239,635 Assets Balances with banks and money at call Deposits with banks Premium and insurance balance receivable Re-insurance share in insurance funds Investment securities Investments in associates Investments in subsidiaries Loans and advances to customers Due from subsidiaries (net) Other assets Investment properties Projects work in progress Property and equipment Intangible assets 212,686 121,637 43,122 28,129 175,799 219,055 3,215 38,937 432,664 2,271 36,982 307.702 2,006,330 1,826,817 115,876 2,322 2,100 188,260 2.842 69.296 10,776 10 11(a) 11(b) 11(c) 12 61,270 17,043 3,260 36,727 16,537 50,904 18,377 1,102 404 Total assets 2,992,143 2,762,082 600,765 540,824 80,777 43,838 76,931 47,684 Equity and liabilities Equity Share capital Share premium Treasury shares Legal reserve General reserve Other non-distributable reserves Cumulative changes in fair value reserve Retained earnings Equity attributable to equity holders of the Parent Company Perpetual bonds 13(a) a 14(a) 13(c) 14(b) 14(e) 15 80,777 43,838 (81,464) 38,871 13,033 41,350 (8,384) 64,268 76,931 47,684 (81,464) 34,423 13,033 33,323 (8,391) 64,359 38,871 13,033 19,618 (21,891) 84,461 34.423 13.033 11,591 (20.452 84,763 192,289 116,762 13(b) 179,898 129,641 258,707 60,638 247,973 60,638 319,345 308,611 309,051 162,522 309,539 154,495 13(d) 471,573 464,034 319,345 308,611 276,551 228,800 Non-controlling interests Total equity Liabilities Due to banks Deposits from customers Insurance funds Subordinated debt Other liabilities Taxation Total liabilities 17 18 19 20 21 22 310,016 1,978,832 80,108 20.000 122,467 9,147 2,520,570 238.007 1,862,768 78,011 20,000 91,504 7,758 4,730 139 3,405 8 2,298,048 281,420 232,213 2,992,143 2,762,082 600,765 540,824 Total equity and liabilities Net assets per share (Rial Omani) 32 0.313 0.308 0.320 0.322 The financial statements were authorised for issue by the Board of Directors on 26 February 2020 and signed by: KHALID BIN MUHAMMAD AL ZUBAIR CHAIRMAN ABDULAZIZAL BALUSHI GROUP CHIEF EXECUTIVE OFFICER The attached notes 1 to 44 form part of these financial statements, 7