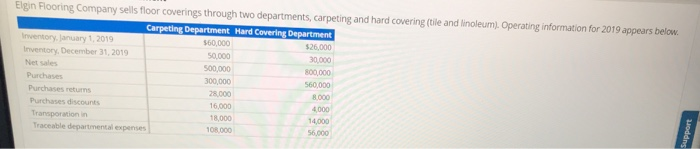

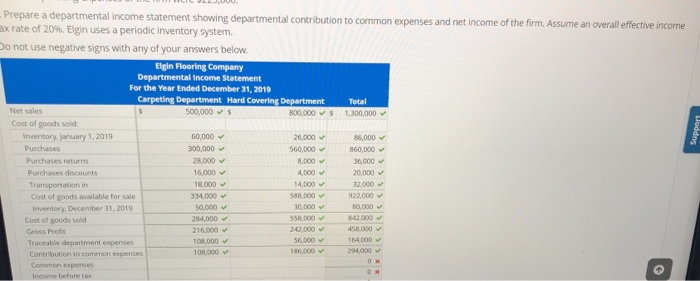

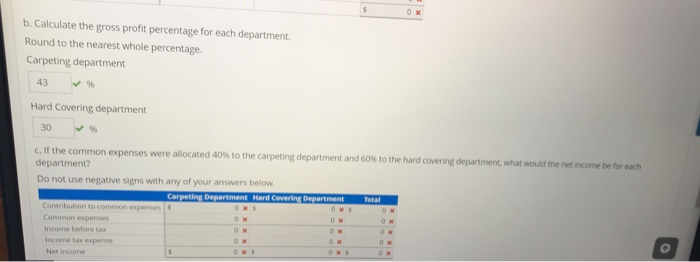

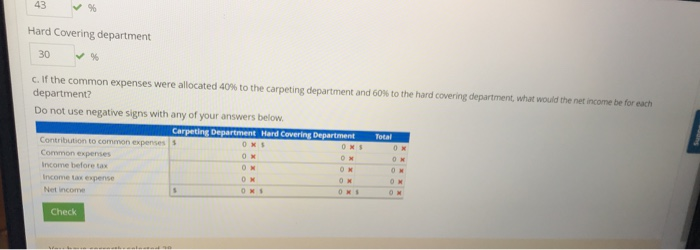

Elgin Flooring Company sells floor coverings through two departments, carpeting and hard covering (tile and linoleum). Operating information for 2019 appears below. Carpeting Department Hard Covering Department ventory January 1, 2019 160,000 526,000 Inventory, December 31, 2019 50.000 Net sales 500,000 300.000 Purchases 300 000 Purchases returns 28 000 8000 Purchases discounts 16.000 4000 Tramporation in TR000 14,000 Traceable departmental expenses 10 000 Wedding Prepare a departmental income statement showing departmental contribution to common expenses and net income of the firm Assume an overall effective income ex rate of 20% Elgin uses a periodic inventory system. Do not use negative signs with any of your answers below. Elgin Flooring Company Departmental Income Statement For the Year Ended December 31, 2019 Carpeting Department Hard Covering Department Total Neties 500.000 000 200.000 Cost of goods soldi trventory, anuary 1, 2019 60,000 26.000 85,000 Purchases 300,000 560,000 860.000 Purchase returns 28.000 36.000 Purchases discounts 15,000 20.000 Trenin 18.000 14.000 000 334000 922.000 Inwertery, December 31, 2019 50.000 0.000 Cost of goods sold 284,000 S5.000 Gross Proth 210,000 242.000 450 SO 000 Traceable department expenses 154 000 TOROCO 16000 294000 Contribute to comment s Common expenses b. Calculate the gross profit percentage for each department. Round to the nearest whole percentage Carpeting department 43 % Hard Covering department 30 % c. If the common expenses were allocated 40% to the carpeting department and 60to the hard covering department what would the net income beforeach department? Do not use negative signs with any of your answers below. Carpeting Department Hard Covering Department Total income before can Income tax expense 43 % Hard Covering department 30 c. If the common expenses were allocated 40% to the carpeting department and 60% to the hard covering department, what would the net income be for each department? Do not use negative signs with any of your answers below. Carpetine Department Hard Covering Department Total Contribution to common expenses Common expenses Income before tax Check Elgin Flooring Company sells floor coverings through two departments, carpeting and hard covering (tile and linoleum). Operating information for 2019 appears below. Carpeting Department Hard Covering Department ventory January 1, 2019 160,000 526,000 Inventory, December 31, 2019 50.000 Net sales 500,000 300.000 Purchases 300 000 Purchases returns 28 000 8000 Purchases discounts 16.000 4000 Tramporation in TR000 14,000 Traceable departmental expenses 10 000 Wedding Prepare a departmental income statement showing departmental contribution to common expenses and net income of the firm Assume an overall effective income ex rate of 20% Elgin uses a periodic inventory system. Do not use negative signs with any of your answers below. Elgin Flooring Company Departmental Income Statement For the Year Ended December 31, 2019 Carpeting Department Hard Covering Department Total Neties 500.000 000 200.000 Cost of goods soldi trventory, anuary 1, 2019 60,000 26.000 85,000 Purchases 300,000 560,000 860.000 Purchase returns 28.000 36.000 Purchases discounts 15,000 20.000 Trenin 18.000 14.000 000 334000 922.000 Inwertery, December 31, 2019 50.000 0.000 Cost of goods sold 284,000 S5.000 Gross Proth 210,000 242.000 450 SO 000 Traceable department expenses 154 000 TOROCO 16000 294000 Contribute to comment s Common expenses b. Calculate the gross profit percentage for each department. Round to the nearest whole percentage Carpeting department 43 % Hard Covering department 30 % c. If the common expenses were allocated 40% to the carpeting department and 60to the hard covering department what would the net income beforeach department? Do not use negative signs with any of your answers below. Carpeting Department Hard Covering Department Total income before can Income tax expense 43 % Hard Covering department 30 c. If the common expenses were allocated 40% to the carpeting department and 60% to the hard covering department, what would the net income be for each department? Do not use negative signs with any of your answers below. Carpetine Department Hard Covering Department Total Contribution to common expenses Common expenses Income before tax Check