Elias Corporation, has sales of $326,500, cost of sales of $158,000, depreciation expense of $26,000, a tax rate of 30 percent. The company also carries

Elias Corporation, has sales of $326,500,

cost of sales of $158,000,

depreciation expense of $26,000,

a tax rate of 30 percent.

The company also carries $250,000 of debt and paid 5% interest on the loan for the year.

What is the net income for this firm?

If the firm decides to distribute 60% of the firm's net income as dividends, what is the addition to retained earnings for that year?

Please show work (what formula you used) and fill chart on bottom:

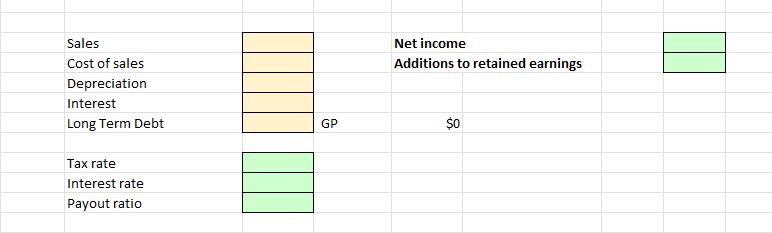

Sales Cost of sales Depreciation Interest Long Term Debt Tax rate Interest rate Payout ratio GP Net income Additions to retained earnings $0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Operating Income EBIT Earnings Before Interest and Taxes Operating Income Sales Cost of Sales Deprec...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started