Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E-Link Company requires P1.5M for the installation of a new unit, which will yield annual earnings before interest and taxes (EBIT) of P250,000. The

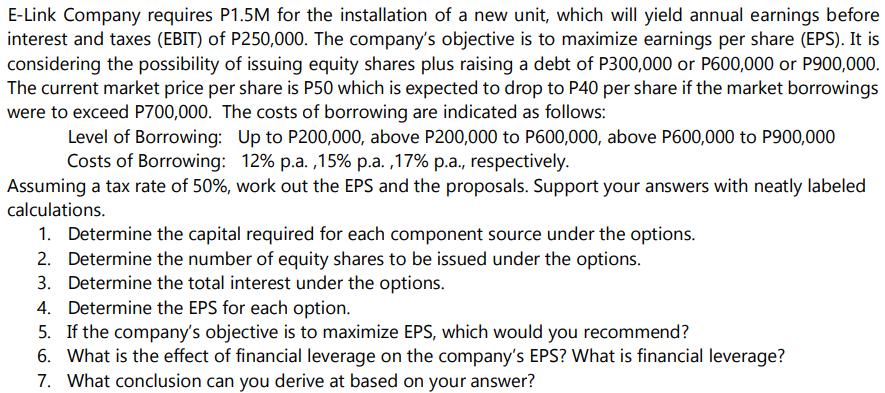

E-Link Company requires P1.5M for the installation of a new unit, which will yield annual earnings before interest and taxes (EBIT) of P250,000. The company's objective is to maximize earnings per share (EPS). It is considering the possibility of issuing equity shares plus raising a debt of P300,000 or P600,000 or P900,000. The current market price per share is P50 which is expected to drop to P40 per share if the market borrowings were to exceed P700,000. The costs of borrowing are indicated as follows: Level of Borrowing: Up to P200,000, above P200,000 to P600,000, above P600,000 to P900,000 Costs of Borrowing: 12% p.a.,15% p.a.,17% p.a., respectively. Assuming a tax rate of 50%, work out the EPS and the proposals. Support your answers with neatly labeled calculations. 1. Determine the capital required for each component source under the options. 2. Determine the number of equity shares to be issued under the options. 3. Determine the total interest under the options. 4. Determine the EPS for each option. 5. If the company's objective is to maximize EPS, which would you recommend? 6. What is the effect of financial leverage on the company's EPS? What is financial leverage? 7. What conclusion can you derive at based on your answer?

Step by Step Solution

★★★★★

3.55 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To solve the given problem lets calculate the capital required number of equity shares total interest EPS and make a recommendation based on the objective of maximizing EPS 1 Capital Required for Each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started