Answered step by step

Verified Expert Solution

Question

1 Approved Answer

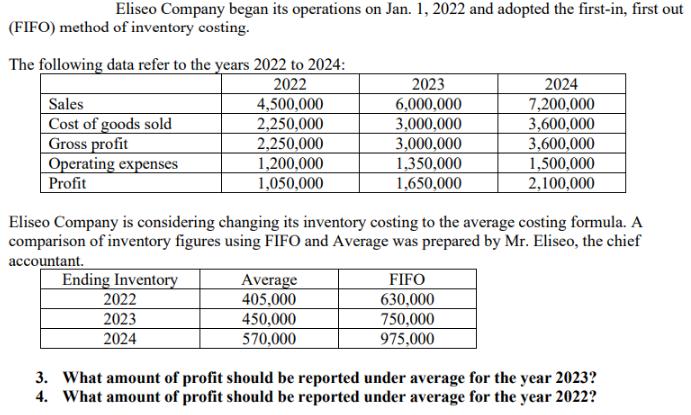

Eliseo Company began its operations on Jan. 1, 2022 and adopted the first-in, first out (FIFO) method of inventory costing. The following data refer

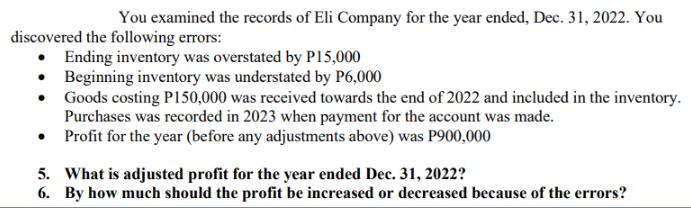

Eliseo Company began its operations on Jan. 1, 2022 and adopted the first-in, first out (FIFO) method of inventory costing. The following data refer to the years 2022 to 2024: 2022 Sales Cost of goods sold Gross profit Operating expenses Profit 4,500,000 2,250,000 2,250,000 Ending Inventory 2022 2023 2024 1,200,000 1,050,000 2023 6,000,000 3,000,000 3,000,000 1,350,000 1,650,000 Eliseo Company is considering changing its inventory costing to the average costing formula. A comparison of inventory figures using FIFO and Average was prepared by Mr. Eliseo, the chief accountant. Average 405,000 450,000 570,000 2024 7,200,000 3,600,000 3,600,000 1,500,000 2,100,000 FIFO 630,000 750,000 975,000 3. What amount of profit should be reported under average for the year 2023? 4. What amount of profit should be reported under average for the year 2022? You examined the records of Eli Company for the year ended, Dec. 31, 2022. You discovered the following errors: Ending inventory was overstated by P15,000 Beginning inventory was understated by P6,000 Goods costing P150,000 was received towards the end of 2022 and included in the inventory. Purchases was recorded in 2023 when payment for the account was made. Profit for the year (before any adjustments above) was P900,000 5. What is adjusted profit for the year ended Dec. 31, 2022? 6. By how much should the profit be increased or decreased because of the errors?

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

3 Profit for the Year 2023 under Average Costing Calculation Average Ending Inventory 2023 450000 75...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started