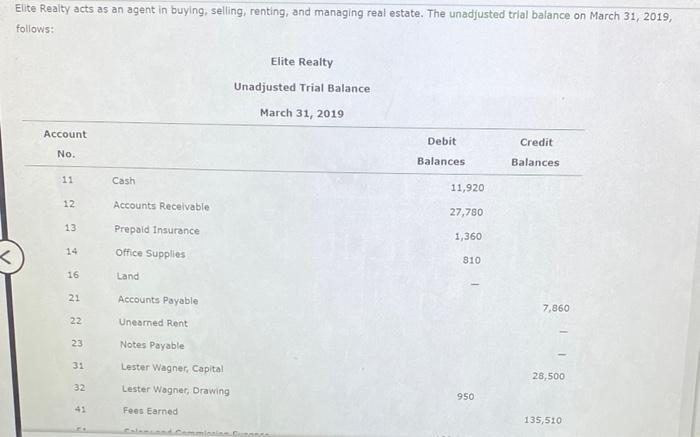

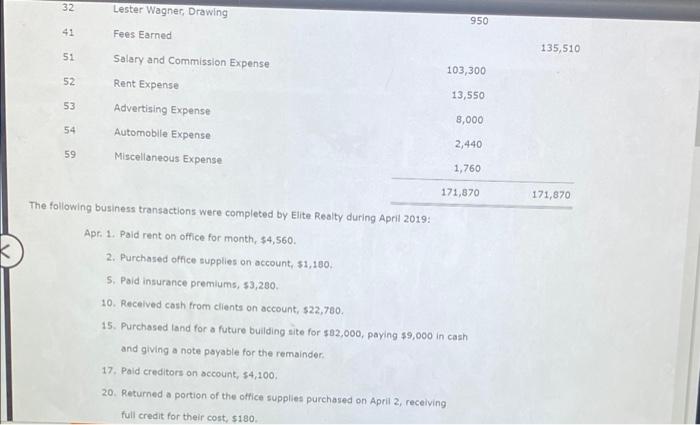

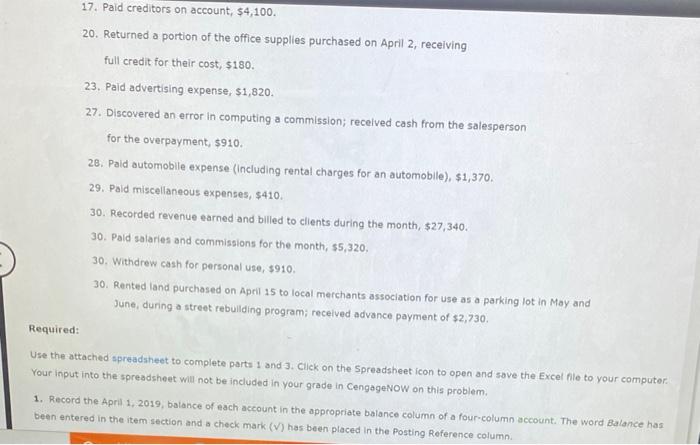

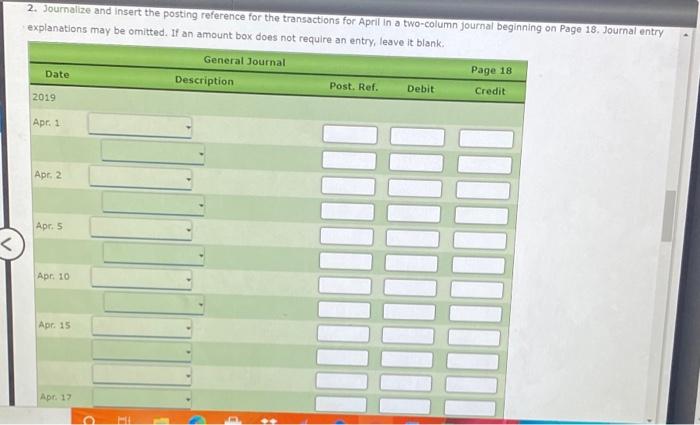

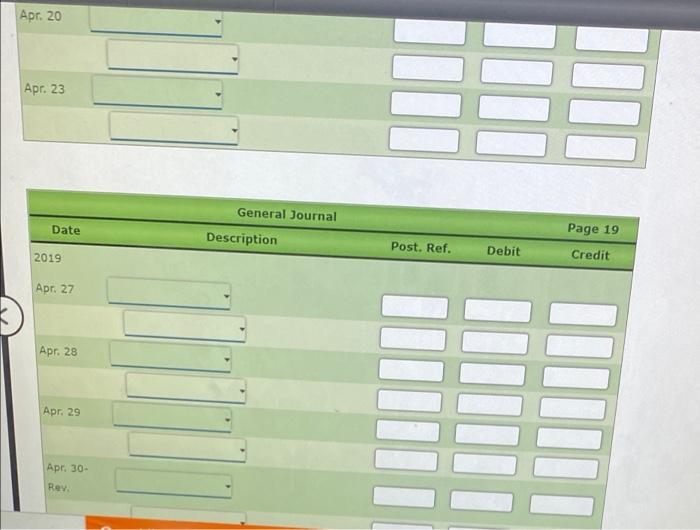

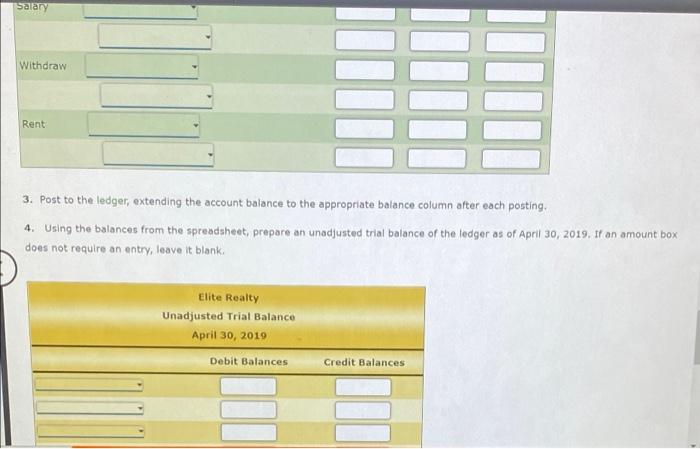

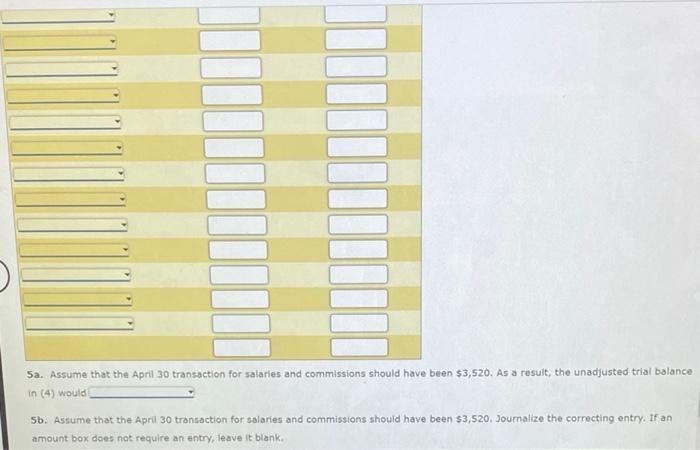

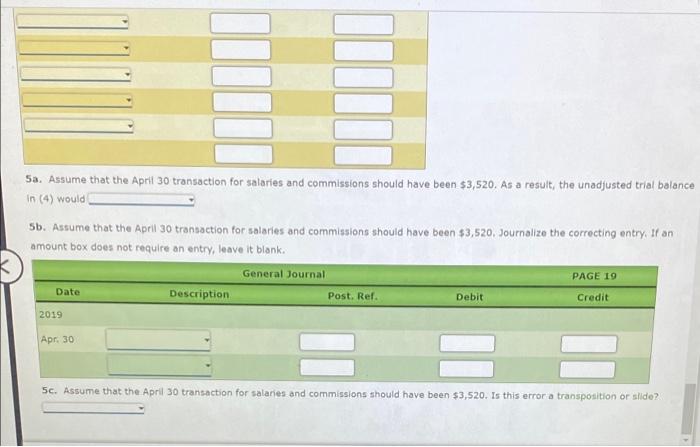

Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2019, follows: Elite Realty Unadjusted Trial Balance March 31, 2019 Account Debit Credit No. Balances Balances 11 Cash 11,920 12 Accounts Receivable 27,780 13 Prepaid Insurance 1,360 14 Office Supplies 810 16 Land 21 Accounts Payable 7.860 22 Uneamed Rent 23 Notes Payable 31 Lester Wagner, Capital 28,500 32 Lester Wagner, Drawing 950 Fees Earned 135,510 32 Lester Wagner, Drawing 950 41 Fees Earned 135,510 51 103,300 52 13,550 53 Salary and Commission Expense Rent Expense Advertising Expense Automobile Expense Miscellaneous Expense 8,000 54 2,440 59 1,760 171,870 171,870 The following business transactions were completed by Elite Realty during April 2019: Apr. 1. Paid rent on office for month, $4,560 2. Purchased office supplies on account, 51,180. S. Pald insurance premiums, $3,250 10. Received cash from clients on account, $22,760. 15. Purchased land for a future building site for $82,000, paying $9,000 in cash and giving a note payable for the remainder. 17. Paid creditors on account, 54,100 20. Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, $180 17. Paid creditors on account, $4,100. 20. Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, $180. 23. Pald advertising expense, $1,820. 27. Discovered an error in computing a commission; received cash from the salesperson for the overpayment, $910. 28. Pald automobile expense (Including rental charges for an automobile), $1,370. 29. Pald miscellaneous expenses, $410. 30. Recorded revenue earned and billed to clients during the month, $27,340. 30. Pald salaries and commissions for the month, $5,320. 30. Withdrew cash for personal use, $910, 30. Rented and purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of $2,730, Required: Use the attached spreadsheet to complete parts 1 and 3. Click on the Spreadsheet Scon to open and save the Excel file to your computer. Your input into the spreadsheet will not be included in your grade in CengageNOW on this problem. 1. Record the April 1, 2019, balance of each account in the appropriate balance column of a four-column account. The word Balance has been entered in the item section and a check mark (V) has been placed in the Posting Reference column 2. Journalize and insert the posting reference for the transactions for April in a two-column Journal beginning on Page 18. Journal entry explanations may be omitted. If an amount box does not require an entry, leave it blank. Date General Journal Description Page 18 Post. Ref. Debit Credit 2019 Apr. 1 Apr. 2 Apr. 5 Apr 10 Apr. 15 | Apr. 17 Apr. 20 Apr. 23 General Journal Date Description Post. Ref. Page 19 Credit Debit 2019 Apr. 27 K. Apr. 28 Apr. 29 Apr. 30- Rev. Salary Withdraw Rent 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting 4. Using the balances from the spreadsheet, prepare an unadjusted trial balance of the ledger as of April 30, 2019. If an amount box does not require an entry, leave it blank. Elite Realty Unadjusted Trial Balance April 30, 2019 Debit Balances Credit Balances Sa. Assume that the April 30 transaction for salaries and commissions should have been $3,520. As a result, the unadjusted trial balance in (4) would Sb. Assume that the April 30 transaction for salaries and commissions should have been $3,520. Joumalize the correcting entry. If an amount box does not require an entry, leave it blank 5a. Assume that the April 30 transaction for salaries and commissions should have been $3,520. As a result, the unadjusted trial balance in (4) would K 5b. Assume that the April 30 transaction for salaries and commissions should have been $3,520. Journalize the correcting entry, If an amount box does not require an entry, leave it blank. General Journal PAGE 19 Description Post. Ref. Debit 2019 Date Credit Apr. 30 5c. Assume that the April 30 transaction for salaries and commissions should have been $3,520. Is this error a transposition or slide