Answered step by step

Verified Expert Solution

Question

1 Approved Answer

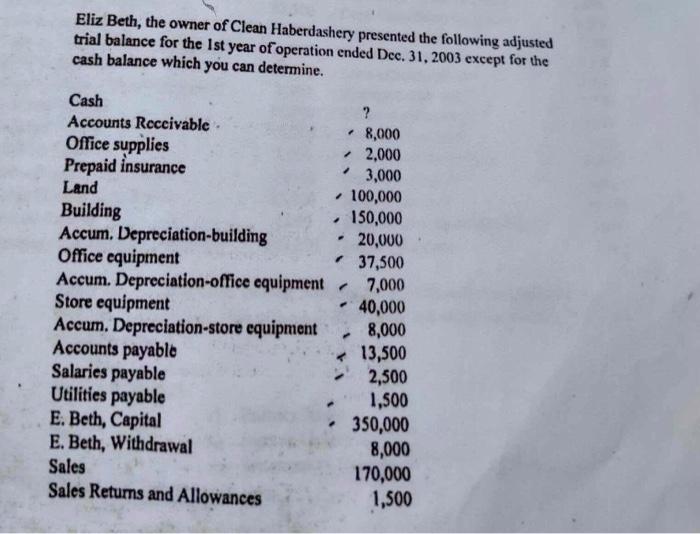

Eliz Beth, the owner of Clean Haberdashery presented the following adjusted trial balance for the 1st year of operation ended, Dec. 31, 2003, EXCEPT FOR

Eliz Beth, the owner of Clean Haberdashery presented the following adjusted trial balance for the 1st year of operation ended, Dec. 31, 2003, EXCEPT FOR THE CASH BALANCE WHICH YOU MUST DETERMINE.

Cash - (determine the cash balance)

Accounts Receivable - 8,000

Office Supplies - 2,000

Prepaid Insurance - 3,000

Land - 100,000

Building - 150,000

Accumulated Depreciation - Building - 20,000

Office Equipment - 37,500

Accumulated Depreciation - Office Equipment - 7,000

Store Equipment - 40,000

Accumulated Depreciation - Store Equipment - 8,000

Accounts Payable - 13,500

Salaries Payable - 2,500

Utilities Payable - 1,500

E. Beth, Capital - 350,000

E. Beth, Withdrawal - 8,000

Sales - 170,000

Sales Returns and Allowances - 1,500

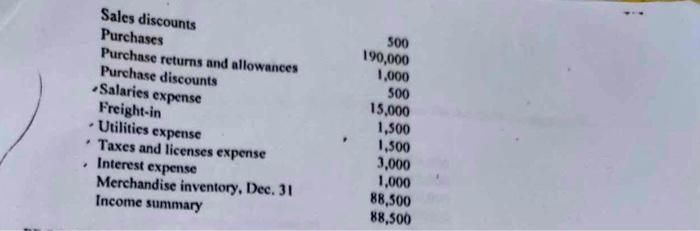

Sales Discounts - 500

Purchases - 190,000

Purchase Returns and Allowances - 1,000

Purchase Discounts - 500

Salaries Expense - 15,000

Freight In - 1,500

Utilities Expense - 1,500

Taxes and Licenses Expense - 3,000

Interest Expense - 1,000

Merchandise Inventory, December 31 - 88,500

Income Summary - 88,500

REQUIRED: On the basis of the data given above, prepare the following.

a) Closing entries WITH AMOUNTS IN A TABLE

b) Post-Closing Trial Balance WITH AMOUNTS IN A TABLE. Make sure that the Debit and Credit are equal to each other.

c) Determine the cash balance and make sure that the Post-Closing Trial Balance's Debit and Credit are equal to each other.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started