Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ella Ltd purchased 30% of the shares of Monica Ltd on 1 January 2019. This purchase resulted in Ella Ltd having significant influence over

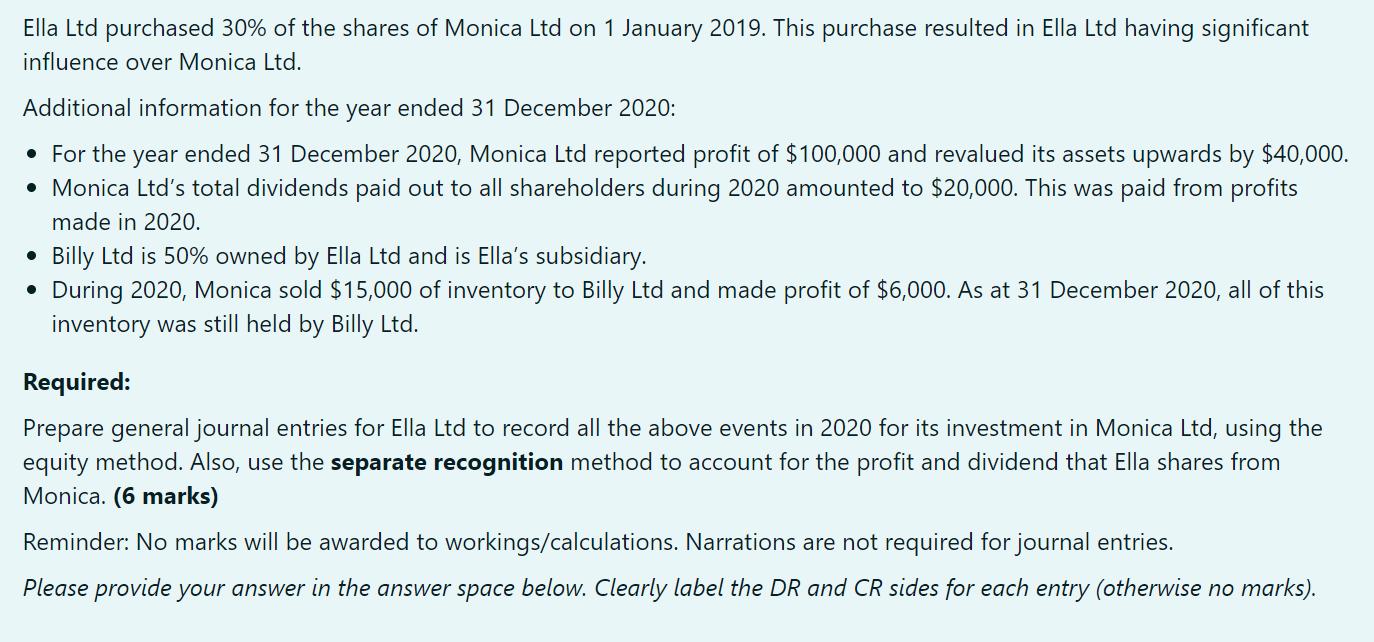

Ella Ltd purchased 30% of the shares of Monica Ltd on 1 January 2019. This purchase resulted in Ella Ltd having significant influence over Monica Ltd. Additional information for the year ended 31 December 2020: For the year ended 31 December 2020, Monica Ltd reported profit of $100,000 and revalued its assets upwards by $40,000. Monica Ltd's total dividends paid out to all shareholders during 2020 amounted to $20,000. This was paid from profits made in 2020. Billy Ltd is 50% owned by Ella Ltd and is Ella's subsidiary. During 2020, Monica sold $15,000 of inventory to Billy Ltd and made profit of $6,000. As at 31 December 2020, all of this inventory was still held by Billy Ltd. Required: Prepare general journal entries for Ella Ltd to record all the above events in 2020 for its investment in Monica Ltd, using the equity method. Also, use the separate recognition method to account for the profit and dividend that Ella shares from Monica. (6 marks) Reminder: No marks will be awarded to workings/calculations. Narrations are not required for journal entries. Please provide your answer in the answer space below. Clearly label the DR and CR sides for each entry (otherwise no marks).

Step by Step Solution

★★★★★

3.61 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

In consolidating the above entries following treatment will be done 1 Profit of Monica 10000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started