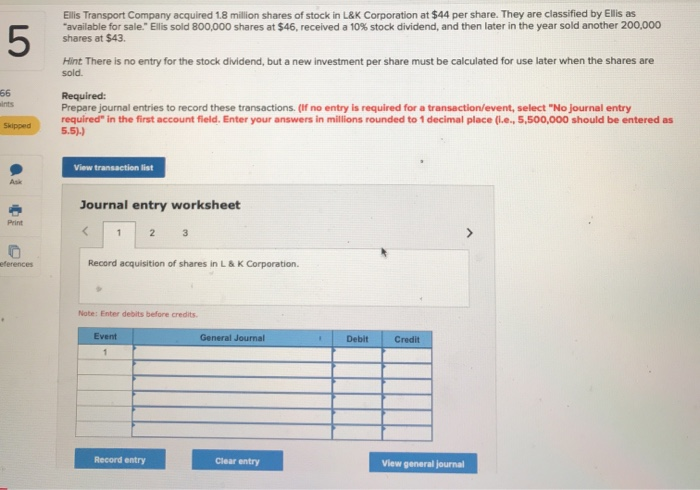

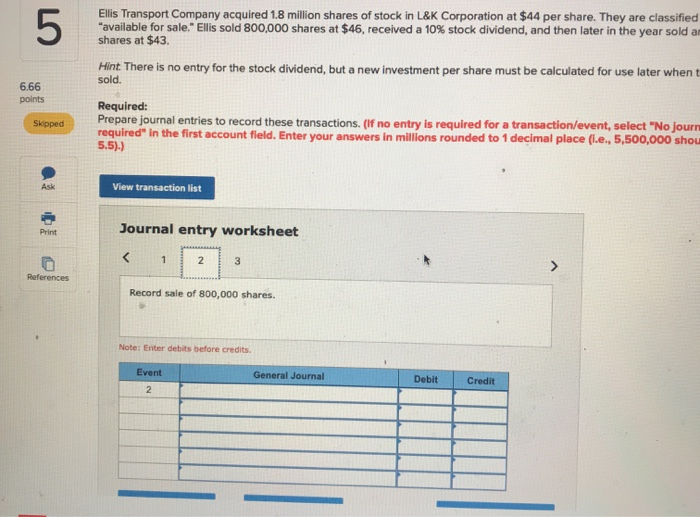

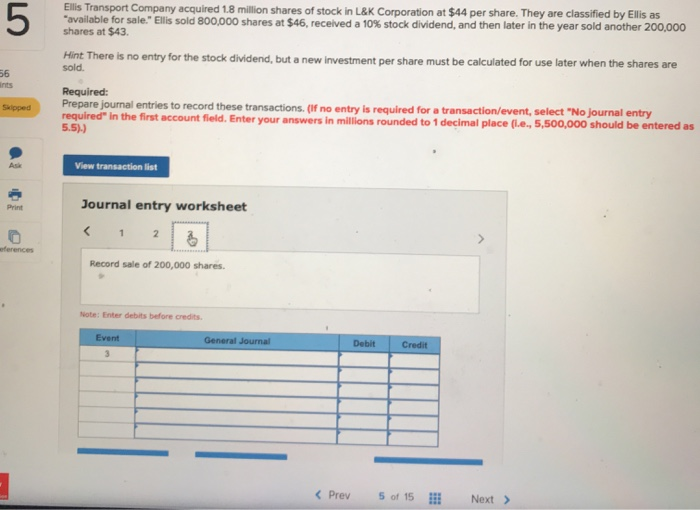

Ellis Transport Company acquired 1.8 million shares of stock in L&K Corporation at $44 per share. They are classified by Ellis as "available for sale. Ellis sold 800,000 shares at $46, received a 10% stock dividend, and then later in the year sold another 200,000 shares at $43 Hint There is no entry for the stock dividend, but a new investment per share must be calculated for use later when the shares are sold. Required: Prepare journal entries to record these transactions. If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions rounded to 1 decimal place .e., 5,500,000 should be entered as 5.5)) Spoed View transaction list Journal entry worksheet 2 3 Record acquisition of shares in L&K Corporation Note: Enter debits before credits Event General Journal Debit Credit Record entry Clear entry View general journal Ellis Transport Company acquired 1.8 million shares of stock in L&K Corporation at $44 per share. They are classified "available for sale." Ellis sold 800,000 shares at $46, received a 10% stock dividend, and then later in the year sold an shares at $43. Hint There is no entry for the stock dividend, but a new investment per share must be calculated for use later when t sold. 6.66 points Skipped Required: Prepare journal entries to record these transactions. (If no entry is required for a transaction/event, select "No journ required in the first account field. Enter your answers in millions rounded to 1 decimal place (.e., 5,500,000 shou 5.5).) View transaction list Journal entry worksheet References Record sale of 800,000 shares. Note: Enter debits before credits Event General Journal Debit Credit Ellis Transport Company acquired 18 million shares of stock in L&K Corporation at $44 per share. They are classified by Ellis as "available for sale." Ellis sold 800,000 shares at $46, received a 10% stock dividend, and then later in the year sold another 200,000 shares at $43 Hint There is no entry for the stock dividend, but a new Investment per share must be calculated for use later when the shares are sold. Sipped Required: Prepare journal entries to record these transactions. (if no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions rounded to 1 decimal place fi.e., 5,500,000 should be entered as 5.5)) View transaction list Journal entry worksheet references Record sale of 200,000 shares Note: Enter debits before credits Event General Journal Doble Credit