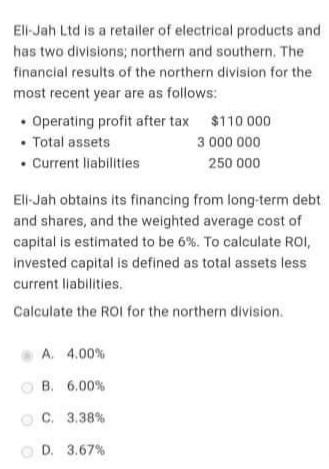

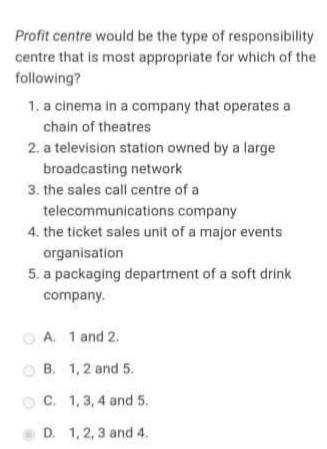

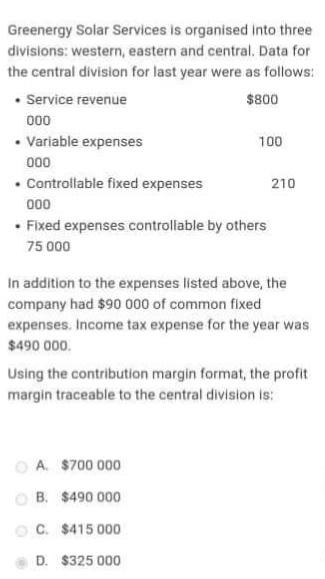

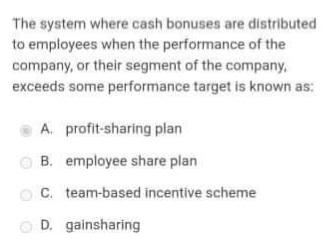

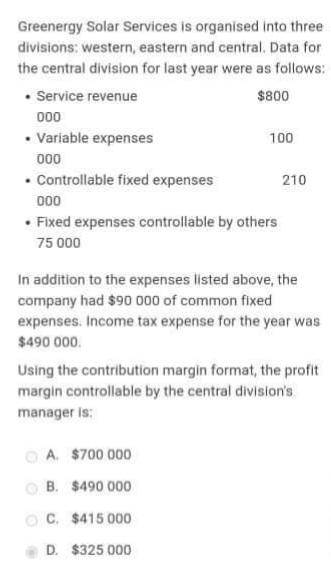

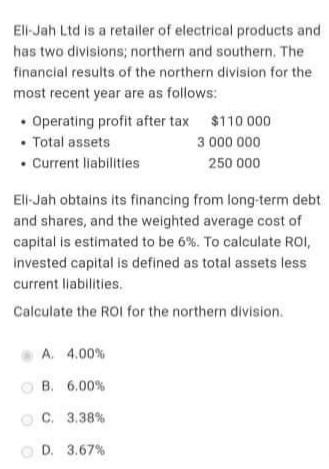

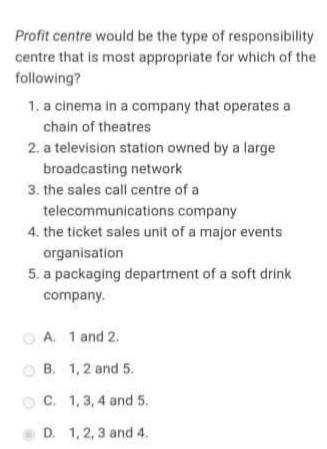

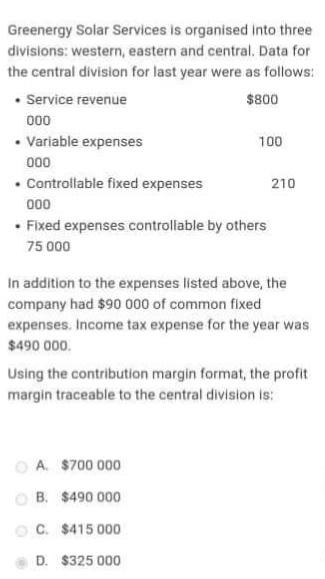

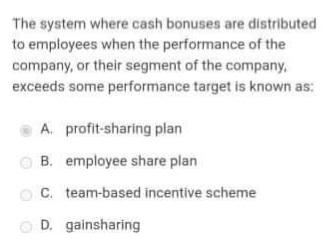

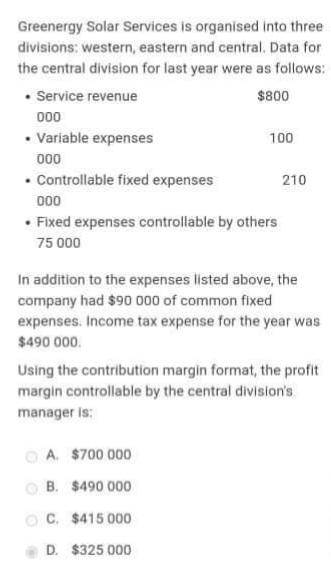

Ell-Jah Ltd is a retailer of electrical products and has two divisions, northern and southern. The financial results of the northern division for the most recent year are as follows: Operating profit after tax $110.000 Total assets 3 000 000 . Current liabilities 250 000 Ell-Jah obtains its financing from long-term debt and shares, and the weighted average cost of capital is estimated to be 6%. To calculate ROI Invested capital is defined as total assets less current liabilities. Calculate the ROI for the northern division A. 4.00% B. 6.00% C. 3.38% D. 3.67% Profit centre would be the type of responsibility centre that is most appropriate for which of the following? 1. a cinema in a company that operates a chain of theatres 2. a television station owned by a large broadcasting network 3. the sales call centre of a telecommunications company 4. the ticket sales unit of a major events organisation 5. a packaging department of a soft drink company A 1 and 2 B 1.2 and 5 C 1,3,4 and 5 D. 1, 2, 3 and 4 1,2,3 . Greenergy Solar Services is organised into three divisions: western, eastern and central. Data for the central division for last year were as follows: Service revenue $800 000 Variable expenses 100 000 Controllable fixed expenses 210 000 . Fixed expenses controllable by others 75 000 In addition to the expenses listed above, the company had $90 000 of common fixed expenses. Income tax expense for the year was $490 000 Using the contribution margin format, the profit margin traceable to the central division is: A $700 000 B. $490 000 C. $415 000 D. $325 000 The system where cash bonuses are distributed to employees when the performance of the company, or their segment of the company, exceeds some performance target is known as: A profit-sharing plan B. employee share plan C. team-based incentive scheme D. gainsharing Greenergy Solar Services is organised into three divisions: western, eastern and central. Data for the central division for last year were as follows: Service revenue $800 000 Variable expenses 100 000 Controllable fixed expenses 210 000 Fixed expenses controllable by others 75 000 In addition to the expenses listed above, the company had $90 000 of common fixed expenses, Income tax expense for the year was $490 000 Using the contribution margin format, the profit margin controllable by the central division's manager is: A $700 000 B. $490 000 C. $415 000 D. $325 000