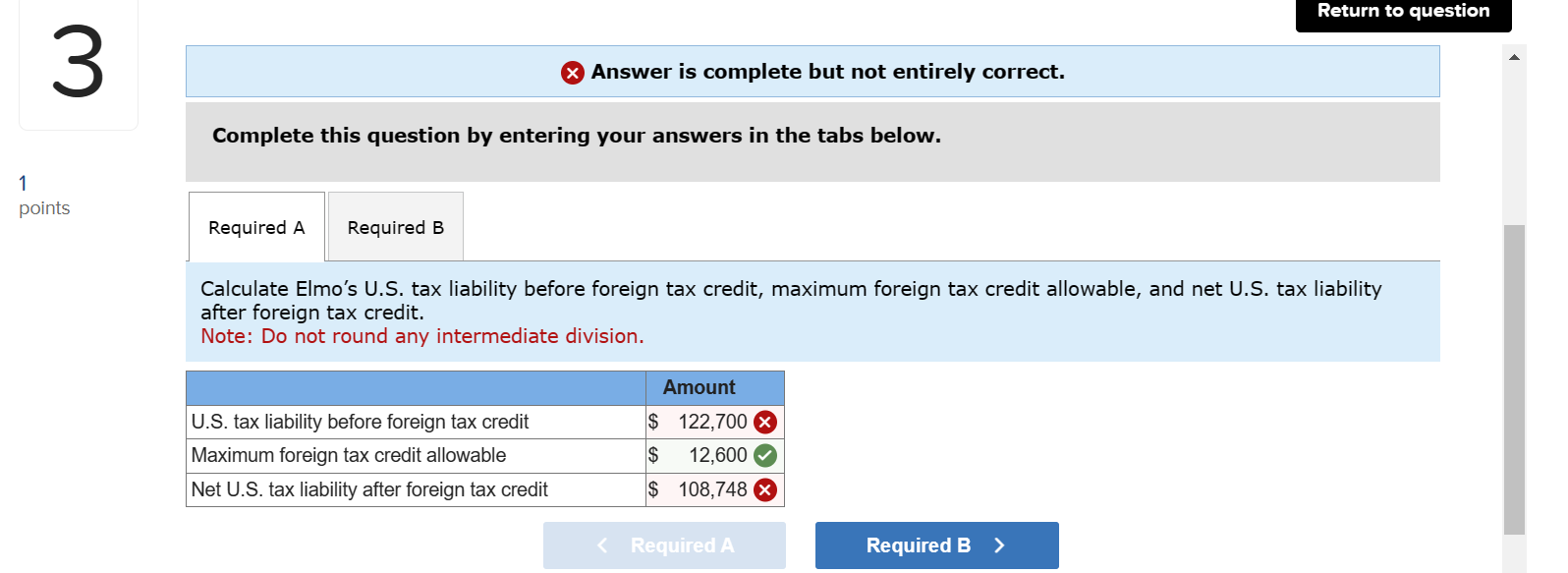

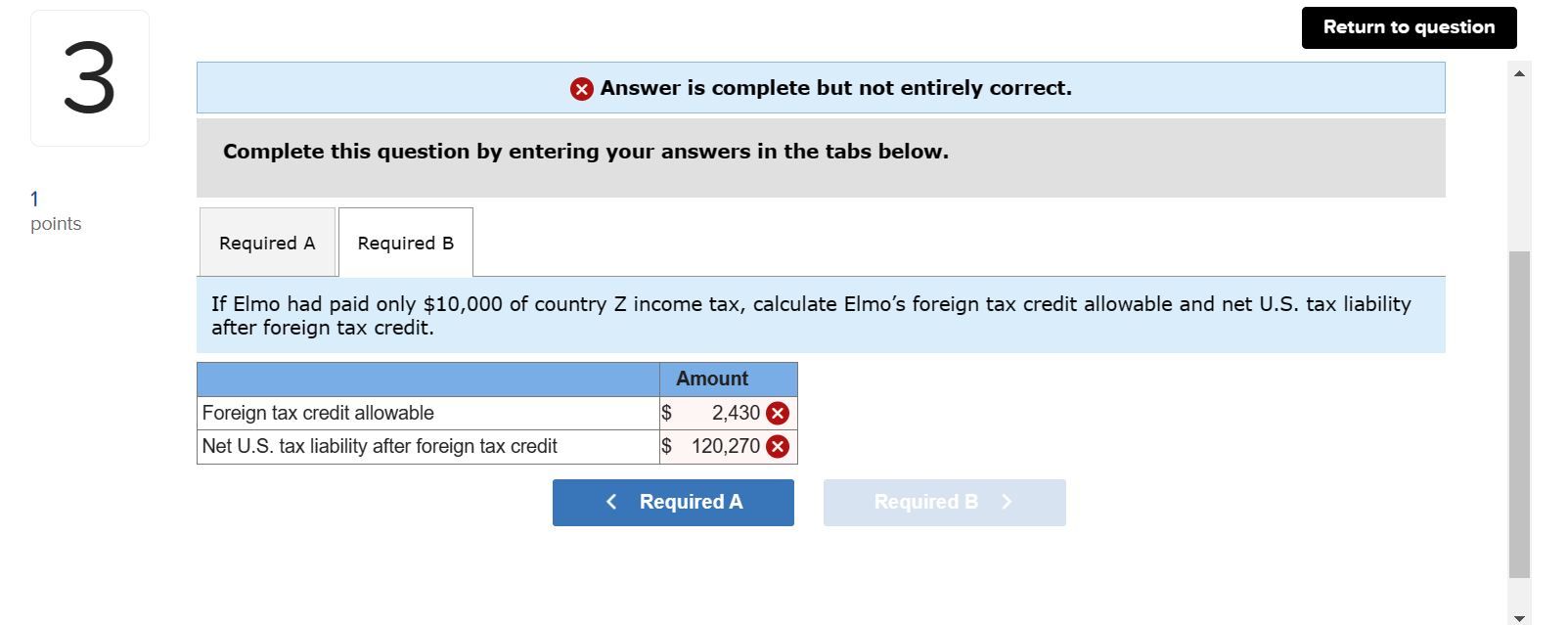

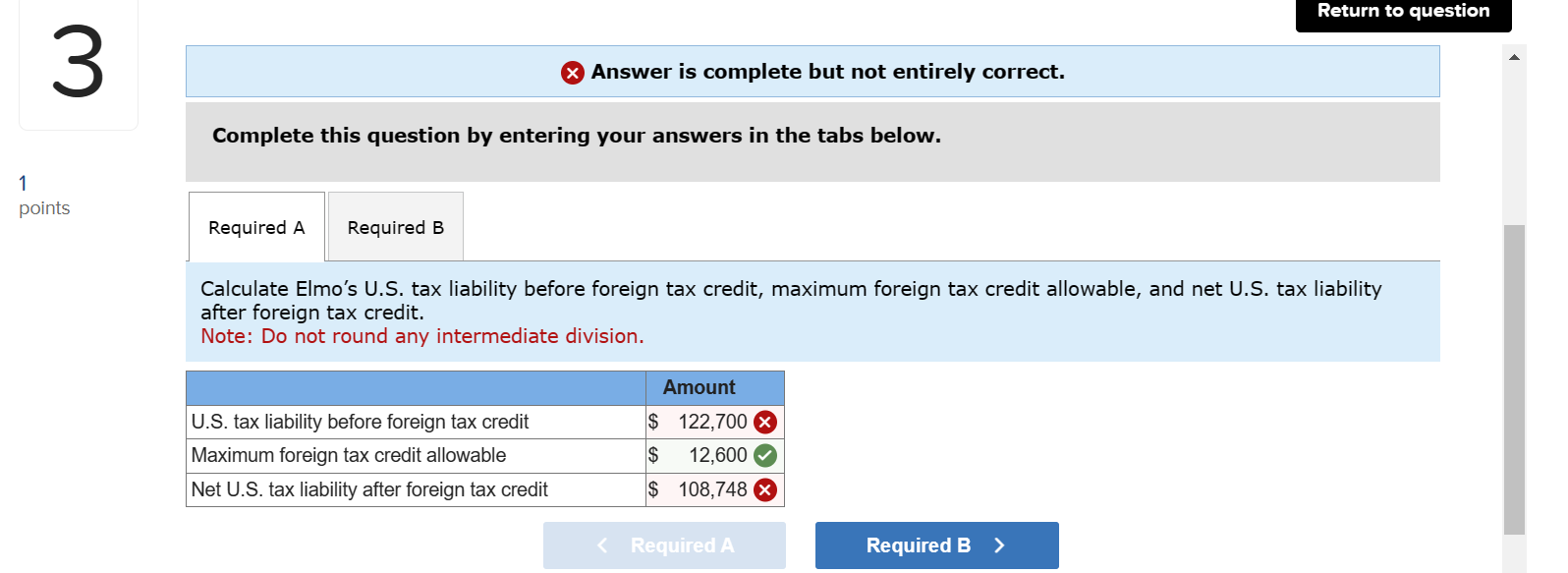

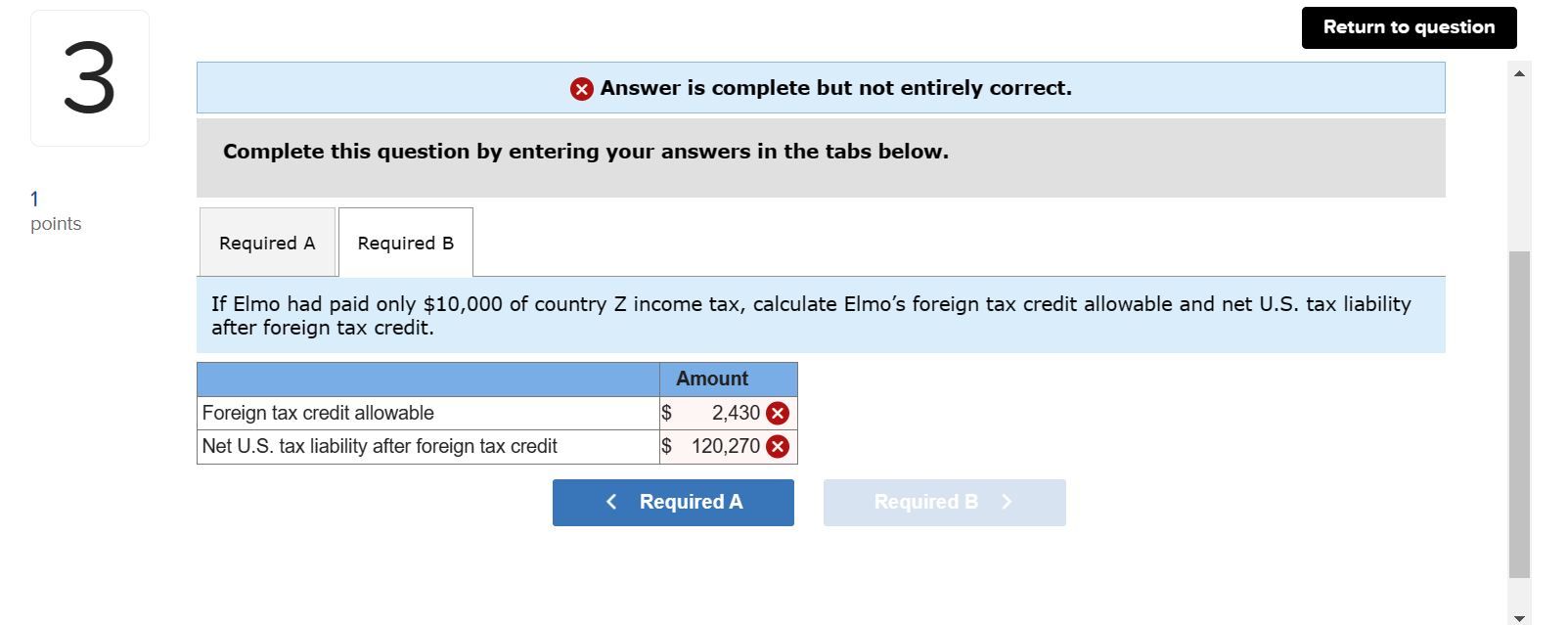

Elmo, Incorporated is a U.S. corporation with a branch office in foreign country Z. During the current year, Elmo had $340,000 of U.S. source income and $60,000 of foreign source income from Z, on which Elmo paid $28,000 of country Z income tax. Required: a. Calculate Elmo's U.S. tax liability before foreign tax credit, maximum foreign tax credit allowable, and net U.S. tax liability after foreign tax credit. b. If Elmo had paid only $10,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. If Elmo had paid only $10,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Calculate Elmo's U.S. tax liability before foreign tax credit, maximum foreign tax credit allowable, and net U.S. tax liability after foreign tax credit. Note: Do not round any intermediate division. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. If Elmo had paid only $10,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit. Elmo, Incorporated is a U.S. corporation with a branch office in foreign country Z. During the current year, Elmo had $340,000 of U.S. source income and $60,000 of foreign source income from Z, on which Elmo paid $28,000 of country Z income tax. Required: a. Calculate Elmo's U.S. tax liability before foreign tax credit, maximum foreign tax credit allowable, and net U.S. tax liability after foreign tax credit. b. If Elmo had paid only $10,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. If Elmo had paid only $10,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Calculate Elmo's U.S. tax liability before foreign tax credit, maximum foreign tax credit allowable, and net U.S. tax liability after foreign tax credit. Note: Do not round any intermediate division. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. If Elmo had paid only $10,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit