Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Elon Dust started a company called Busla Corporation on January 2, 2018. The annual reporting period ends on December 31, 2018. During the year

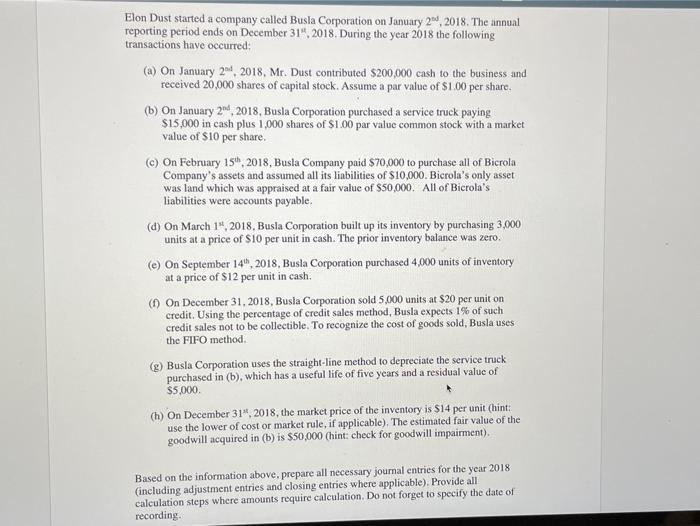

Elon Dust started a company called Busla Corporation on January 2, 2018. The annual reporting period ends on December 31", 2018. During the year 2018 the following transactions have occurred: (a) On January 2d, 2018, Mr. Dust contributed $200,000 cash to the business and received 20,000 shares of capital stock. Assume a par value of $1.00 per share. (b) On January 2, 2018, Busla Corporation purchased a service truck paying $15,000 in cash plus 1,000 shares of $1.00 par value common stock with a market value of $10 per share. (c) On February 15th, 2018, Busla Company paid $70,000 to purchase all of Bicrola Company's assets and assumed all its liabilities of $10,000. Bicrola's only asset was land which was appraised at a fair value of $50,000. All of Bicrola's liabilities were accounts payable. (d) On March 1", 2018, Busla Corporation built up its inventory by purchasing 3,000 units at a price of $10 per unit in cash. The prior inventory balance was zero. (e) On September 14t, 2018, Busla Corporation purchased 4,000 units of inventory at a price of $12 per unit in cash. () On December 31, 2018, Busla Corporation sold 5,000 units at $20 per unit on credit. Using the percentage of credit sales method, Busla expects 1% of such credit sales not to be collectible. To recognize the cost of goods sold, Busla uses the FIFO method. Busla Corporation uses the straight-line method to depreciate the service truck purchased in (b), which has a useful life of five years and a residual value of $5,000. (h) On December 31", 2018, the market price of the inventory is $14 per unit (hint: use the lower of cost or market rule, if applicable). The estimated fair value of the goodwill acquired in (b) is $50,000 (hint: check for goodwill impairment). Based on the information above, prepare all necessary journal entries for the year 2018 (including adjustment entries and closing entries where applicable). Provide all calculation steps where amounts require calculation. Do not forget to specify the date of recording.

Step by Step Solution

★★★★★

3.19 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Date particulars Debit Credit a Jan 2 Bank account capital account 220000 220...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started