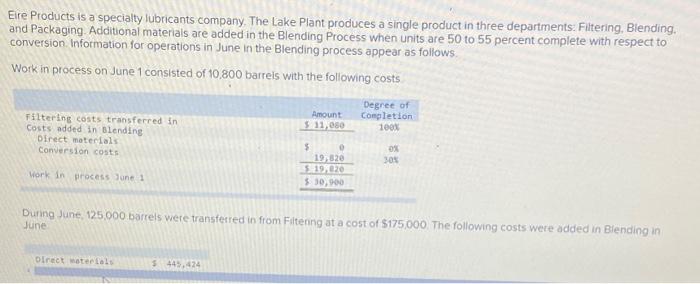

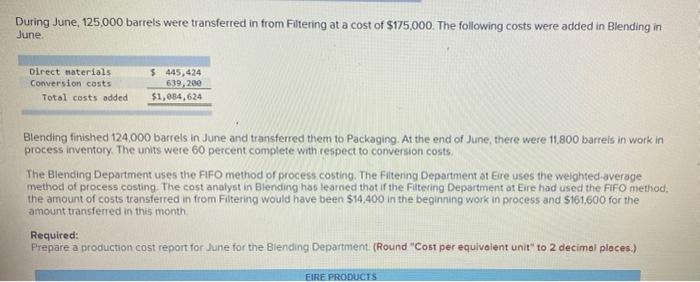

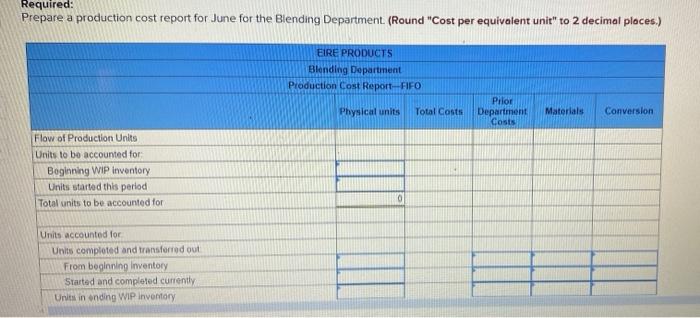

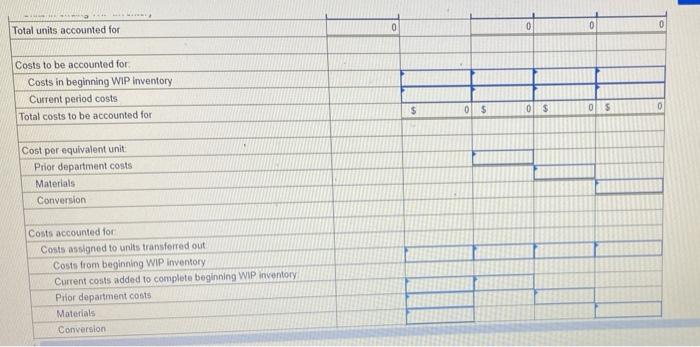

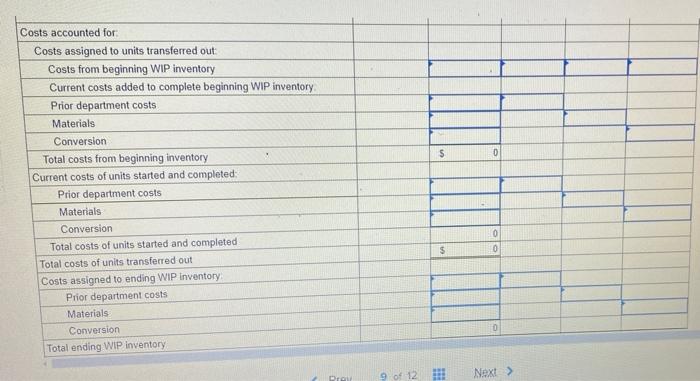

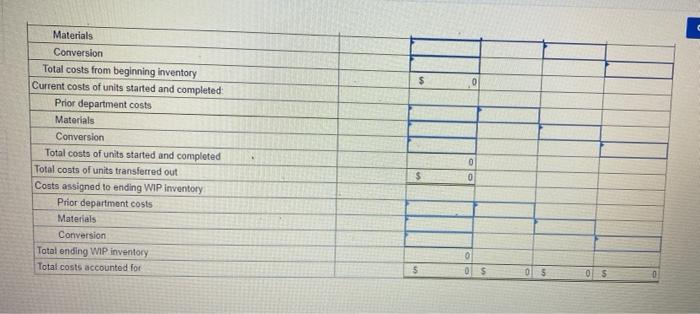

Elre Products is a specialty lubricants company. The Lake Plant produces a single product in three departments: Filtering, Blending. and Packaging Additional materials are added in the Blending Process when units are 50 to 55 percent complete with respect to conversion Information for operations in June in the Blending process appear as follows Work in process on June 1 consisted of 10,800 barrels with the following costs Amount 511,050 Degree of Completion 100% Filtering costs transferred in Costs added in Blending Direct materials Conversion costs 0% 30% 3 19820 5-19020 $ 30,00 Work in process June 1 During June 125.000 barrels were transferred in from Filtering at a cost of $175,000. The following costs were added in Blending in June Oirect materials $ 449,424 During June, 125,000 barrels were transferred in from Filtering at a cost of $175,000. The following costs were added in Blending in June Direct materials Conversion costs Total costs added $ 445,424 639,209 $1,884,624 Blending finished 124,000 barrels in June and transferred them to Packaging. At the end of June, there were 11.800 barrels in work in process inventory. The units were 60 percent complete with respect to conversion costs The Blending Department uses the FIFO method of process costing. The Filtering Department at Ere uses the weighted average method of process costing. The cost analyst in Blending has learned that if the Filtering Department at Eire had used the FIFO method the amount of costs transferred in from Filtering would have been $14.400 in the beginning work in process and S161,600 for the amount transferred in this month Required: Prepare a production cost report for June for the Blending Department (Round "Cost per equivalent unit" to 2 decimal places.) EIRE PRODUCTS Required: Prepare a production cost report for June for the Blending Department. (Round "Cost per equivalent unit" to 2 decimal places.) EIRE PRODUCTS Blending Department Production Cost Report--FIFO Physical units Total Costs Pilor Department Costs Materials Conversion Flow of Production Units Units to be accounted for Boginning WIP Inventory Units started this period Total units to be accounted for 0 Units accounted for Units completed and transferred out From beginning Inventory Started and completed currently Units in onding WIP Inventory 0 0 Total units accounted for Costs to be accounted for Costs in beginning WIP inventory Current period costs Total costs to be accounted for $ 0 $ 0 $ 0 5 0 Cost per equivalent unit: Prior department costs Materials Conversion Costs accounted for Costs assigned to units transferred out Costs from beginning WIP Inventory Current costs added to complete beginning WIP inventory Prior department costs Materials Conversion $ 0 Costs accounted for Costs assigned to units transferred out: Costs from beginning WIP inventory Current costs added to complete beginning WIP inventory Prior department costs Materials Conversion Total costs from beginning inventory Current costs of units started and completed: Prior department costs Materials Conversion Total costs of units started and completed Total costs of units transferred out Costs assigned to ending WIP Inventory Prior department costs Materials Conversion Total ending WIP inventory 0 $ 0 Pro 9 of 12 Next > 0 Materials Conversion Total costs from beginning inventory Current costs of units started and completed Prior department costs Materials Conversion Total costs of units started and completed Total costs of units transferred out Costs assigned to ending WIP Inventory Prior department costs Materials Conversion Total ending WIP inventory Total costs accounted for 0 $ 0 O 5 0$ 03 015