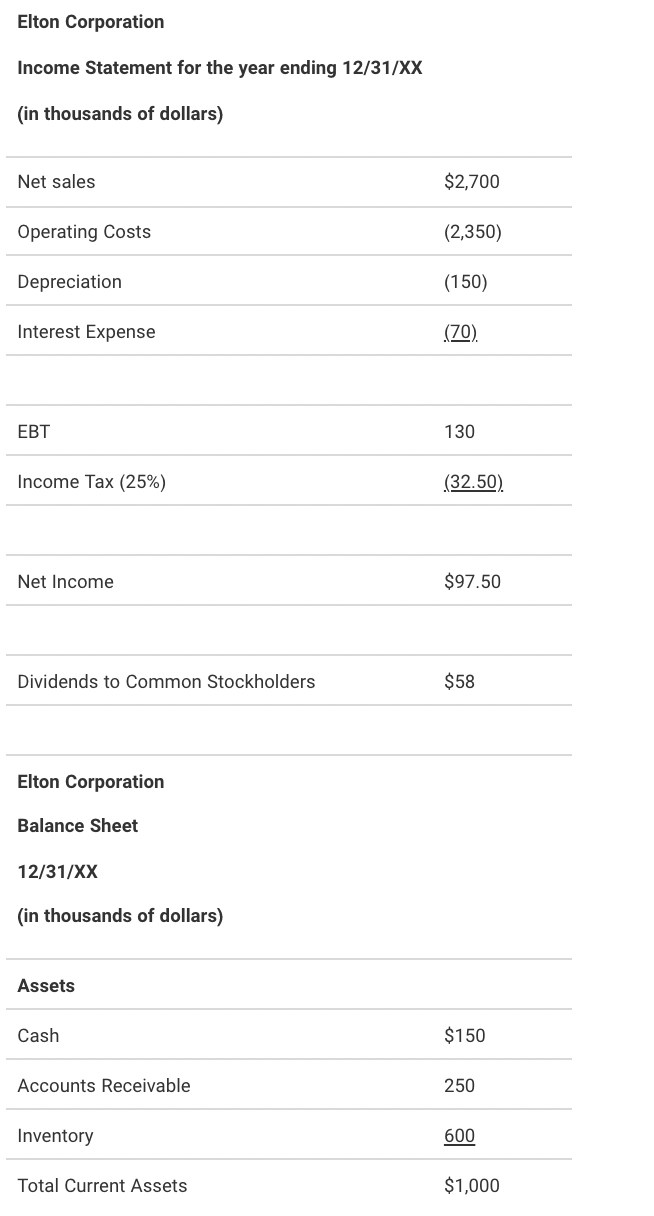

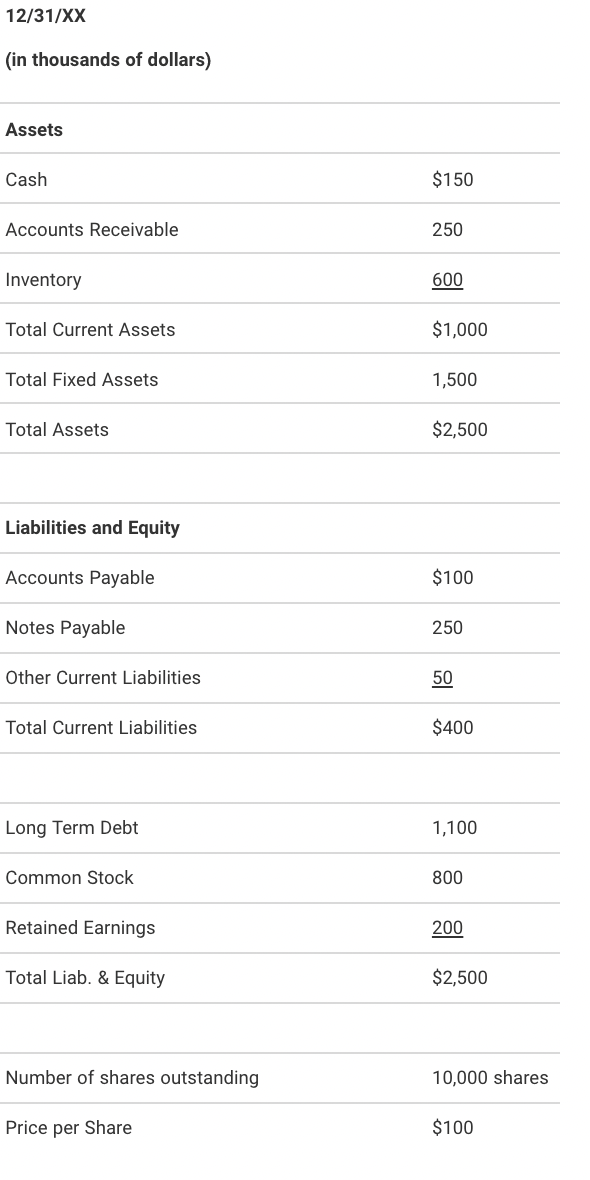

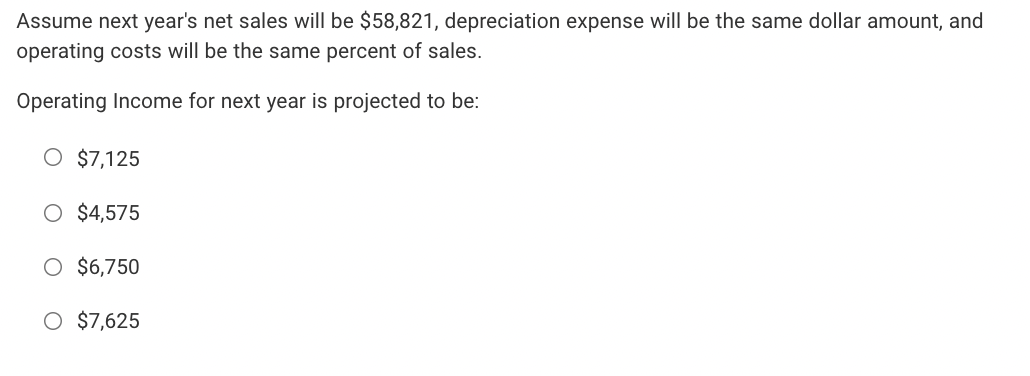

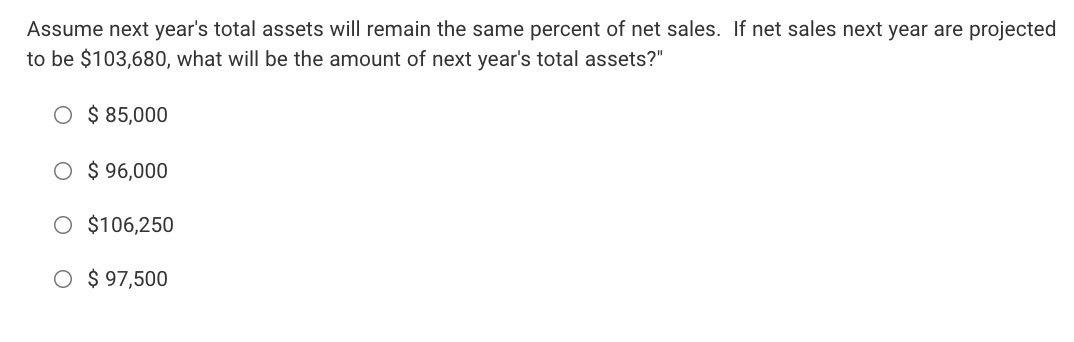

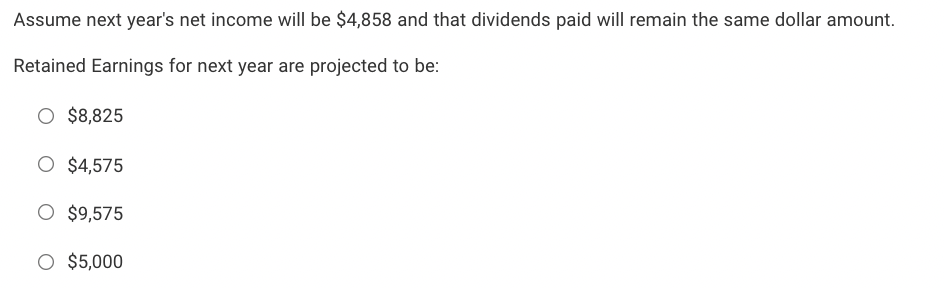

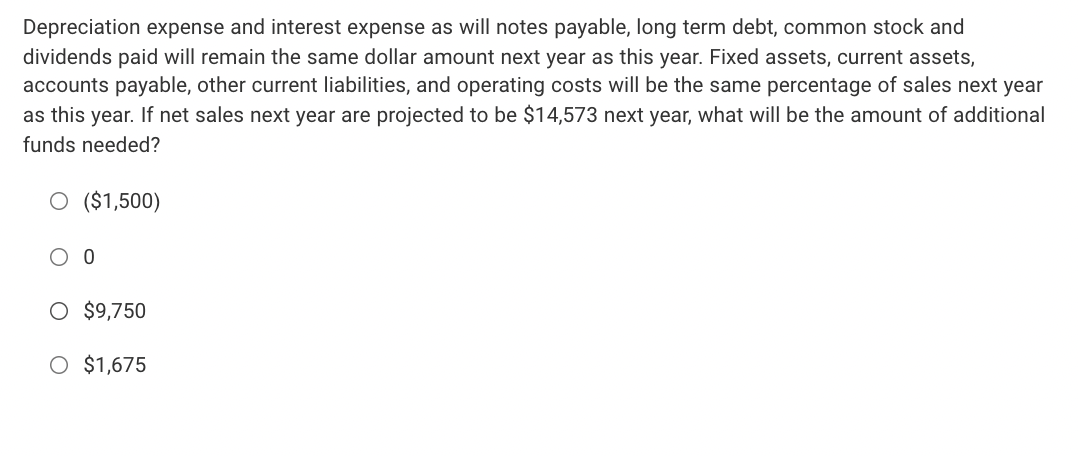

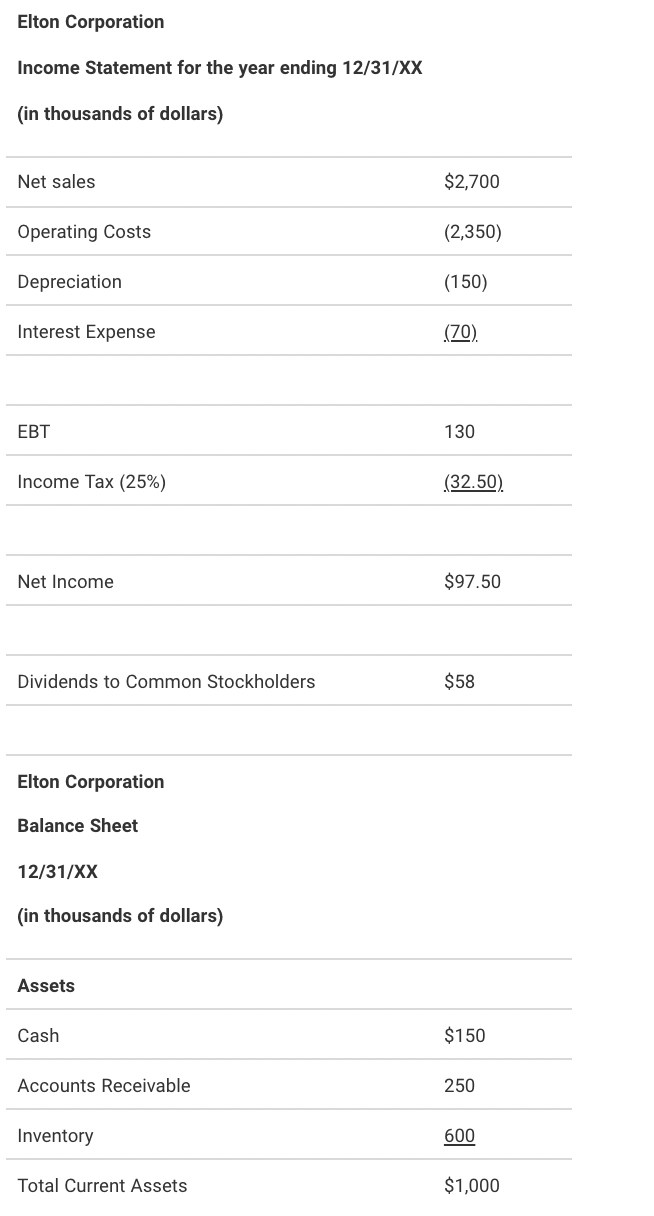

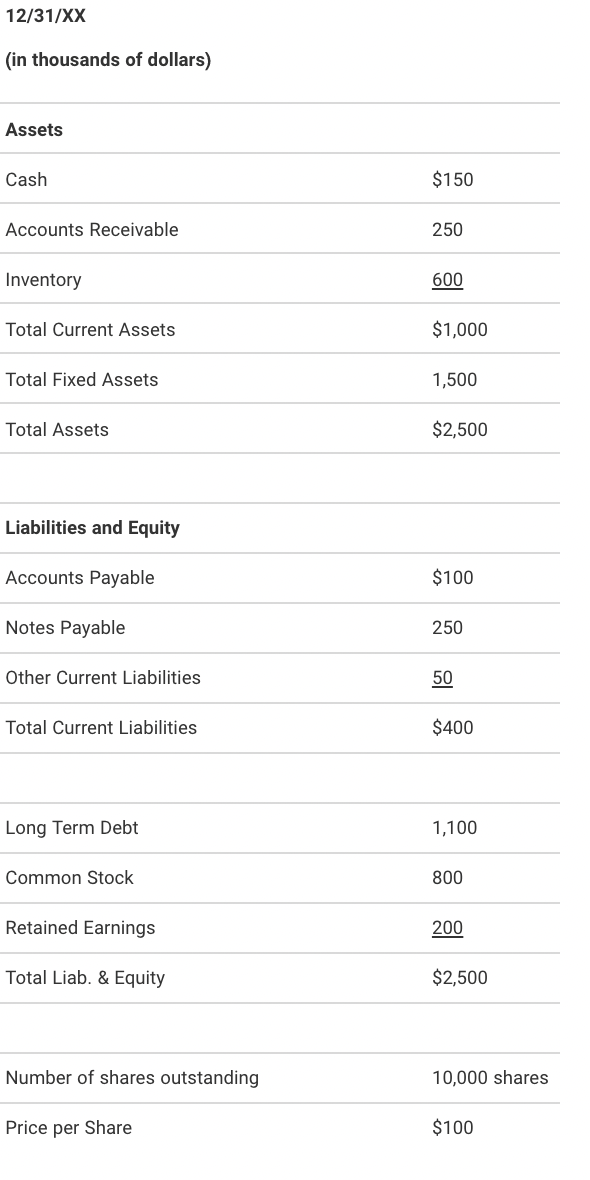

Elton Corporation Income Statement for the year ending 12/31/XX (in thousands of dollars) Net sales $2,700 Operating costs (2,350) Depreciation (150) Interest Expense (70). 130 Income Tax (25%) (32.50) Net Income $97.50 Dividends to Common Stockholders $58 Elton Corporation Balance Sheet 12/31/XX (in thousands of dollars) Assets Cash $150 Accounts Receivable 250 Inventory 600 Total Current Assets $1,000 12/31/XX (in thousands of dollars) Assets Cash $150 Accounts Receivable 250 Inventory 600 Total Current Assets $1,000 Total Fixed Assets 1,500 Total Assets $2,500 Liabilities and Equity Accounts Payable $100 Notes Payable 250 Other Current Liabilities 50 Total Current Liabilities $400 Long Term Debt 1,100 Common Stock 800 Retained Earnings 200 Total Liab. & Equity $2,500 Number of shares outstanding 10,000 shares Price per Share $100 Assume next year's net sales will be $58,821, depreciation expense will be the same dollar amount, and operating costs will be the same percent of sales. Operating Income for next year is projected to be: O $7,125 O $4,575 O $6,750 O $7,625 Assume next year's total assets will remain the same percent of net sales. If net sales next year are projected to be $103,680, what will be the amount of next year's total assets?" O $ 85,000 O $ 96,000 $106,250 O $ 97,500 Assume next year's net income will be $4,858 and that dividends paid will remain the same dollar amount. Retained Earnings for next year are projected to be: O $8,825 O $4,575 O $9,575 O $5,000 Depreciation expense and interest expense as will notes payable, long term debt, common stock and dividends paid will remain the same dollar amount next year as this year. Fixed assets, current assets, accounts payable, other current liabilities, and operating costs will be the same percentage of sales next year as this year. If net sales next year are projected to be $14,573 next year, what will be the amount of additional funds needed? O ($1,500) O $9,750 O $1,675 Elton Corporation Income Statement for the year ending 12/31/XX (in thousands of dollars) Net sales $2,700 Operating costs (2,350) Depreciation (150) Interest Expense (70). 130 Income Tax (25%) (32.50) Net Income $97.50 Dividends to Common Stockholders $58 Elton Corporation Balance Sheet 12/31/XX (in thousands of dollars) Assets Cash $150 Accounts Receivable 250 Inventory 600 Total Current Assets $1,000 12/31/XX (in thousands of dollars) Assets Cash $150 Accounts Receivable 250 Inventory 600 Total Current Assets $1,000 Total Fixed Assets 1,500 Total Assets $2,500 Liabilities and Equity Accounts Payable $100 Notes Payable 250 Other Current Liabilities 50 Total Current Liabilities $400 Long Term Debt 1,100 Common Stock 800 Retained Earnings 200 Total Liab. & Equity $2,500 Number of shares outstanding 10,000 shares Price per Share $100 Assume next year's net sales will be $58,821, depreciation expense will be the same dollar amount, and operating costs will be the same percent of sales. Operating Income for next year is projected to be: O $7,125 O $4,575 O $6,750 O $7,625 Assume next year's total assets will remain the same percent of net sales. If net sales next year are projected to be $103,680, what will be the amount of next year's total assets?" O $ 85,000 O $ 96,000 $106,250 O $ 97,500 Assume next year's net income will be $4,858 and that dividends paid will remain the same dollar amount. Retained Earnings for next year are projected to be: O $8,825 O $4,575 O $9,575 O $5,000 Depreciation expense and interest expense as will notes payable, long term debt, common stock and dividends paid will remain the same dollar amount next year as this year. Fixed assets, current assets, accounts payable, other current liabilities, and operating costs will be the same percentage of sales next year as this year. If net sales next year are projected to be $14,573 next year, what will be the amount of additional funds needed? O ($1,500) O $9,750 O $1,675