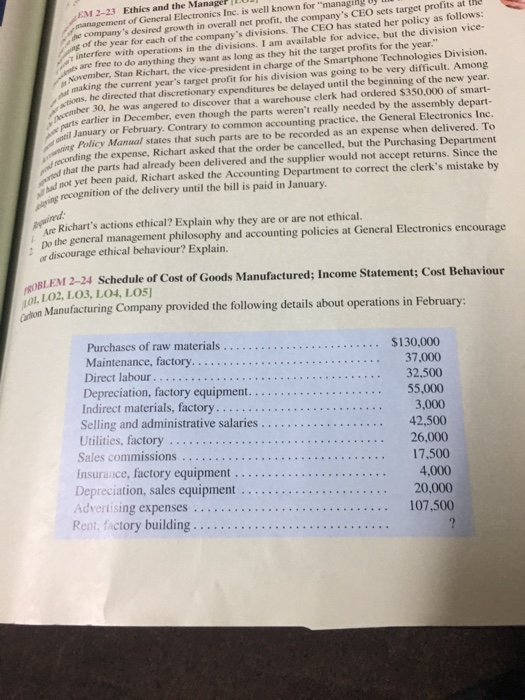

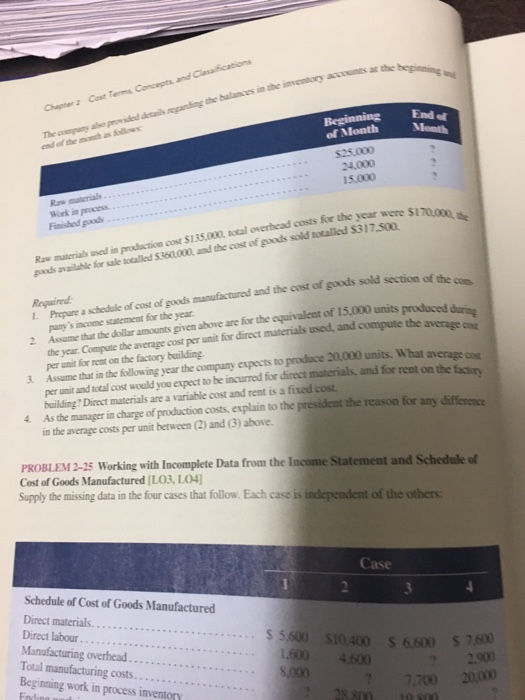

EM 2-23 Ethics and the ManagePLU management of General Electronics Inc. is well known for managing ug e company's desired growth in overall net profit, the company's CEO sets target profits at the of the year for each of the company's divisions. The CEO has stated her policy as follows: interfere with operations in the divisions. I am available for advice, but the division vice- es are free to do anything they want as long as they hit the target profits for the year." November. Stan Richart, the vice-president in charge of the Smartphone Technologies Division, making the current year's target profit for his division was going to be very difficult. Among was, he directed that discretionary expenditures be delayed until the beginning of the new year ember 30, he was angered to discover that a warehouse clerk had ordered $350,000 of smart- its earlier in December, even though the parts weren't really needed by the assembly depart- January or February. Contrary to common accounting practice, the General Electronics Inc. Policy Manual states that such parts are to be recorded as an expense when delivered. To ending the expense, Richart asked that the order be cancelled, but the Purchasing Department hat the parts had already been delivered and the supplier would not accept returns. Since the yet been paid, Richart asked the Accounting Department to correct the clerk's mistake by recognition of the delivery until the bill is paid in January ry experter his divise or the ser profits to Pure Richart's actions ethical? Explain why they are or are not ethical. Do the general management philosophy and accounting policies at General Electronics encourage discourage ethical behaviour? Explain. BLEM 2-24 Schedule of Cost of Goods Manufactured; Income Statement; Cost Behaviour 01.102, LO3, LO4, LOS on Manufacturing Company provided the following details about operations in February: Purchases of raw materials .... Maintenance, factory................. Direct labour .......... Depreciation, factory equipment. .......... Indirect materials, factory................. Selling and administrative salaries ........ Utilities, factory ........ Sales commissions ........... Insurance, factory equipment .......... Depreciation, sales equipment .. Advertising expenses .... Rent, factory building.......... $130,000 37,000 32,500 55,000 3,000 42,500 26,000 17,500 4,000 20,000 107,500 the s Chapter 2 Cost Terms Concepts and Classifications provided details regarding the balances in the memory a Ende Nem The Beginning of Month $25.000 15.000 were $170,000 Work in process Fished goods Raw materials used in production cost $1.35.000 bocal overhead costs for the year were si poodsailable for sale totalled $360,000, and the cost of goods sold totalled $317.500 old section of the com Juced during Is used, and compute the average cos Required: Prepare a schedule of cost of goods manufactured and the cost of goods sold section of pam's income statement for the year. 2 Assume that the dollar amounts given above are for the equivalent of 15.000 units produced the year Compute the average cost per unit for direct materials used and compute the ange per unit for rent on the factory building. Assume that in the following year the company expects to produce 20.000 units. What ang per unit and total cost would you expect to be incurred for direct materials and for rent on the building Direct materials are a variable cost and rent is a fixed cost. 4. As the manager in charge of production costs, explain to the president the reason for any difference in the average costs per unit between (2) and (3) above. PROBLEM 2-25 Working with Incomplete Data from the Income Statement and Schedule of Cost of Goods Manufactured (LO3, L04 Supply the missing data in the four cases that follow. Each case is independent of the others Case Schedule of Cost of Goods Manufactured Direct materials. Direct labour... Manufacturing overhead.... Total manufacturing costs....... Beginning work in process inventory Ft $ 5.600 1.600 8.000 $10.400 4.600 S 6.600 57.800 2.900 20.000 7700 8100