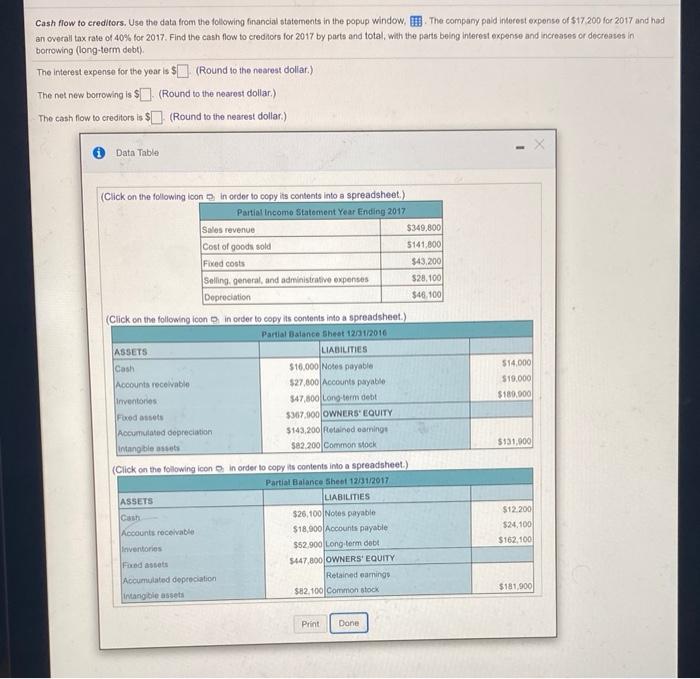

. em (Hound Theodor Theo Round rotar Da Click on the one in Crasheet Part 10 Save 3000 Canode Stato 143200 Sadece 128.100 Deprecat 146.100 $14.000 $15.000 3100.900 5131100 Click on the town in order to contato spreadsheet Paralance 018 ASSETS LIABILITIES loan 550.000 Notes payable Account $27.000 Stones $17.000 Long F 536700 OWNERS' EQUITY Acumulated precio $183.200 Rained angeles $82,200 Commons (Click on the following soon in order to copy its contents into spreadsheet) Partial Balance Sheet 121/2017 ASSETS LIABILITIES $26.100 Noles payable Accounts receive $18.900 Accounts payable Inventions 552.900 Long-term det Fixed asses 5447.800 OWNERS' EQUITY Accumulated depreciation Retained saming Intangible assets $82,100 Common stock $12.200 $24.100 $162.100 $181.900 Print Done sur answer in each of the answer boxes Cash flow to creditors. Une herom flowing financial powindow. The compense $17200 2017 an overal of 40 for 2017 decat fow to cred 2017 byte and total wartenges and down DO (og-orabo The rest eagerne for the year is $(Round is nearest dollar) The retreats found the real dolar) The can tow to creditore $ Round to be redo) Table ASSETS (Click on the towing on into the contents are Post Year 2017 SH 300 Could 514100 543200 Seting Do 15.100 (Click on the flowing connectors Partisanente LIABILITIES Cal $16.000 A 20 os 547.00 53670 OWNERS EQUITY 143.00 10000 (Click on ong concerto copy count into a sprachet) Behus ASSES LABUTE caun 26.10 Account 118.00 con 147.300 OWNERE ET 114.000 550.000 ol 112200 10 11030 Clock Print Done 7 Cash flow to creditors. Use the data from the following financial statements in the popup window. The company paid interest exponse of $17.200 for 2017 and had an overall tax rate of 40% for 2017. Find the cash flow to creditors for 2017 by parts and total, with the parts being interest expense and increases or decreases in borrowing (long-term debt) The Interest expense for the year is $ (Round to the nearest dollar.) The net new borrowing is $(Round to tho nearest dollar) The cash flow to creditors is $(Round to the nearest dollar) 1 Data Table (Click on the following loon in order to copy its contents into a spreadsheet.) Partial income Statement Year Ending 2017 Sales revenue $349,800 Cost of goods sold 5141.800 Fixed costs $43,200 Selling general and administrative expenses $28.100 Depreciation $46.100 (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 121/2016 ASSETS LIABILITIES Cash $10.000 Notes payable Accounts receivable $27,800 Accounts payable inventores $47.000 Long-term debt Foxed assets $347.000 OWNERS' EQUITY Accumulated depreciation 5143,200 Retained oaming Intangible assets 582.200 Common stock 514.000 $19.000 $180,000 $131,000 $12 200 (Click on the following loon in order to copy its contents into a spreadsheet) Partial Balance Sheet 12/31/2017 ASSETS LIABILITIES Cash $26,100 Notes payable Accounts receivable $18,000 Accounts payable Invertorios $52.900 Long term obt Faxed assets 5447.800 OWNERS' EQUITY Accumulated depreciation Retained earning Intangible assets $82,100 Common stock $24.100 $162.100 $181.900 Print Done