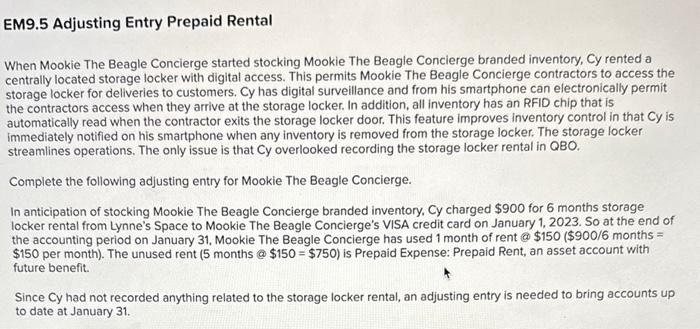

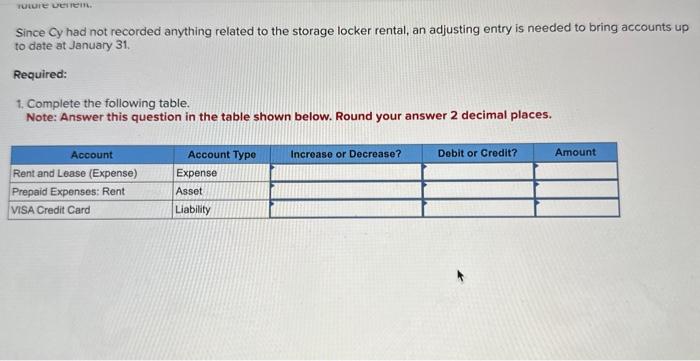

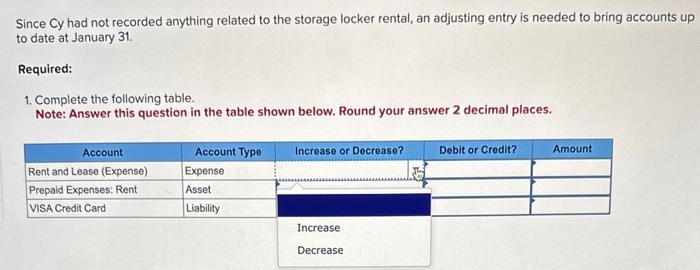

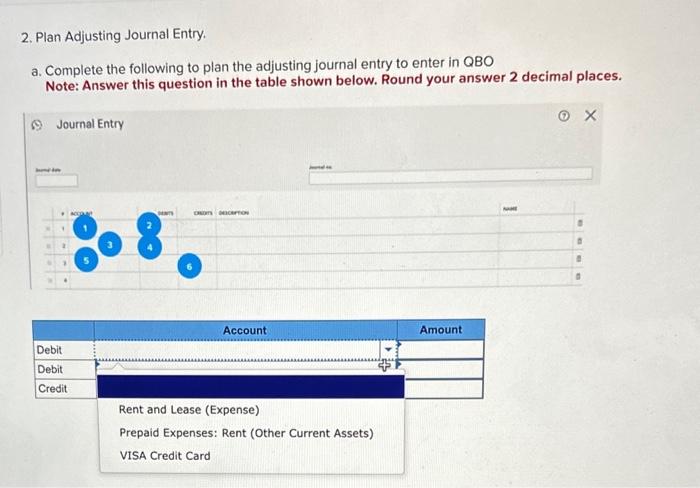

EM9.5 Adjusting Entry Prepaid Rental When Mookie The Beagle Concierge started stocking Mookie The Beagle Concierge branded inventory, Cy rented a centrally located storage locker with digital access. This permits Mookie The Beagle Concierge contractors to access the storage locker for deliveries to customers. Cy has digital surveillance and from his smartphone can electronically permit the contractors access when they arrive at the storage locker. In addition, all inventory has an RFID chip that is automatically read when the contractor exits the storage locker door. This feature improves inventory control in that Cy is immediately notified on his smartphone when any inventory is removed from the storage locker. The storage locker streamlines operations. The only issue is that Cy overlooked recording the storage locker rental in QBO. Complete the following adjusting entry for Mookie The Beagle Concierge. In anticipation of stocking Mookie The Beagle Concierge branded inventory, Cy charged $900 for 6 months storage locker rental from Lynne's Space to Mookie The Beagle Concierge's VISA credit card on January 1, 2023. So at the end of the accounting period on January 31, Mookie The Beagle Concierge has used 1 month of rent @$150 ( $900/6 months = $150 per month). The unused rent (5 months @$150=$750 ) is Prepaid Expense: Prepaid Rent, an asset account with future benefit. Since Cy had not recorded anything related to the storage locker rental, an adjusting entry is needed to bring accounts up to date at January 31. Since Cy had not recorded anything related to the storage locker rental, an adjusting entry is needed to bring accounts up to date at January 31 . Required: 1. Complete the following table. Note: Answer this question in the table shown below. Round your answer 2 decimal places. Since Cy had not recorded anything related to the storage locker rental, an adjusting entry is needed to bring accounts up to date at January 31. Required: 1. Complete the following table. Note: Answer this question in the table shown below. Round your answer 2 decimal places. 2. Plan Adjusting Journal Entry. a. Complete the following to plan the adjusting journal entry to enter in QBO Note: Answer this question in the table shown below. Round your answer 2 decimal places. Q Journal Entry