Answered step by step

Verified Expert Solution

Question

1 Approved Answer

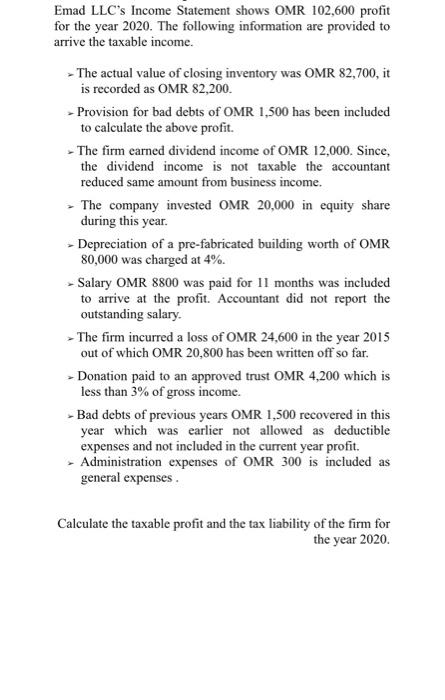

Emad LLC's Income Statement shows OMR 102,600 profit for the year 2020. The following information are provided to arrive the taxable income. - The

Emad LLC's Income Statement shows OMR 102,600 profit for the year 2020. The following information are provided to arrive the taxable income. - The actual value of closing inventory was OMR 82,700, it is recorded as OMR 82,200. - Provision for bad debts of OMR 1,500 has been included to calculate the above profit. - The firm earned dividend income of OMR 12,000. Since, the dividend income is not taxable the accountant reduced same amount from business income. - The company invested OMR 20,000 in equity share during this year. - Depreciation of a pre-fabricated building worth of OMR 80,000 was charged at 4%. - Salary OMR 8800 was paid for 11 months was included to arrive at the profit. Accountant did not report the outstanding salary. - The firm incurred a loss of OMR 24,600 in the year 2015 out of which OMR 20,800 has been written off so far. - Donation paid to an approved trust OMR 4,200 which is less than 3% of gross income. - Bad debts of previous years OMR 1,500 recovered in this year which was earlier not allowed as deductible expenses and not included in the current year profit. - Administration expenses of OMR 300 is included as general expenses. Calculate the taxable profit and the tax liability of the firm for the year 2020.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Particular Amount Amount Profit of the year 102600 Add Understated cl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started