Answered step by step

Verified Expert Solution

Question

1 Approved Answer

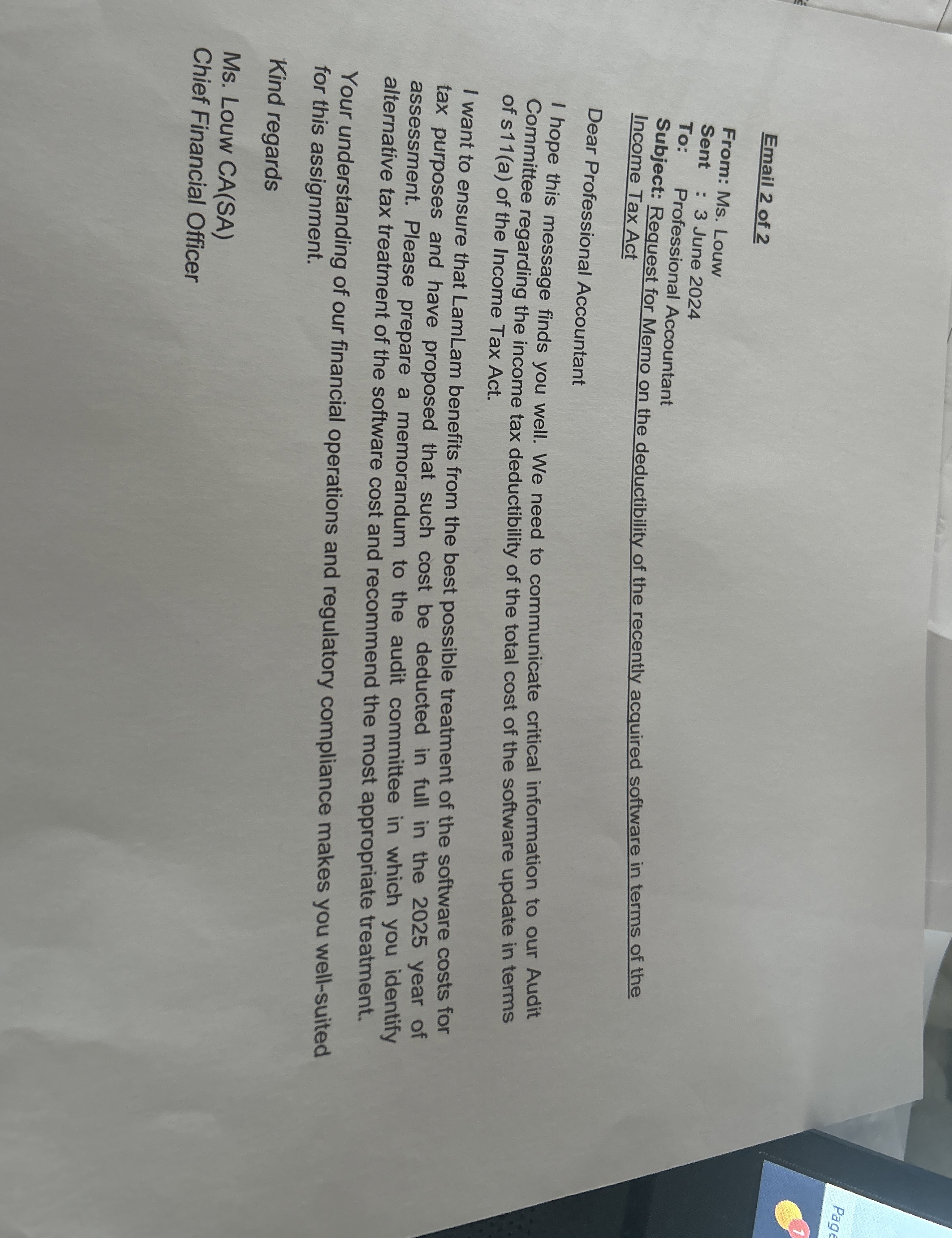

Email 2 of 2 From: Ms . Louw Sent : 3 June 2 0 2 4 To: Professional Accountant Subject: Request for Memo on the

Email of

From: Ms Louw

Sent : June

To: Professional Accountant

Subject: Request for Memo on the deductibility of the recently acquired software in terms of the

Income Tax Act

Dear Professional Accountant

I hope this message finds you well. We need to communicate critical information to our Audit Committee regarding the income tax deductibility of the total cost of the software update in terms of sa of the Income Tax Act.

I want to ensure that LamLam benefits from the best possible treatment of the software costs for tax purposes and have proposed that such cost be deducted in full in the year of assessment. Please prepare a memorandum to the audit committee in which you identify alternative tax treatment of the software cost and recommend the most appropriate treatment.

Your understanding of our financial operations and regulatory compliance makes you wellsuited for this assignment.

Kind regards

Ms Louw CASA

Chief Financial Officer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started