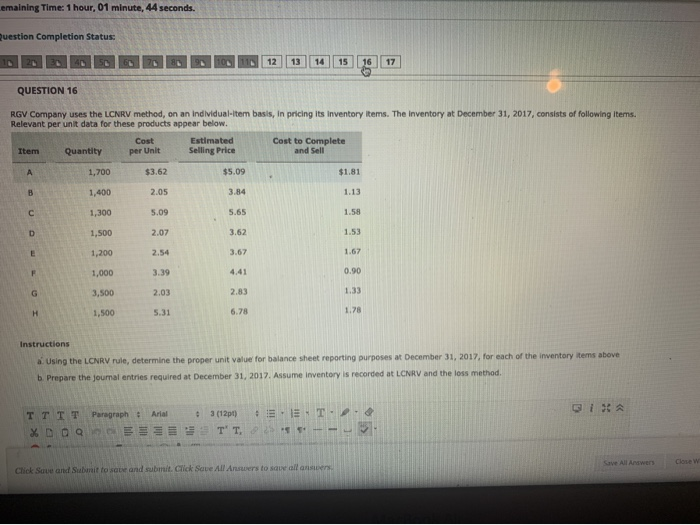

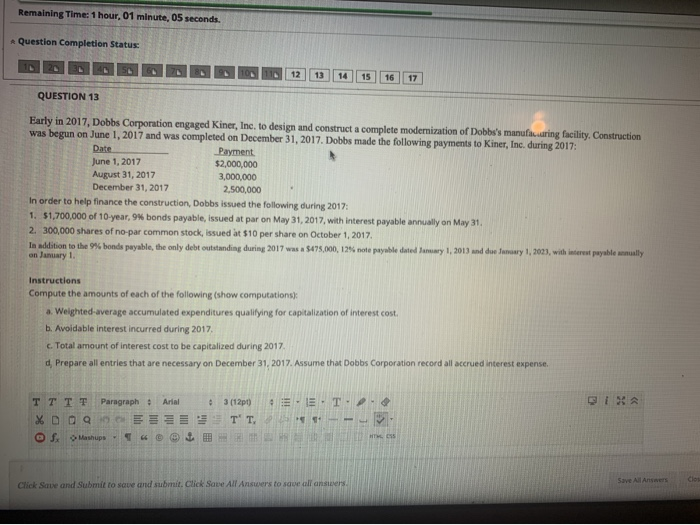

emaining Time: 1 hour, 01 minute, 44 seconds. Question Completion Status: 10 20 50 6 8 10 11 12 13 14 15 16 17 QUESTION 16 RGV Company uses the LCNRV method, on an individual-Item basis, in pricing its inventory Items. The inventory at December 31, 2017, consists of following items. Relevant per unit data for these products appear below. Estimated Selling Price Cost per Unit Cost to Complete and Sell Item Quantity 1,700 $3.62 $5.09 $1.81 1,400 2.05 3.84 1,300 5.09 1,500 1,200 1,000 3,500 1,500 5.31 Instructions Using the LCNRV rule, determine the proper unit value for balance sheet reporting purposes at December 31, 2017 for each of the inventory items above b. Prepare the journal entries required at December 31, 2017. Assume Inventory is recorded at LCNRV and the loss method. E Q TTTT Paragraph # Arial 3 (12pt) %DO QESETT.2 Save All Anwen d ome Click Save and Submit to save and submit. Click Save All Answers to see all answers Remaining Time: 1 hour, 01 minute, 05 seconds. Question Completion Status: QUESTION 13 Early in 2017, Dobbs Corporation engaged Kiner, Inc. to design and construct a complete modernization of Dobbs's manufaring facility. Construction was begun on June 1, 2017 and was completed on December 31, 2017. Dobbs made the following payments to Kiner, Inc. during 2017: Date Payment June 1, 2017 $2,000,000 August 31, 2017 3,000,000 December 31, 2017 2,500,000 In order to help finance the construction, Dobbs issued the following during 2017: 1. 51,700,000 of 10 year, 9% bonds payable, issued at par on May 31, 2017, with interest payable annually on May 31 2. 300,000 shares of no-par common stock, issued at $10 per share on October 1, 2017 In addition to the 9% bonds payable, the only debt outstanding during 2017 was a $475,000, 12 note payable dated January 1, 2013 and due fenuary 1, 2023, with interest payable mully on January 1. Instructions Compute the amounts of each of the following (show computations): a. Weighted-average accumulated expenditures qualifying for capitalization of interest cost. b. Avoidable interest incurred during 2017 c. Total amount of interest cost to be capitalized during 2017 d. Prepare all entries that are necessary on December 31, 2017. Assume that Dobbs Corporation record all accrued interest expense Arial TT T T Paragraph %DO Q E f. Manups 3 (12pt) T' T. @ Click Save and Submit to save and submit. Click Save All Answers to save all answers