Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ember Technologies stock is expected to pay the first dividend of $3.00 at the end of three years. Once the firm starts paying dividends,

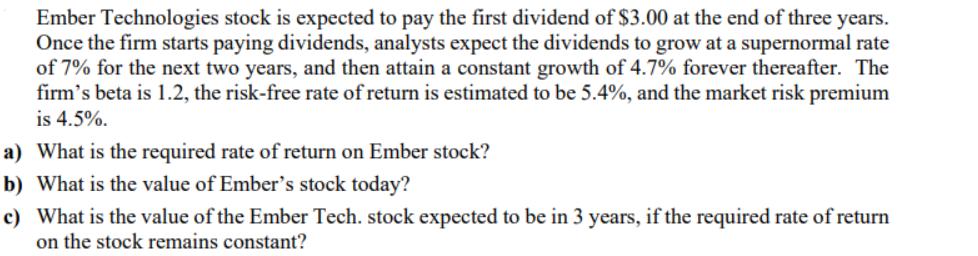

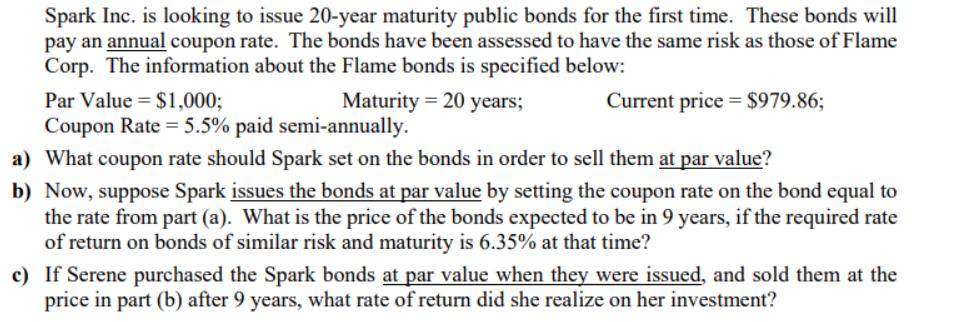

Ember Technologies stock is expected to pay the first dividend of $3.00 at the end of three years. Once the firm starts paying dividends, analysts expect the dividends to grow at a supernormal rate of 7% for the next two years, and then attain a constant growth of 4.7% forever thereafter. The firm's beta is 1.2, the risk-free rate of return is estimated to be 5.4%, and the market risk premium is 4.5%. a) What is the required rate of return on Ember stock? b) What is the value of Ember's stock today? c) What is the value of the Ember Tech. stock expected to be in 3 years, if the required rate of return on the stock remains constant? Spark Inc. is looking to issue 20-year maturity public bonds for the first time. These bonds will pay an annual coupon rate. The bonds have been assessed to have the same risk as those of Flame Corp. The information about the Flame bonds is specified below: Maturity = 20 years; Current price = $979.86; a) What coupon rate should Spark set on the bonds in order to sell them at par value? b) Now, suppose Spark issues the bonds at par value by setting the coupon rate on the bond equal to the rate from part (a). What is the price of the bonds expected to be in 9 years, if the required rate of return on bonds of similar risk and maturity is 6.35% at that time? Par Value = $1,000; Coupon Rate = 5.5% paid semi-annually. c) If Serene purchased the Spark bonds at par value when they were issued, and sold them at the price in part (b) after 9 years, what rate of return did she realize on her investment?

Step by Step Solution

★★★★★

3.42 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

a The required rate of return on Ember stock can be calculated using the capital asset pricing model ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started