Answered step by step

Verified Expert Solution

Question

1 Approved Answer

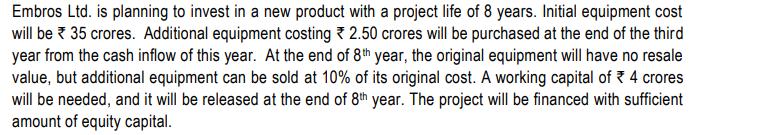

Embros Ltd. is planning to invest in a new product with a project life of 8 years. Initial equipment cost will be 35 crores.

Embros Ltd. is planning to invest in a new product with a project life of 8 years. Initial equipment cost will be 35 crores. Additional equipment costing 2.50 crores will be purchased at the end of the third year from the cash inflow of this year. At the end of 8th year, the original equipment will have no resale value, but additional equipment can be sold at 10% of its original cost. A working capital of * 4 crores will be needed, and it will be released at the end of 8th year. The project will be financed with sufficient amount of equity capital. The sales volumes over eight years have been estimated as follows: 1 2 3 4-5 6-8 14,40,000 21,60,000 52,00,000 54,00,000 36,00,000 Sales price of 120 per unit is expected and variable expenses will amount to 60% of sales revenue. Fixed cash operating costs will amount 3.60 crores per year. The loss of any year will be set off from the profits of subsequent year. The company follows straight line method of depreciation and is subject to 30% tax rate. Considering 12% after-tax cost of capital for this project, you are required to CALCULATE the net present value (NPV) of the project and advise the management to take appropriate decision. PV factors @ 12% are: Year Year Units 1 .893 2 .797 3 .712 4 .636 5 .567 6 .507 7 .452 8 .404

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Answer and detailed step by step explanation Net Present Value NPV Initial Investment Present Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started