Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Emergency anyone help me to answer this, I only have 2 hours to complete this : please help me (d) Makenzie, a U.S based foreign

Emergency anyone help me to answer this, I only have 2 hours to complete this : please help me

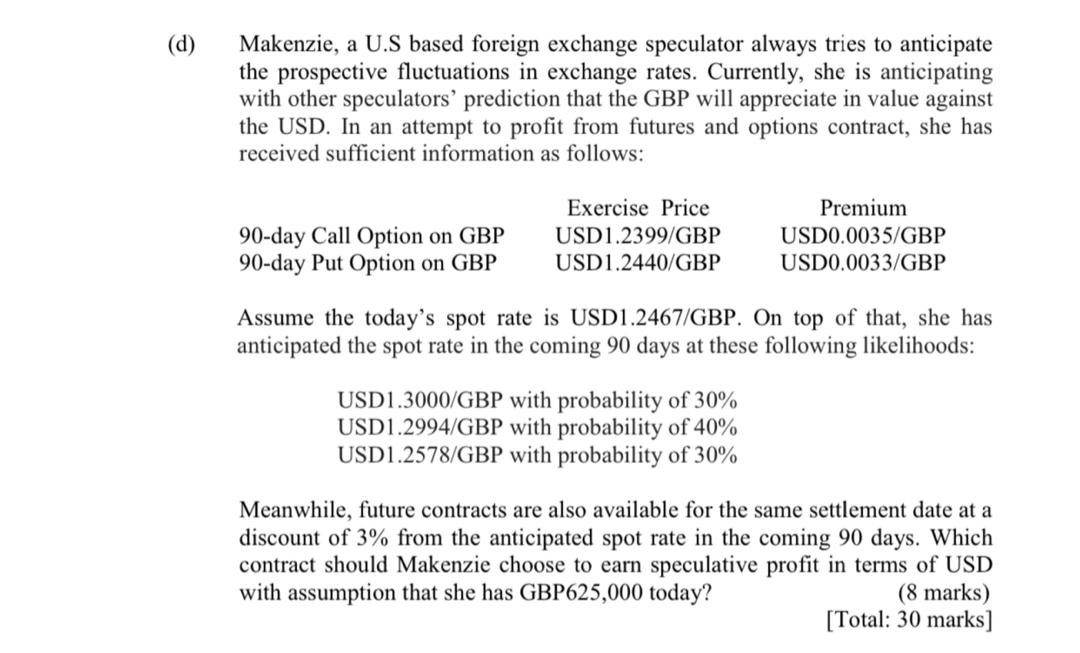

(d) Makenzie, a U.S based foreign exchange speculator always tries to anticipate the prospective fluctuations in exchange rates. Currently, she is anticipating with other speculators' prediction that the GBP will appreciate in value against the USD. In an attempt to profit from futures and options contract, she has received sufficient information as follows: 90-day Call Option on GBP 90-day Put Option on GBP Exercise Price USD1.2399/GBP USD1.2440/GBP Premium USD0.0035/GBP USD0.0033/GBP Assume the today's spot rate is USD1.2467/GBP. On top of that, she has anticipated the spot rate in the coming 90 days at these following likelihoods: USD1.3000/GBP with probability of 30% USD1.2994/GBP with probability of 40% USD1.2578/ GBP with probability of 30% Meanwhile, future contracts are also available for the same settlement date at a discount of 3% from the anticipated spot rate in the coming 90 days. Which contract should Makenzie choose to earn speculative profit in terms of USD with assumption that she has GBP625,000 today? (8 marks) [Total: 30 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started