Question

emergency USE THE DATA IN THE TABLE AS GUIDE TO ANSWER THE QUESTIONS A. Paul had a contract with Tony to build a pool in

emergency

USE THE DATA IN THE TABLE AS GUIDE TO ANSWER THE QUESTIONS

A. Paul had a contract with Tony to build a pool in his backyard for the sum of $25, 000. Paul was to supply all the construction materials and Tony was to build the pool under specifications. Paul monitored the progress of the construction but at no time did he tell Tony how to do the job nor did he supervise Tonys working methods. Tony had lots of experience in building and had even worked on other projects for Paul before.

i. Based on the case above, explain to Tony whether or not he has a contract for services and justify your answer. (5 marks)

ii. Differentiate between a contract of services and a contract for services citing TWO (2) criteria/guidelines of each. (5 marks)

B. Gary Samuel is employed by Kings Ltd. He earns $250,000 per month as a gross salary. The company has an approved pension scheme to which he contributes 10% of his salary. He also has a mortgage payment of $35,000 per month.

i. Calculate Gary Samuels income tax computation and net pay for the month of April 2019.

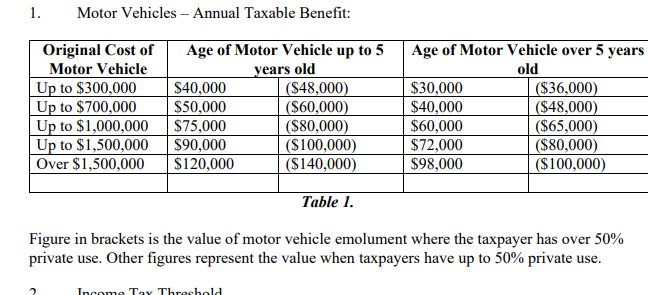

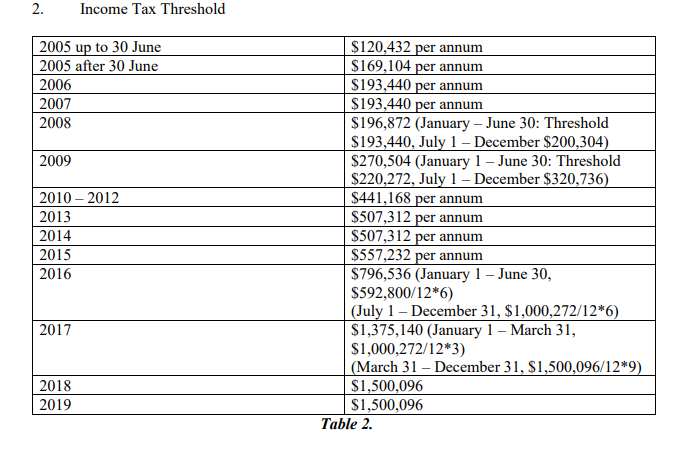

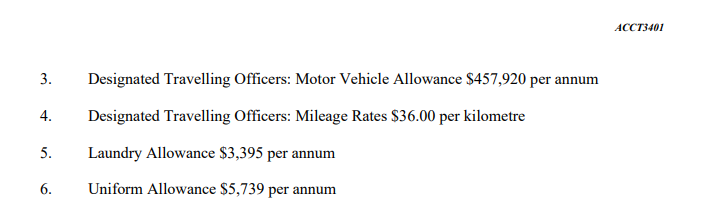

1. Motor Vehicles - Annual Taxable Benefit: Table 1. Figure in brackets is the value of motor vehicle emolument where the taxpayer has over 50% private use. Other figures represent the value when taxpayers have up to 50% private use. Income Tax Threshold 3. Designated Travelling Officers: Motor Vehicle Allowance $457,920 per annum 4. Designated Travelling Officers: Mileage Rates $36.00 per kilometre 5. Laundry Allowance $3,395 per annum 6. Uniform Allowance $5,739 per annum

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started