Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Emerson, Lake and Palmer each hold 10% of the ordinary shares in Barbarian Limited, which has earned a cash profit of 12 million in

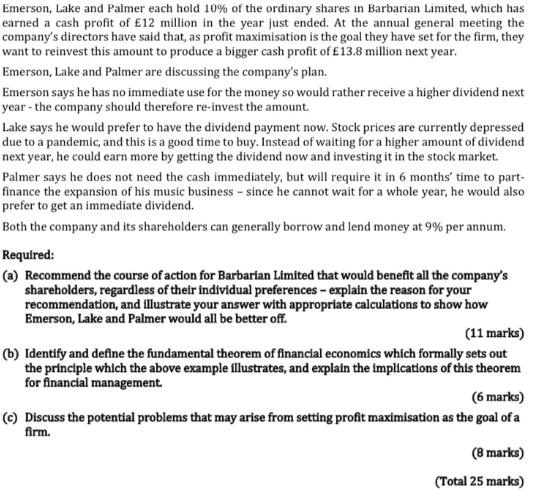

Emerson, Lake and Palmer each hold 10% of the ordinary shares in Barbarian Limited, which has earned a cash profit of 12 million in the year just ended. At the annual general meeting the company's directors have said that, as profit maximisation is the goal they have set for the firm, they want to reinvest this amount to produce a bigger cash profit of 13.8 million next year. Emerson, Lake and Palmer are discussing the company's plan. Emerson says he has no immediate use for the money so would rather receive a higher dividend next year - the company should therefore re-invest the amount. Lake says he would prefer to have the dividend payment now. Stock prices are currently depressed due to a pandemic, and this is a good time to buy. Instead of waiting for a higher amount of dividend next year, he could earn more by getting the dividend now and investing it in the stock market. Palmer says he does not need the cash immediately, but will require it in 6 months' time to part- finance the expansion of his music business - since he cannot wait for a whole year, he would also prefer to get an immediate dividend. Both the company and its shareholders can generally borrow and lend money at 9% per annum. Required: (a) Recommend the course of action for Barbarian Limited that would benefit all the company's shareholders, regardless of their individual preferences - explain the reason for your recommendation, and illustrate your answer with appropriate calculations to show how Emerson, Lake and Palmer would all be better off. (11 marks) (b) Identify and define the fundamental theorem of financial economics which formally sets out the principle which the above example illustrates, and explain the implications of this theorem for financial management. (6 marks) (c) Discuss the potential problems that may arise from setting profit maximisation as the goal of a firm. (8 marks) (Total 25 marks)

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The best course of action for Barbarian Limited that would benefit all shareholders would be to reinvest the profit to produce a higher cash profit of 138 million next year This is because if the co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started