Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Emily, 59, works full-time and receives a salary of $125,000 gross per annum. She has $580,000 ($116,000 tax free, balance taxable-taxed component) in her

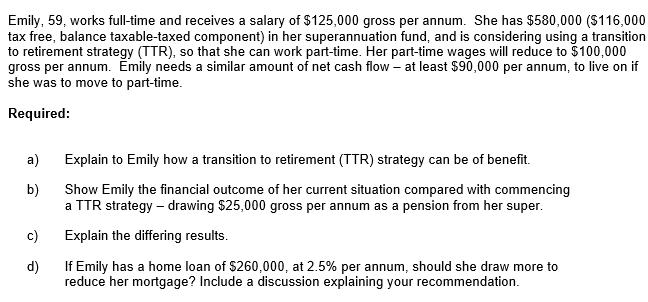

Emily, 59, works full-time and receives a salary of $125,000 gross per annum. She has $580,000 ($116,000 tax free, balance taxable-taxed component) in her superannuation fund, and is considering using a transition to retirement strategy (TTR), so that she can work part-time. Her part-time wages will reduce to $100,000 gross per annum. Emily needs a similar amount of net cash flow - at least $90,000 per annum, to live on if she was to move to part-time. Required: a) b) c) d) Explain to Emily how a transition to retirement (TTR) strategy can be of benefit. Show Emily the financial outcome of her current situation compared with commencing a TTR strategy - drawing $25,000 gross per annum as a pension from her super. Explain the differing results. If Emily has a home loan of $260,000, at 2.5% per annum, should she draw more to reduce her mortgage? Include a discussion explaining your recommendation.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a A transition to retirement TTR strategy can be of benefit for Emily as it allows her to access a portion of her superannuation savings while still w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started