Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Emily and Joel realise that they are not getting anywhere financially. They have decided it is time to bite the bullet and get their

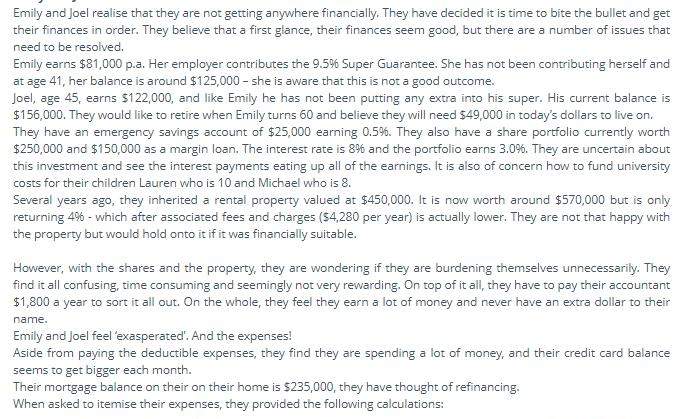

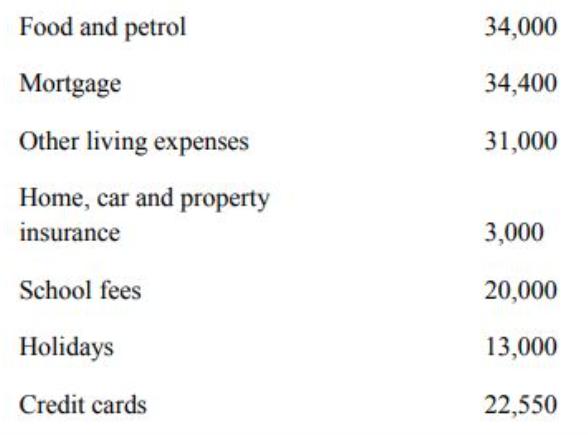

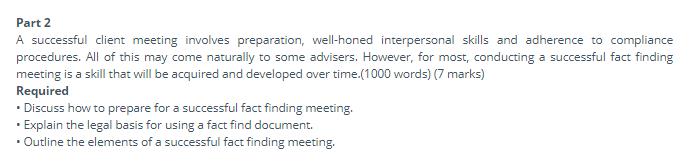

Emily and Joel realise that they are not getting anywhere financially. They have decided it is time to bite the bullet and get their finances in order. They believe that a first glance, their finances seem good, but there are a number of issues that need to be resolved. Emily earns $81,000 p.a. Her employer contributes the 9.5% Super Guarantee. She has not been contributing herself and at age 41, her balance is around $125,000 - she is aware that this is not a good outcome. Joel, age 45, earns $122,000, and like Emily he has not been putting any extra into his super. His current balance is $156,000. They would like to retire when Emily turns 60 and believe they will need $49,000 in today's dollars to live on. They have an emergency savings account of $25,000 earning 0.5%. They also have a share portfolio currently worth $250,000 and $150,000 as a margin loan. The interest rate is 8% and the portfolio earns 3.0%. They are uncertain about this investment and see the interest payments eating up all of the earnings. It is also of concern how to fund university costs for their children Lauren who is 10 and Michael who is 8. Several years ago, they inherited a rental property valued at $450,000. It is now worth around $570,000 but is only returning 4% - which after associated fees and charges ($4,280 per year) is actually lower. They are not that happy with the property but would hold onto it if it was financially suitable. However, with the shares and the property, they are wondering if they are burdening themselves unnecessarily. They find it all confusing, time consuming and seemingly not very rewarding. On top of it all, they have to pay their accountant $1,800 a year to sort it all out. On the whole, they feel they earn a lot of money and never have an extra dollar to their name. Emily and Joel feel'exasperated'. And the expenses! Aside from paying the deductible expenses, they find they are spending a lot of money, and their credit card balance seems to get bigger each month. Their mortgage balance on their on their home is $235,000, they have thought of refinancing. When asked to itemise their expenses, they provided the following calculations: Food and petrol 34,000 Mortgage 34,400 Other living expenses 31,000 Home, car and property insurance 3,000 School fees 20,000 Holidays 13,000 Credit cards 22,550 Part 2 A successful client meeting involves preparation, well-honed interpersonal skills and adherence to compliance procedures. All of this may come naturally to some advisers. However, for most, conducting a successful fact finding meeting is a skill that will be acquired and developed over time.(1000 words) (7 marks) Required Discuss how to prepare for a successful fact finding meeting. Explain the legal basis for using a fact find document. Outline the elements of a successful fact finding meeting.

Step by Step Solution

★★★★★

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Learn the basics of the world of finance Reading up on the ins and outs of financing will help you better understand and manage your money Think digit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started