Answered step by step

Verified Expert Solution

Question

1 Approved Answer

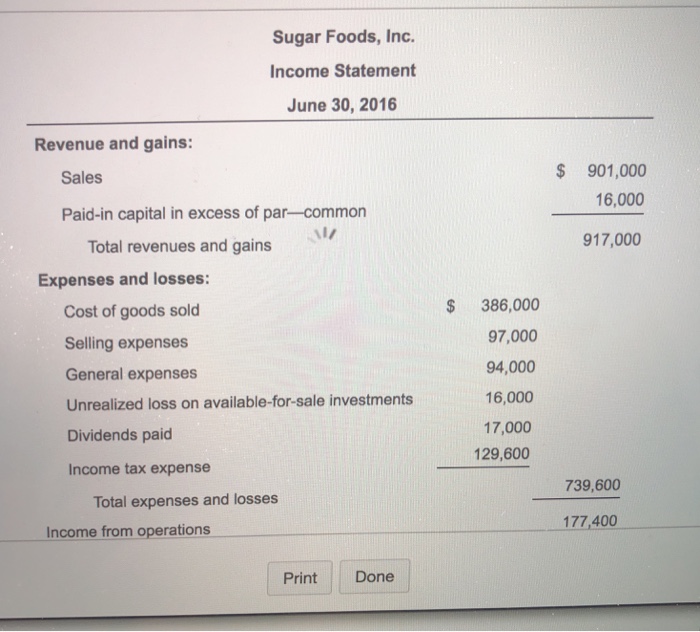

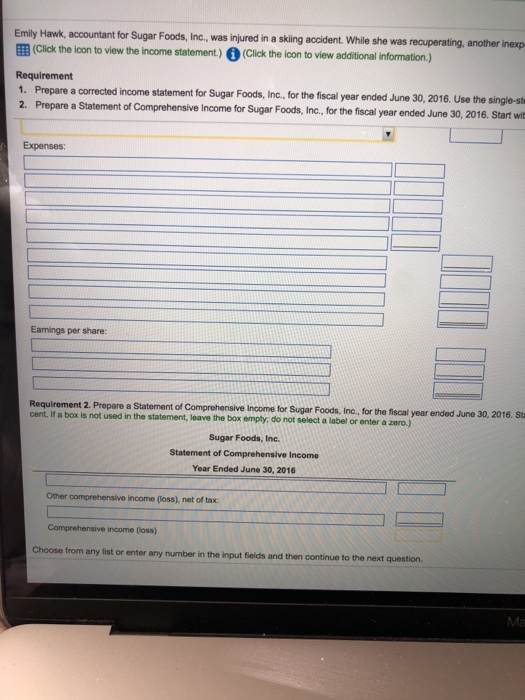

Emily Hawk, accountant for Sugar Foods Inc., was injured in a skiing accident. While she was recuperating, another inexperienced employee prepared the following income statement

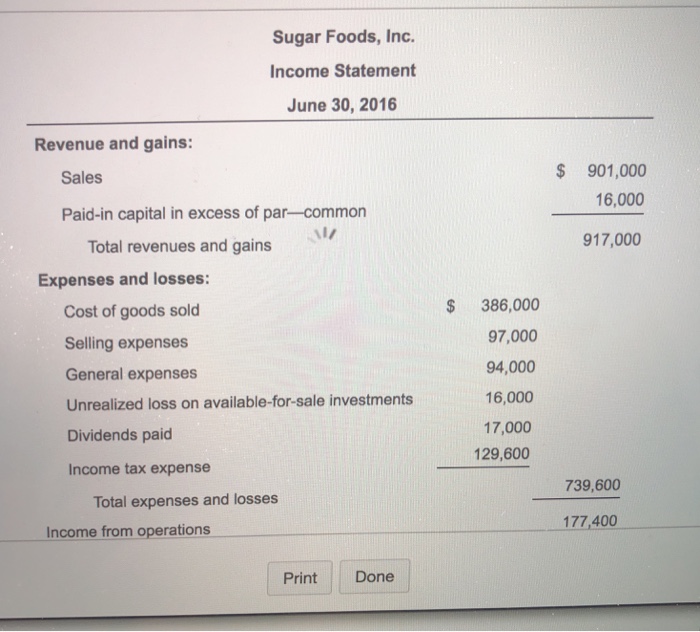

Emily Hawk, accountant for Sugar Foods Inc., was injured in a skiing accident. While she was recuperating, another inexperienced employee prepared the following income statement for the fiscal year ended June 30, 2016.

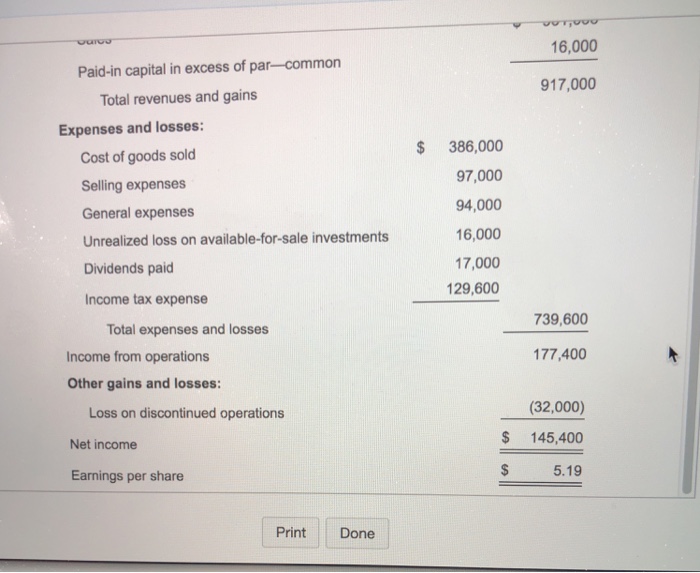

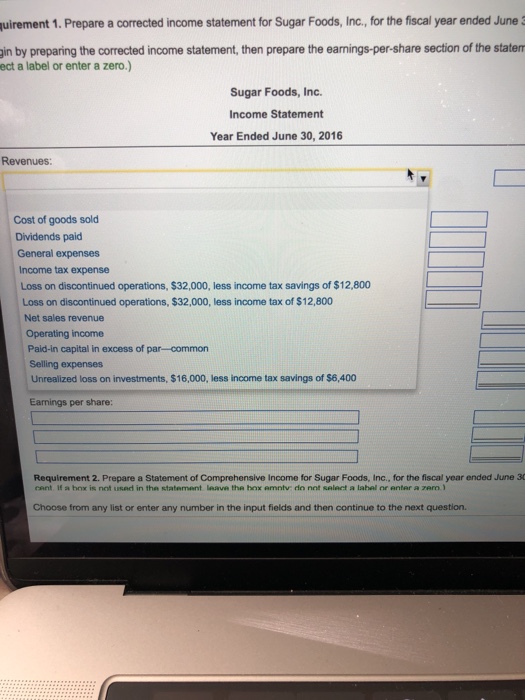

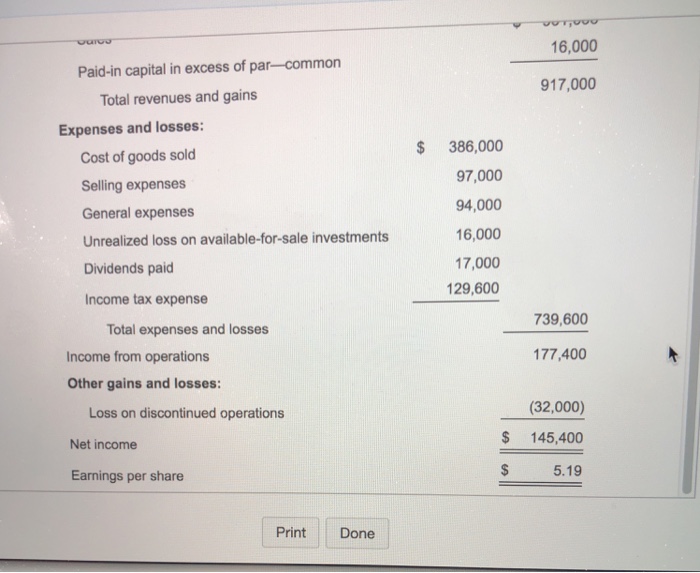

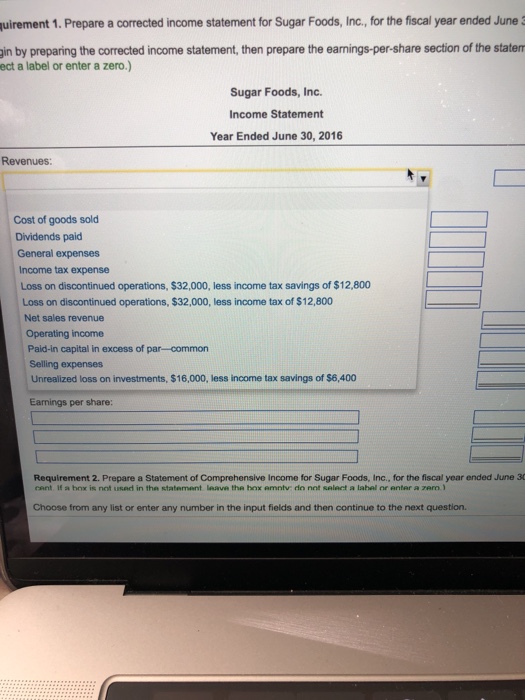

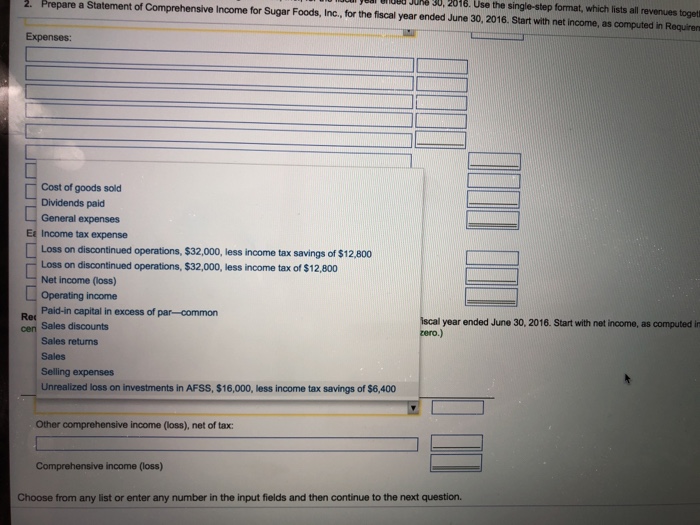

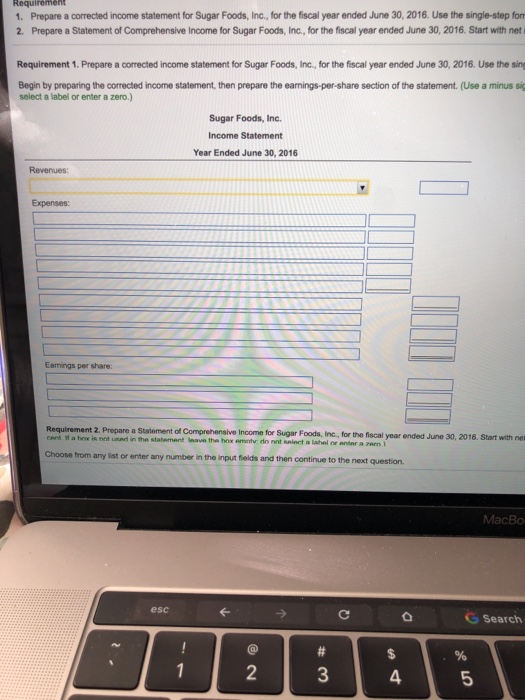

Sugar Foods, Inc. Income Statement June 30, 2016 Revenue and gains: $901,000 16,000 917,000 Sales Paid-in capital in excess of par-common Total revenues and gains Expenses and losses: Cost of goods sold Selling expenses General expenses Unrealized loss on available-for-sale investments Dividends paid Income tax expense $386,000 97,000 94,000 16,000 17,000 129,600 739,600 Total expenses and losses 177,400 ncome from operations Print Done Requirement 1. Prepare a corrected income statement for Sugar Foods, Inc. for the fiscal year ended June 30, 2016. Use the single step format, which list all revenues together and all expenses together. Also prepare the earnings per-share section of the statement.

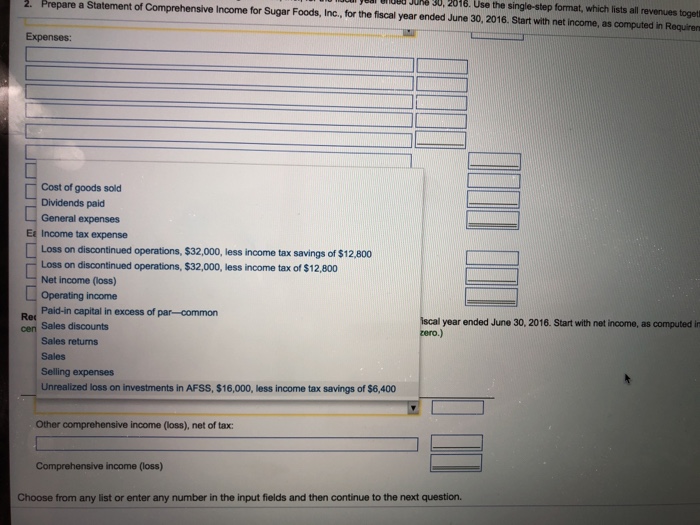

Requirement 2. Prepare a statement of Comprehensive Income for Sugar Foods, Inc. for the fiscal year ended June 30, 2016. Start with net income as competed in requirement 1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started