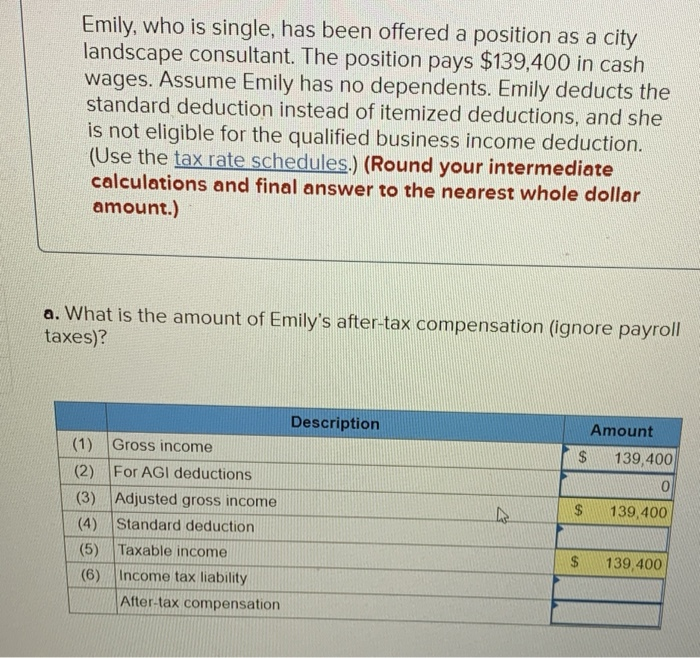

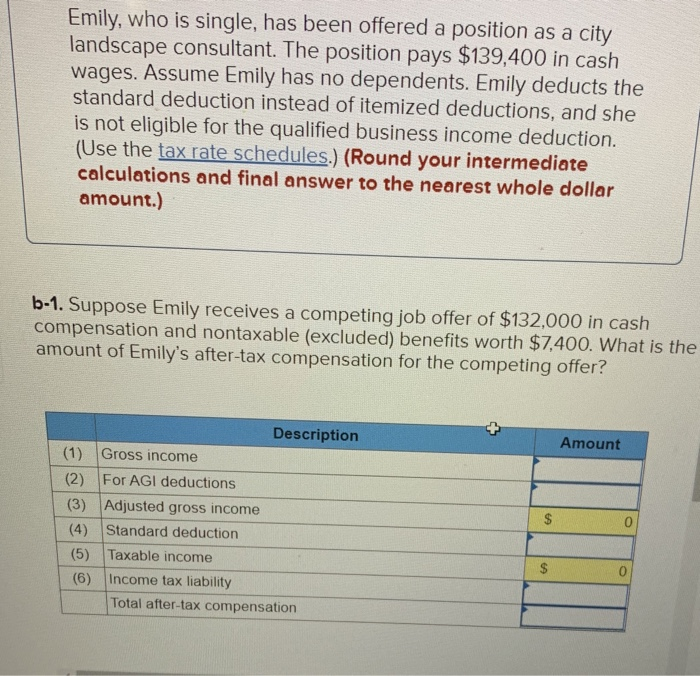

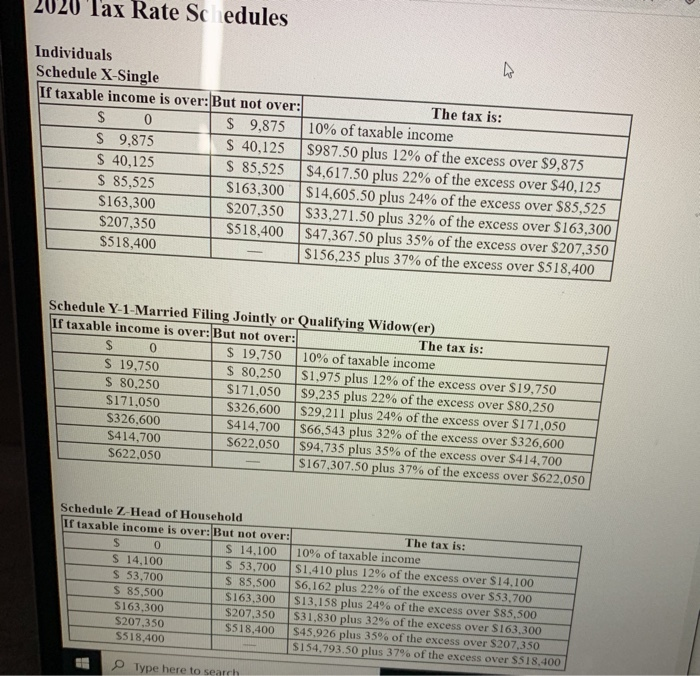

Emily, who is single, has been offered a position as a city landscape consultant. The position pays $139,400 in cash wages. Assume Emily has no dependents. Emily deducts the standard deduction instead of itemized deductions, and she is not eligible for the qualified business income deduction. (Use the tax rate schedules.) (Round your intermediate calculations and final answer to the nearest whole dollar amount.) a. What is the amount of Emily's after-tax compensation (ignore payroll taxes)? Amount $ 139,400 0 Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Taxable income (6) Income tax liability After-tax compensation $ 139,400 $ $ 139,400 Emily, who is single, has been offered a position as a city landscape consultant. The position pays $139,400 in cash wages. Assume Emily has no dependents. Emily deducts the standard deduction instead of itemized deductions, and she is not eligible for the qualified business income deduction. (Use the tax rate schedules.) (Round your intermediate calculations and final answer to the nearest whole dollar amount.) b-1. Suppose Emily receives a competing job offer of $132,000 in cash compensation and nontaxable (excluded) benefits worth $7,400. What is the amount of Emily's after-tax compensation for the competing offer? Amount Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Taxable income (6) Income tax liability Total after-tax compensation $ 0 Tax Rate Sc edules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income S 9,875 $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 $163,300 $14,605.50 plus 24% of the excess over $85,525 S163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $518,400 $47,367.50 plus 35% of the excess over $207,350 $518,400 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: S 0 $ 19,750 10% of taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19,750 S 80.250 $171,050 $9,235 plus 22% of the excess over $80,250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 S414,700 $622,050 $94,735 plus 35% of the excess over $414,700 $622,050 $167,307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: $ 0 S 14,100 S 14,100 $ 53,700 $ 53,700 S 85.500 S 85.500 S163,300 S163,300 $207,350 S207,350 $518,400 S518.400 The tax is: 10% of taxable income $1.410 plus 12% of the excess over $14.100 S6,162 plus 22% of the excess over $53,700 $13,158 plus 24% of the excess over $85,500 $31.830 plus 32% of the excess over S163,300 $45.926 plus 35% of the excess over $207,350 S154.793.50 plus 37% of the excess over $518,400 Type here to search