Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Emirates Steel Manufacturing Co. estimates its predetermined overhead rate annually on the basis of machine hours. At the beginning of the year 2019, The

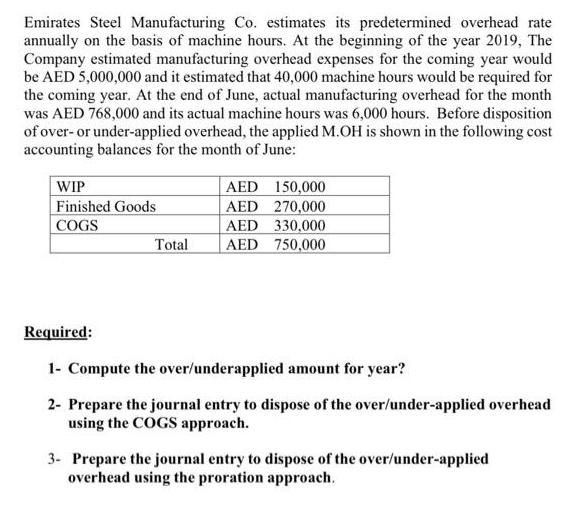

Emirates Steel Manufacturing Co. estimates its predetermined overhead rate annually on the basis of machine hours. At the beginning of the year 2019, The Company estimated manufacturing overhead expenses for the coming year would be AED 5,000,000 and it estimated that 40,000 machine hours would be required for the coming year. At the end of June, actual manufacturing overhead for the month was AED 768,000 and its actual machine hours was 6,000 hours. Before disposition of over- or under-applied overhead, the applied M.OH is shown in the following cost accounting balances for the month of June: WIP Finished Goods COGS Total AED 150,000 AED 270,000 AED 330,000 AED 750,000 Required: 1- Compute the over/underapplied amount for year? 2- Prepare the journal entry to dispose of the over/under-applied overhead using the COGS approach. 3- Prepare the journal entry to dispose of the over/under-applied overhead using the proration approach.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The problem provided involves the calculation of over or underapplied manufacturing overhead for a company and the subsequent accounting entries for d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started